Toyota 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2007 89

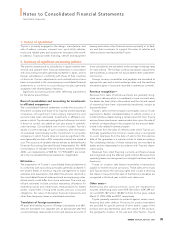

Related Party Transactions

Toyota does not have any significant related party transactions

other than transactions with affiliated companies in the ordinary

course of business as described in note 12 to the consolidated

financial statements.

Legislation Regarding End-of-Life Vehicles

In October 2000, the European Union enforced a directive that

requires member states to promulgate regulations implementing

the following:

• manufacturers shall bear all or a significant part of the costs

for taking back end-of-life vehicles put on the market after

July 1, 2002 and dismantling and recycling those vehicles.

Beginning January 1, 2007, this requirement will also be

applicable to vehicles put on the market before July 1, 2002;

• manufacturers may not use certain hazardous materials in

vehicles sold after July 2003;

• vehicles type-approved and put on the market after

December 15, 2008, shall be re-usable and/or recyclable to

a minimum of 85% by weight per vehicle and shall be re-

usable and/or recoverable to a minimum of 95% by weight

per vehicle; and

• end-of-life vehicles must meet actual re-use of 80% and re-

use as material or energy of 85%, respectively, of vehicle

weight by 2006, rising to 85% and 95%, respectively, by 2015.

See note 23 to the consolidated financial statements for fur-

ther discussion.

Recent Accounting Pronouncements

in the United States

In February 2006, FASB issued FAS No. 155, Accounting for

Certain Hybrid Instruments (“FAS 155”), which permits, but does

not require, fair value accounting for any hybrid financial instru-

ment that contains an embedded derivative that would otherwise

require bifurcation in accordance with FAS No. 133, Accounting

for Derivative Instruments and Hedging Activities (“FAS 133”).

The Statement also subjects beneficial interests issued by securi-

tization vehicles to the requirements of FAS133. FAS 155 is effec-

tive as of the beginning of first fiscal year that begins after

September 15, 2006. Management does not expect this

Statement to have a material impact on Toyota’s consolidated

financial statements.

In March 2006, FASB issued FAS No. 156, Accounting for

Servicing of Financial Assets (“FAS 156”), which amends FAS No.

140, Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities (“FAS 140”), with respect to the account-

ing for separately recognized servicing assets and servicing liabili-

ties. FAS 156 is effective for fiscal year beginning after September

15, 2006. Management does not expect this Statement to have a

material impact on Toyota’s consolidated financial statements.

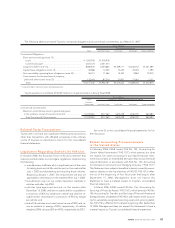

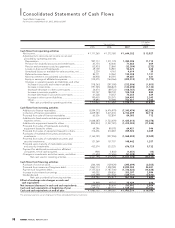

The following tables summarize Toyota’s contractual obligations and commercial commitments as of March 31, 2007:

Yen in millions

Payments Due by Period

Total Less than 1 year 1 to 3 years 3 to 5 years 5 years and after

Contractual Obligations:

Short-term borrowings (note 13)

Loans ........................................................................................ ¥ 1,055,918 ¥1,055,918

Commercial paper................................................................... 2,441,473 2,441,473

Long-term debt* (note 13) .......................................................... 8,580,815 2,355,863 ¥3,359,711 ¥1,634,152 ¥1,231,089

Capital lease obligations (note 13)............................................. 50,886 12,253 13,235 24,303 1,095

Non-cancelable operating lease obligations (note 22) ............ 56,141 11,364 15,345 9,862 19,570

Commitments for the purchase of property,

plant and other assets (note 23) ............................................... 132,443 87,310 21,951 21,061 2,121

Total.......................................................................................... ¥12,317,676 ¥5,964,181 ¥3,410,242 ¥1,689,378 ¥1,253,875

* “Long-term debt” represents future principal payments.

Toyota expects to contribute ¥132,447 million to its pension plans in during fiscal 2008.

Yen in millions

Total Amount of Commitment Expiration Per Period

Amounts

Committed Less than 1 year 1 to 3 years 3 to 5 years 5 years and after

Commercial Commitments:

Maximum potential exposure to guarantees given

in the ordinary course of business (note 23)............................ ¥1,333,961 ¥417,260 ¥610,228 ¥246,190 ¥60,283

Total Commercial Commitments........................................... ¥1,333,961 ¥417,260 ¥610,228 ¥246,190 ¥60,283