UPS 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

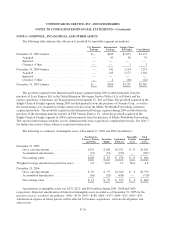

NOTE 6. GOODWILL, INTANGIBLES, AND OTHER ASSETS

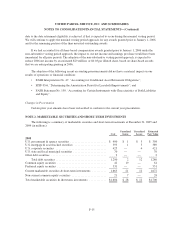

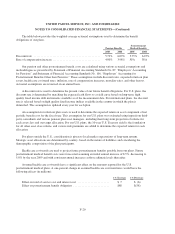

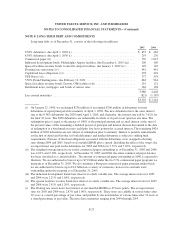

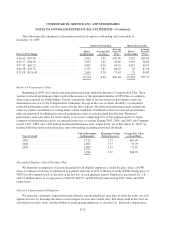

The following table indicates the allocation of goodwill by reportable segment (in millions):

U.S. Domestic

Package

International

Package

Supply Chain

& Freight Consolidated

December 31, 2003 balance ....................... $— $100 $1,073 $1,173

Acquired .................................. — 41 38 79

Impaired ................................... — — — —

Currency / Other ............................ — — 3 3

December 31, 2004 balance ....................... — 141 1,114 1,255

Acquired .................................. — 145 1,171 1,316

Impaired ................................... — — — —

Currency / Other ............................ — 4 (26) (22)

December 31, 2005 balance ....................... $— $290 $2,259 $2,549

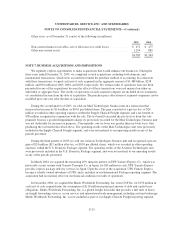

The goodwill acquired in the International Package segment during 2005 resulted primarily from the

purchase of Lynx Express Ltd. in the United Kingdom, Messenger Service Stolica S.A. in Poland, and the

express operations of Sinotrans Air Transportation Development Co. Ltd. in China. The goodwill acquired in the

Supply Chain & Freight segment during 2005 resulted primarily from the purchase of Overnite Corp., as well as

the restructuring costs incurred in exiting certain activities from the Menlo Worldwide Forwarding operations

acquired previously. The goodwill acquired in the International Package segment during 2004 resulted from the

purchase of the remaining minority interest in UPS Yamato Express Co., while the goodwill acquired in the

Supply Chain & Freight segment in 2004 resulted primarily from the purchase of Menlo Worldwide Forwarding.

The currency/other balance includes escrow reimbursements from acquisitions completed previously. See Note 7

for further discussion of these business acquisition transactions.

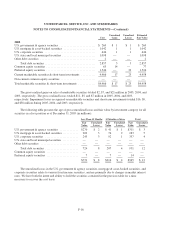

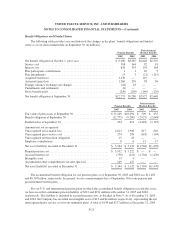

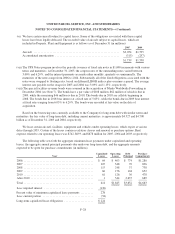

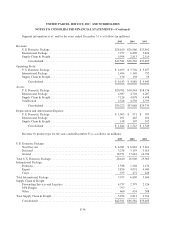

The following is a summary of intangible assets at December 31, 2005 and 2004 (in millions):

Trademarks,

Licenses, Patents,

and Other

Franchise

Rights

Capitalized

Software

Intangible

Pension

Asset

Total

Intangible

Assets

December 31, 2005:

Gross carrying amount ..................... $139 $ 108 $1,391 $ 13 $1,651

Accumulated amortization .................. (31) (23) (913) — (967)

Net carrying value ........................ $108 $ 85 $ 478 $ 13 $ 684

Weighted-average amortization period (in years) .... 9.6 20.0 3.1 N/A 4.8

December 31, 2004:

Gross carrying amount ..................... $ 29 $ 97 $1,249 $ 4 $1,379

Accumulated amortization .................. (16) (18) (676) — (710)

Net carrying value ........................ $ 13 $ 79 $ 573 $ 4 $ 669

Amortization of intangible assets was $255, $221, and $196 million during 2005, 2004 and 2003,

respectively. Expected amortization of finite-lived intangible assets recorded as of December 31, 2005 for the

next five years is as follows (in millions): 2006—$179; 2007—$180; 2008—$179; 2009—$23; 2010—$23.

Amortization expense in future periods will be affected by business acquisitions, software development, and

other factors.

F-24