UPS 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During the second quarter of 2003, we sold our Mail Technologies business unit in a transaction that

increased net income by $14 million, or $0.01 per diluted share. The gain consisted of a pre-tax loss of $24

million recorded in other operating expenses within the Supply Chain & Freight segment, and a tax benefit of

$38 million recognized in conjunction with the sale. The tax benefit exceeded the pre-tax loss from this sale

primarily because the goodwill impairment charge we previously recorded for the Mail Technologies business

unit was not deductible for income tax purposes. Consequently, our tax basis was greater than our book basis,

thus producing the tax benefit described above. The operating results of the Mail Technologies unit were

previously included in our Supply Chain & Freight segment, and were not material to our consolidated operating

results in any of the periods presented.

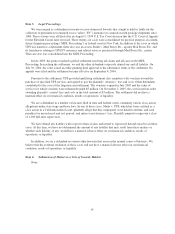

Operating Expenses

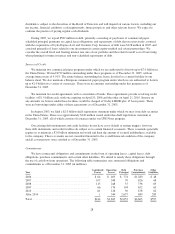

2005 compared to 2004

Consolidated operating expenses increased by $4.845 billion, or 15.3%, for the year, and were significantly

impacted by the acquisitions of Menlo Worldwide Forwarding and Overnite. Operating expenses also increased

$56 million for the year due to the impact on revenue and expense of currency fluctuations (net of hedging

activity) in our International Package and Supply Chain & Freight segments, and increased $55 million for the

year due to currency repatriation losses in our International Package segment.

Compensation and benefits increased by $1.694 billion, or 8.1%, for the year, largely due to the acquisitions

of Menlo Worldwide Forwarding and Overnite, as well as increased health and welfare benefit costs and higher

pension expense for our union benefit plans. Stock-based and other management incentive compensation expense

decreased $297 million, or 33.4%, in the year, due to a change in our Management Incentive Awards program

implemented in 2005, described in the next paragraph, which was partially offset by the impact of prospectively

adopting the measurement provisions of FAS 123 beginning with 2003 stock-based compensation awards.

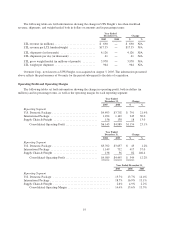

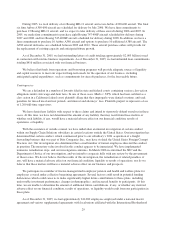

During the first quarter of 2005, we modified our Management Incentive Awards program under our

Incentive Compensation Plan to provide that half of the annual award be made in restricted stock units (“RSUs”).

The RSUs granted in November 2005 under this program have a five-year graded vesting period, with

approximately 20% of the total RSU award vesting at each anniversary date of the grant. The other half of the

award granted in November 2005 was in the form of cash and unrestricted shares of Class A common stock and

was fully vested at the time of grant. Previous awards under the Management Incentive Awards program were

made in common stock that was fully vested in the year of grant. This change had the effect of lowering 2005

expense. As a result, 2005 expense for our Management Incentive Awards program (reported in operating

expenses under “compensation and benefits”), including the RSUs, decreased $334 million ($213 million after-

tax, or $0.19 per diluted share) compared with 2004.

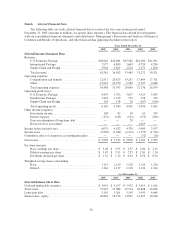

Other operating expenses increased by $3.151 billion, or 29.3%, for the year, largely due to the Menlo

Worldwide Forwarding and Overnite acquisitions, as well as increases in fuel expense and purchased

transportation. The 47.2% increase in fuel expense for the year was impacted by higher prices for jet-A, diesel

and unleaded gasoline, as well as higher fuel usage, but was partially mitigated with hedging gains. The 96.7%

increase in purchased transportation was primarily due to the Menlo Worldwide Forwarding acquisition, but was

also influenced by volume growth in our International Package business and higher fuel prices. The 9.2%

increase in repairs and maintenance was largely due to higher expense on vehicle parts (partially affected by the

Overnite acquisition), airframe and aircraft engine maintenance. The 6.5% increase in depreciation and

amortization for the year was impacted by higher depreciation expense on buildings (largely due to acquisitions),

aircraft, and capitalized software. The 16.0% increase in other occupancy expense was largely due to higher

facilities rent expense in our Supply Chain & Freight segment, which was impacted by the Menlo Worldwide

Forwarding acquisition, and increased utilities expense. The 4.5% increase in other expenses was primarily due

to the Overnite acquisition, but partially offset by the absence in 2005 of the $110 million aircraft impairment

charge that we incurred in 2004.

24