UPS 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

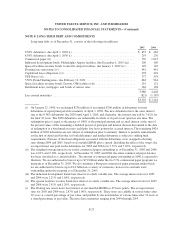

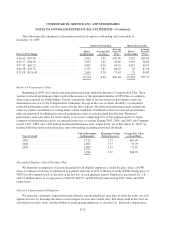

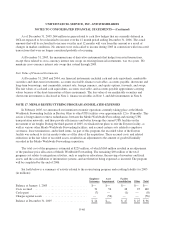

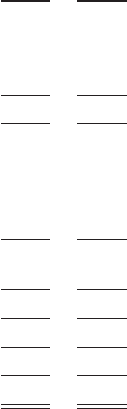

Deferred tax liabilities and assets are comprised of the following at December 31 (in millions):

2005 2004

Property, plant and equipment ......................................... $2,572 $2,624

Goodwill and intangible assets ......................................... 491 428

Pensionplans....................................................... 1,722 1,481

Other ............................................................. 396 167

Gross deferred tax liabilities ........................................... 5,181 4,700

Other postretirement benefits .......................................... 681 684

Loss and credit carryforwards (non-U.S. and state) ......................... 113 135

Insurance reserves ................................................... 543 469

Vacation pay accrual ................................................. 154 145

Other ............................................................. 794 471

Gross deferred tax assets .............................................. 2,285 1,904

Deferred tax assets valuation allowance .................................. (54) (86)

Net deferred tax assets ................................................ 2,231 1,818

Net deferred tax liability .............................................. 2,950 2,882

Current deferred tax asset ............................................. (475) (392)

Long-term liability—see Note 9 ........................................ $3,425 $3,274

The valuation allowance increased (decreased) by $(32), $(31), and $25 million during the years ended

December 31, 2005, 2004 and 2003, respectively.

As of December 31, 2005, we have U.S. state & local operating loss and credit carryforwards of

approximately $1.060 billion and $40 million, respectively. The operating loss carryforwards expire at varying

dates through 2025. The majority of the credit carryforwards may be carried forward indefinitely. We also have

non-U.S. loss carryforwards of approximately $644 million as of December 31, 2005, the majority of which may

be carried forward indefinitely. As indicated in the table above, we have established a valuation allowance for

certain non-U.S. and state loss carryforwards, due to the uncertainty resulting from a lack of previous taxable

income within the applicable tax jurisdictions.

Undistributed earnings of our non-U.S. subsidiaries amounted to approximately $1.062 billion at

December 31, 2005. Those earnings are considered to be indefinitely reinvested and, accordingly, no U.S. federal

or state deferred income taxes have been provided thereon. Upon distribution of those earnings in the form of

dividends or otherwise, we would be subject to U.S. income taxes and withholding taxes payable in various

non-U.S. jurisdictions, which could potentially be offset by foreign tax credits. Determination of the amount of

unrecognized deferred U.S. income tax liability is not practicable because of the complexities associated with its

hypothetical calculation.

The American Jobs Creation Act of 2004, which provided for a temporary 85% dividends received

deduction on certain foreign earnings repatriated during a one-year period (expired in December 2005), did not

have an impact on UPS as we did not repatriate any earnings subject to the Act.

F-37