UPS 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

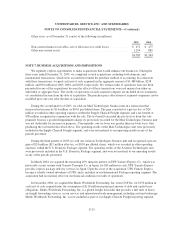

As of December 31, 2005, we had outstanding letters of credit totaling approximately $2.095 billion issued

in connection with routine business requirements.

We maintain two credit agreements with a consortium of banks that provide revolving credit facilities of

$1.0 billion each, with one expiring April 20, 2006 and the other April 21, 2010. Interest on any amounts we

borrow under these facilities would be charged at 90-day LIBOR plus 15 basis points. At December 31, 2005,

there were no outstanding borrowings under these facilities.

We have a $2.0 billion shelf registration statement under which we may issue debt securities in the U.S. The

debt may be denominated in a variety of currencies. There was approximately $126 million issued under this

shelf registration statement at December 31, 2005.

Our existing debt instruments and credit facilities do not have cross-default or ratings triggers, however

these debt instruments and credit facilities do subject us to certain financial covenants. These covenants generally

require us to maintain a $3.0 billion minimum net worth and limit the amount of secured indebtedness available

to the company. These covenants are not considered material to the overall financial condition of the company,

and all covenant tests were passed as of December 31, 2005.

In December 2003, we redeemed our $300 million cash-settled convertible senior notes at a price of

102.703, and also terminated the swap transaction associated with the notes. The redemption amount paid was

lower than the amount recorded for the fair value of the notes at the time of redemption, which, along with the

cash settlement received on the swap, resulted in a $28 million pre-tax gain recorded in 2003 results.

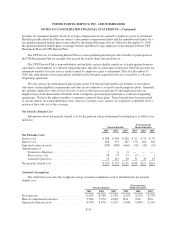

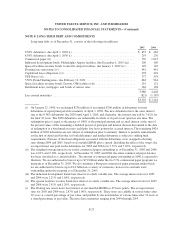

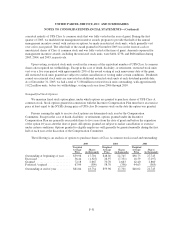

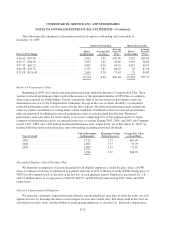

NOTE 9. DEFERRED TAXES, CREDITS, AND OTHER LIABILITIES

Deferred taxes, credits, and other liabilities as of December 31 consist of the following (in millions):

2005 2004

Deferred income taxes (see Note 14) .................................... $3,425 $3,274

Insurance reserves ................................................... 1,354 1,136

Accrued pension cost (see Note 5) ...................................... 750 221

Other credits and non-current liabilities .................................. 1,153 819

$6,682 $5,450

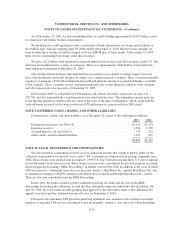

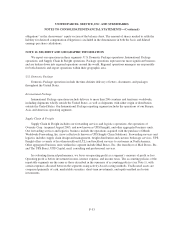

NOTE 10. LEGAL PROCEEDINGS AND CONTINGENCIES

We were named as a defendant in twenty-six now-dismissed lawsuits that sought to hold us liable for the

collection of premiums for reinsured excess value (“EV”) insurance in connection with package shipments since

1984. These actions were all filed after an August 9, 1999 U.S. Tax Court decision that the U.S. Court of Appeals

for the Eleventh Circuit later reversed. These twenty-six cases were consolidated for pre-trial purposes in a multi-

district litigation proceeding (“MDL Proceeding”) in federal court in New York. In addition to the cases in which

UPS was named as a defendant, there also was an action, Smith v. Mail Boxes Etc., against Mail Boxes Etc. and

its franchisees relating to UPS EV insurance and related services purchased through Mail Boxes Etc. centers.

That case also was consolidated into the MDL Proceeding.

In late 2003, the parties reached a global settlement resolving all claims and all cases in the MDL

Proceeding. In reaching the settlement, we and the other defendants expressly denied any and all liability. On

July 30, 2004, the court issued an order granting final approval to the substantive terms of the settlement. No

appeals were filed and the settlement became effective on September 8, 2004.

Pursuant to the settlement, UPS provided qualifying settlement class members with vouchers toward the

purchase of specified UPS services and agreed to pay the plaintiffs’ attorneys’ fees and costs. Other defendants

F-29