UPS 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

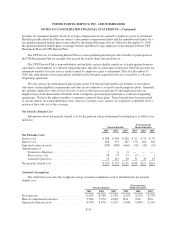

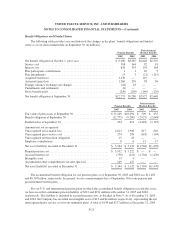

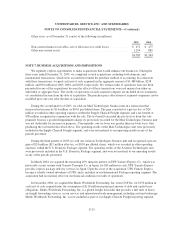

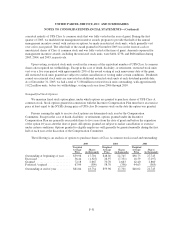

Benefit Obligations and Funded Status

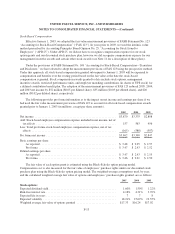

The following table provides a reconciliation of the changes in the plans’ benefit obligations and funded

status as of our measurement date on September 30 (in millions):

Pension Benefits

Postretirement

Medical Benefits

2005 2004 2005 2004

Net benefit obligation at October 1, prior year ....................... $ 9,280 $8,287 $2,648 $2,592

Servicecost .................................................. 388 344 92 91

Interest cost .................................................. 628 533 170 164

Plan participants contributions ................................... 1 1 10 9

Planamendments.............................................. 13 3 (21) (115)

Acquired businesses ........................................... 1,476 — 119 —

Actuarial (gain) loss ........................................... 1,260 299 58 36

Foreign currency exchange rate changes ........................... (16) 18 — —

Curtailments and settlements .................................... (6) — — —

Gross benefits paid ............................................ (249) (205) (149) (129)

Net benefit obligation at September 30 ............................. $12,775 $9,280 $2,927 $2,648

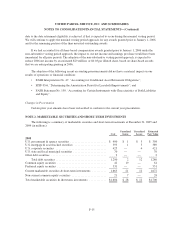

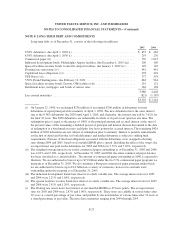

Pension Benefits

Postretirement

Medical Benefits

2005 2004 2005 2004

Fair value of plan assets at September 30 ........................ $13,209 $10,094 $ 509 $ 455

Benefit obligation at September 30 ............................. (12,775) (9,280) (2,927) (2,648)

Funded status at September 30 ................................ 434 814 (2,418) (2,193)

Amounts not yet recognized:

Unrecognized net actuarial loss ............................... 2,613 1,996 817 810

Unrecognized prior service cost ............................... 274 298 (118) (104)

Unrecognized net transition obligation .......................... 15 18 — —

Employercontributions...................................... 8 6 15 17

Net asset (liability) recorded at December 31 ..................... $ 3,344 $ 3,132 $(1,704) $(1,470)

Prepaidpensioncost ........................................ $ 3,932 $ 3,222 $ — $ —

Accrued benefit cost ........................................ (750) (221) (1,704) (1,470)

Intangible asset ............................................ 13 4 — —

Accumulated other comprehensive income (pre-tax) ............... 149 127 — —

Net asset (liability) recorded at December 31 ..................... $ 3,344 $ 3,132 $(1,704) $(1,470)

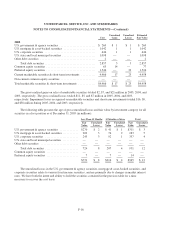

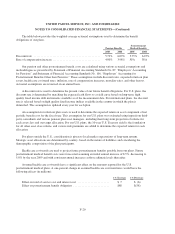

The accumulated benefit obligation for our pension plans as of September 30, 2005 and 2004 was $11.485

and $8.307 billion, respectively. In general, we use a measurement date of September 30 for our pension and

postretirement benefit plans.

For our U.S. and international pension plans in which the accumulated benefit obligation exceeds the assets,

we have recorded a minimum pension liability of $312 and $221 million at December 31, 2005 and 2004,

respectively. This liability is included in accrued pension costs, as detailed in Note 9. As of December 31, 2005

and 2004, the Company has recorded an intangible asset of $13 and $4 million, respectively, representing the net

unrecognized prior service cost for our unfunded plans. A total of $149 and $127 million at December 31, 2005

F-21