UPS 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

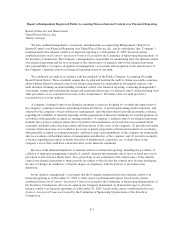

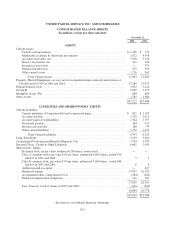

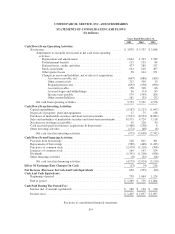

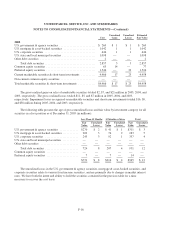

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In millions, except per share amounts)

December 31,

2005 2004

ASSETS

Current Assets:

Cash & cash equivalents .................................................. $ 1,369 $ 739

Marketable securities & short-term investments ............................... 1,672 4,458

Accounts receivable, net .................................................. 5,950 5,156

Finance receivables, net .................................................. 411 524

Income tax receivable .................................................... — 371

Deferred income taxes .................................................... 475 392

Other current assets ...................................................... 1,126 965

Total Current Assets ................................................. 11,003 12,605

Property, Plant & Equipment—at cost, net of accumulated depreciation & amortization of

$14,268 and $13,505 in 2005 and 2004 ........................................ 15,289 13,973

PrepaidPensionCosts ........................................................ 3,932 3,222

Goodwill .................................................................. 2,549 1,255

Intangible Assets, Net ........................................................ 684 669

Other Assets ............................................................... 1,765 1,364

$35,222 $33,088

LIABILITIES AND SHAREOWNERS’ EQUITY

Current Liabilities:

Current maturities of long-term debt and commercial paper ...................... $ 821 $ 1,187

Accounts payable ....................................................... 2,352 2,312

Accrued wages & withholdings ............................................ 1,324 1,197

Dividendspayable ....................................................... 364 315

Incometaxespayable .................................................... 180 79

Other current liabilities ................................................... 1,752 1,439

Total Current Liabilities .............................................. 6,793 6,529

Long-Term Debt ............................................................ 3,159 3,261

Accumulated Postretirement Benefit Obligation, Net ............................... 1,704 1,470

Deferred Taxes, Credits & Other Liabilities ....................................... 6,682 5,450

Shareowners’ Equity:

Preferred stock, no par value, authorized 200 shares, none issued .................. — —

Class A common stock, par value $.01 per share, authorized 4,600 shares, issued 454

and 515 in 2005 and 2004 ............................................... 5 5

Class B common stock, par value $.01 per share, authorized 5,600 shares, issued 646

and 614 in 2005 and 2004 ............................................... 6 6

Additional paid-in capital ................................................. — 417

Retained earnings ....................................................... 17,037 16,192

Accumulated other comprehensive loss ...................................... (164) (242)

Deferred compensation obligations .......................................... 161 169

17,045 16,547

Less: Treasury stock (3 shares in 2005 and 2004) .............................. (161) (169)

16,884 16,378

$35,222 $33,088

See notes to consolidated financial statements.

F-6