UPS 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

dividends is subject to the discretion of the Board of Directors and will depend on various factors, including our

net income, financial condition, cash requirements, future prospects, and other relevant factors. We expect to

continue the practice of paying regular cash dividends.

During 2005, we repaid $589 million in debt, primarily consisting of paydowns of commercial paper,

scheduled principal payments on capital lease obligations, and repayments of debt that was previously assumed

with the acquisitions of Lynx Express Ltd. and Overnite Corp. Issuances of debt were $128 million in 2005, and

consisted primarily of loans related to our investment in certain equity-method real estate partnerships. We

consider the overall fixed and floating interest rate mix of our portfolio and the related overall cost of borrowing

when planning for future issuances and non-scheduled repayments of debt.

Sources of Credit

We maintain two commercial paper programs under which we are authorized to borrow up to $7.0 billion in

the United States. We had $739 million outstanding under these programs as of December 31, 2005, with an

average interest rate of 4.01%. The entire balance outstanding has been classified as a current liability in our

balance sheet. We also maintain a European commercial paper program under which we are authorized to borrow

up to €1.0 billion in a variety of currencies. There were no amounts outstanding under this program as of

December 31, 2005.

We maintain two credit agreements with a consortium of banks. These agreements provide revolving credit

facilities of $1.0 billion each, with one expiring on April 20, 2006 and the other on April 21, 2010. Interest on

any amounts we borrow under these facilities would be charged at 90-day LIBOR plus 15 basis points. There

were no borrowings under either of these agreements as of December 31, 2005.

In August 2003, we filed a $2.0 billion shelf registration statement under which we may issue debt securities

in the United States. There was approximately $126 million issued under this shelf registration statement at

December 31, 2005, all of which consists of issuances under our UPS Notes program.

Our existing debt instruments and credit facilities do not have cross-default or ratings triggers, however

these debt instruments and credit facilities do subject us to certain financial covenants. These covenants generally

require us to maintain a $3.0 billion minimum net worth and limit the amount of secured indebtedness available

to the company. These covenants are not considered material to the overall financial condition of the company,

and all covenant tests were satisfied as of December 31, 2005.

Commitments

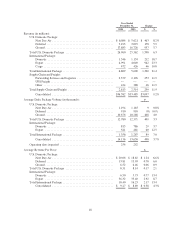

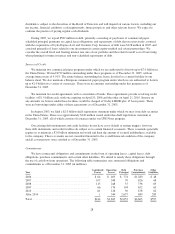

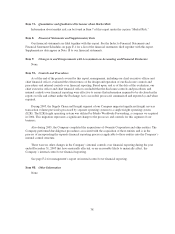

We have contractual obligations and commitments in the form of operating leases, capital leases, debt

obligations, purchase commitments, and certain other liabilities. We intend to satisfy these obligations through

the use of cash flow from operations. The following table summarizes our contractual obligations and

commitments as of December 31, 2005 (in millions):

Year

Capitalized

Leases

Operating

Leases

Debt

Principal

Purchase

Commitments

Other

Liabilities

2006 ....................................... $ 64 $ 403 $ 774 $1,280 $ 48

2007 ....................................... 107 348 70 826 68

2008 ....................................... 115 248 37 738 69

2009 ....................................... 66 176 104 652 65

2010 ....................................... 61 126 30 478 62

After 2010 .................................. 1 544 2,637 689 285

Total ....................................... $414 $1,845 $3,652 $4,663 $597

28