UPS 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

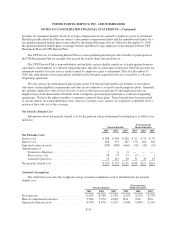

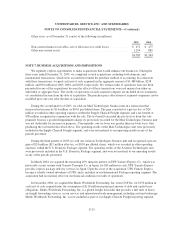

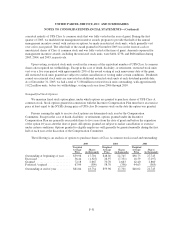

(vi) We have certain aircraft subject to capital leases. Some of the obligations associated with these capital

leases have been legally defeased. The recorded value of aircraft subject to capital leases, which are

included in Property, Plant and Equipment is as follows as of December 31 (in millions):

2005 2004

Aircraft ........................................................... $2,054 $1,795

Accumulated amortization ............................................ (315) (257)

$1,739 $1,538

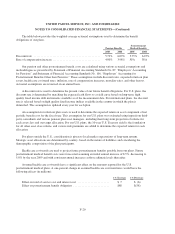

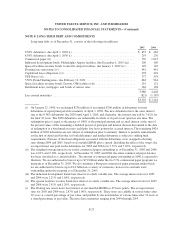

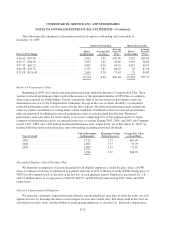

(vii) The UPS Notes program involves the periodic issuance of fixed rate notes in $1,000 increments with various

terms and maturities. At December 31, 2005, the coupon rates of the outstanding notes varied between

3.00% and 6.20%, and the interest payments are made either monthly, quarterly or semiannually. The

maturities of the notes range from 2006 to 2024. Substantially all of the fixed obligations associated with the

notes were swapped to floating rates, based on different LIBOR indices plus or minus a spread. The average

interest rate payable on the swaps for 2005 and 2004 was 3.09% and 1.13%, respectively.

(viii) The special facilities revenue bonds were assumed in the acquisition of Menlo Worldwide Forwarding in

December 2004 (see Note 7). The bonds have a par value of $108 million, $62 million of which is due in

2009, while the remaining $46 million is due in 2018. The bonds due in 2018 are callable beginning in

2008. The bonds due in 2018 bear interest at a fixed rate of 5.63%, while the bonds due in 2009 bear interest

at fixed rates ranging from 6.05% to 6.20%. The bonds were recorded at fair value on the date of

acquisition.

Based on the borrowing rates currently available to the Company for long-term debt with similar terms and

maturities, the fair value of long-term debt, including current maturities, is approximately $4.327 and $4.708

billion as of December 31, 2005 and 2004, respectively.

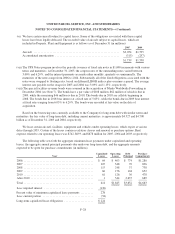

We lease certain aircraft, facilities, equipment and vehicles under operating leases, which expire at various

dates through 2055. Certain of the leases contain escalation clauses and renewal or purchase options. Rent

expense related to our operating leases was $742, $693, and $678 million for 2005, 2004 and 2003, respectively.

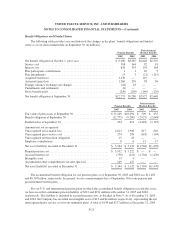

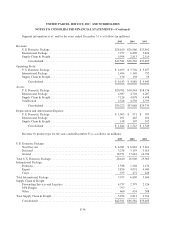

The following table sets forth the aggregate minimum lease payments under capitalized and operating

leases, the aggregate annual principal payments due under our long-term debt, and the aggregate amounts

expected to be spent for purchase commitments (in millions).

Year

Capitalized

Leases

Operating

Leases

Debt

Principal

Purchase

Commitments

2006 ................................................ $ 64 $ 403 $ 774 $1,280

2007 ................................................ 107 348 70 826

2008 ................................................ 115 248 37 738

2009 ................................................ 66 176 104 652

2010 ................................................ 61 126 30 478

After 2010 ........................................... 1 544 2,637 689

Total................................................ 414 $1,845 $3,652 $4,663

Less: imputed interest .................................. (136)

Present value of minimum capitalized lease payments ......... 278

Less: current portion ................................... (54)

Long-term capitalized lease obligations .................... $224

F-28