UPS 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

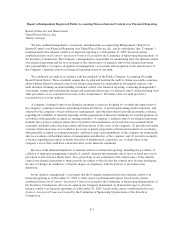

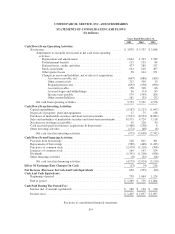

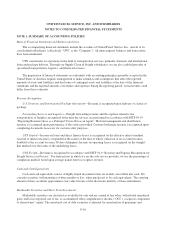

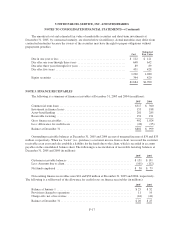

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

STATEMENTS OF CONSOLIDATED CASH FLOWS

(In millions)

Years Ended December 31,

2005 2004 2003

Cash Flows From Operating Activities:

Netincome..................................................... $ 3,870 $3,333 $2,898

Adjustments to reconcile net income to net cash from operating

activities:

Depreciation and amortization ............................. 1,644 1,543 1,549

Postretirement benefits ................................... 115 135 84

Deferred taxes, credits and other ............................ 477 289 317

Stockawardplans ....................................... 234 610 497

Other (gains) losses ...................................... 28 144 151

Changes in assets and liabilities, net of effect of acquisitions:

Accounts receivable, net .............................. (647) (686) (264)

Other current assets .................................. 213 390 13

Prepaidpensioncosts................................. (695) (238) (990)

Accounts payable .................................... 158 318 66

Accrued wages and withholdings ....................... 56 (73) 83

Incometaxespayable................................. 179 (399) 204

Other current liabilities ............................... 161 (35) (32)

Net cash from operating activities ............................... 5,793 5,331 4,576

Cash Flows From Investing Activities:

Capital expenditures ............................................. (2,187) (2,127) (1,947)

Disposals of property, plant and equipment ........................... 27 75 118

Purchases of marketable securities and short-term investments ............ (7,623) (6,322) (8,083)

Sales and maturities of marketable securities and short-term investments .... 10,375 4,724 7,118

Net decrease in finance receivables .................................. 95 318 50

Cash received (paid) for business acquisitions & dispositions ............. (1,488) (238) 8

Other investing activities .......................................... (174) (68) (6)

Net cash (used in) investing activities ............................ (975) (3,638) (2,742)

Cash Flows From Financing Activities:

Proceeds from borrowings ......................................... 128 811 361

Repaymentsofborrowings ........................................ (589) (468) (1,245)

Purchases of common stock ....................................... (2,479) (1,310) (398)

Issuances of common stock ........................................ 164 193 154

Dividends...................................................... (1,391) (1,208) (956)

Other financing activities ......................................... (8) (32) (26)

Net cash (used in) financing activities ............................ (4,175) (2,014) (2,110)

Effect Of Exchange Rate Changes On Cash ............................. (13) (4) 216

Net Increase (Decrease) In Cash And Cash Equivalents ................... 630 (325) (60)

Cash And Cash Equivalents:

Beginning of period .............................................. 739 1,064 1,124

End of period ................................................... $ 1,369 $ 739 $1,064

Cash Paid During The Period For:

Interest (net of amount capitalized) .................................. $ 169 $ 120 $ 126

Incometaxes ................................................... $ 1,465 $2,037 $1,097

See notes to consolidated financial statements.

F-9