UPS 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

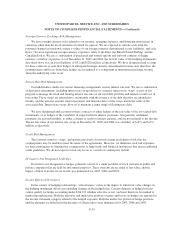

contributed to the costs of the litigation and settlement. The vouchers expired in July 2005 and the value of

services for which vouchers were redeemed totaled $5 million. On November 2, 2005, the court issued an order

awarding plaintiffs’ counsel fees and costs in the total amount of $3 million. The settlement did not have a

material effect on our financial condition, results of operations, or liquidity.

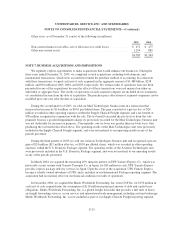

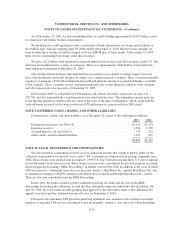

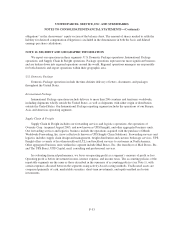

We are a defendant in a number of lawsuits filed in state and federal courts containing various class-action

allegations under state wage-and-hour laws. In one of these cases, Marlo v. UPS, which has been certified as a

class action in a California federal court, plaintiffs allege that they improperly were denied overtime, and seek

penalties for missed meal and rest periods, and interest and attorneys’ fees. Plaintiffs purport to represent a class

of 1,200 full-time supervisors.

We have denied any liability with respect to these claims and intend to vigorously defend ourselves in these

cases. At this time, we have not determined the amount of any liability that may result from these matters or

whether such liability, if any, would have a material adverse effect on our financial condition, results of

operations, or liquidity.

In addition, we are a defendant in various other lawsuits that arose in the normal course of business. We

believe that the eventual resolution of these cases will not have a material adverse effect on our financial

condition, results of operations, or liquidity.

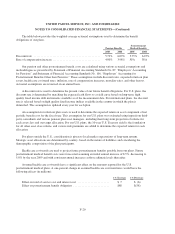

We participate in a number of trustee-managed multi-employer pension and health and welfare plans for

employees covered under collective bargaining agreements. Several factors could result in potential funding

deficiencies which could cause us to make significantly higher future contributions to these plans, including

unfavorable investment performance, changes in demographics, and increased benefits to participants. At this

time, we are unable to determine the amount of additional future contributions, if any, or whether any material

adverse effect on our financial condition, results of operations, or liquidity would result from our participation in

these plans.

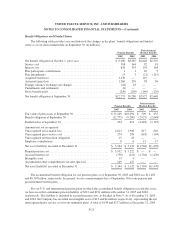

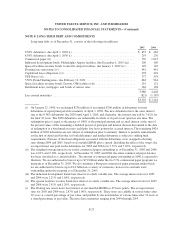

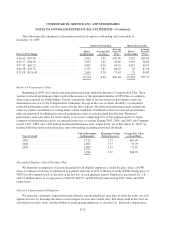

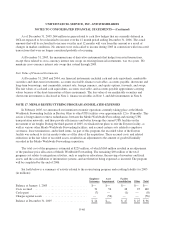

NOTE 11. CAPITAL STOCK AND STOCK-BASED COMPENSATION

Capital Stock

We maintain two classes of common stock, which are distinguished from each other by their respective

voting rights. Class A shares of UPS are entitled to 10 votes per share, whereas Class B shares are entitled to one

vote per share. Class A shares are primarily held by UPS employees and retirees, and these shares are fully

convertible into Class B shares at any time. Class B shares are publicly traded on the New York Stock Exchange

(NYSE) under the symbol “UPS.”

Incentive Compensation Plan

The UPS Incentive Compensation Plan permits the grant of nonqualified stock options, incentive stock

options, stock appreciation rights, restricted stock, performance shares, performance units, and management

incentive awards to eligible employees. The number of shares reserved for issuance under the Plan is

112 million, with the number of shares reserved for issuance as restricted stock limited to 34 million. As of

December 31, 2005, management incentive awards, stock options, restricted performance units, and restricted

stock units had been granted under the Incentive Compensation Plan.

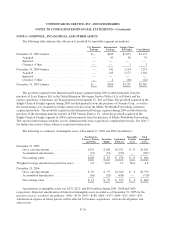

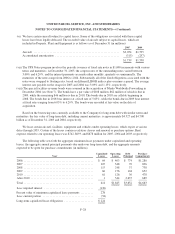

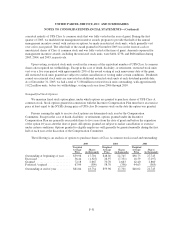

Management Incentive Awards & Restricted Stock Units

Persons earning the right to receive management incentive awards are determined annually by the

Compensation Committee of the UPS Board of Directors. In years prior to 2005, management incentive awards

F-30