Toyota 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2007 113

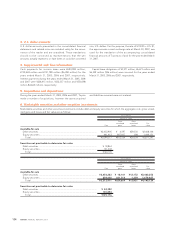

U.S. dollars

Yen in millions in millions

For the year

ended

For the years ended March 31, March 31,

2005 2006 2007 2007

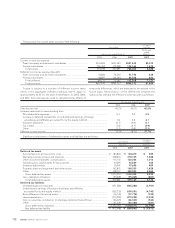

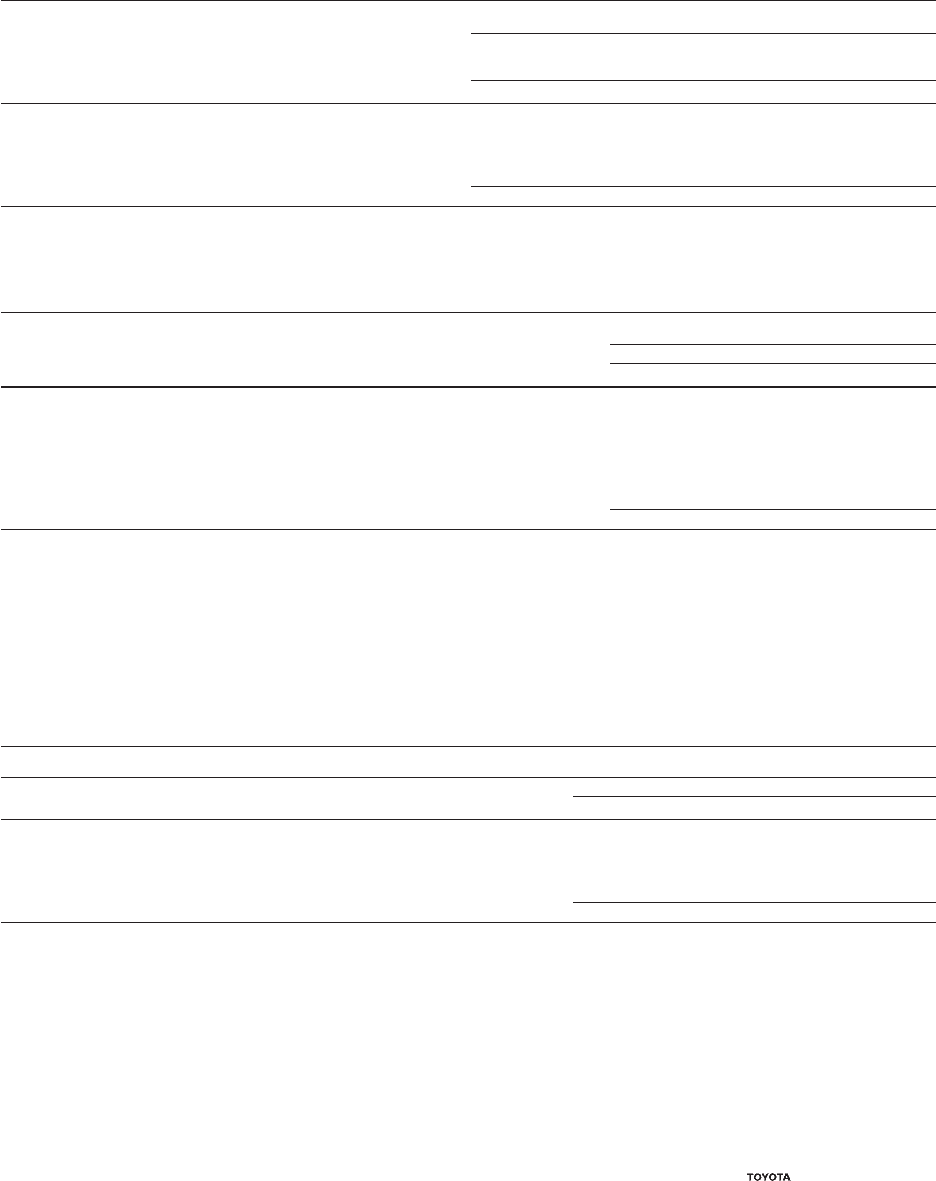

Valuation allowance at beginning of year .......................................... ¥104,083 ¥102,737 ¥ 93,629 $ 793

Additions........................................................................................... 21,249 10,285 20,785 176

Deductions........................................................................................ (22,829) (19,084) (19,015) (161)

Other ................................................................................................. 234 (309) (174) (1)

Valuation allowance at end of year..................................................... ¥102,737 ¥ 93,629 ¥ 95,225 $ 807

The valuation allowance mainly relates to deferred tax assets

of the consolidated subsidiaries with operating loss carryfor-

wards for tax purposes that are not expected to be realized.

The net changes in the total valuation allowance for deferred

tax assets for the years ended March 31, 2005, 2006 and 2007

consist of the following:

The other amount includes the impact of consolidation and deconsolidation of certain entities due to changes in ownership inter-

est during the years ended March 31, 2005, 2006 and 2007.

The deferred tax assets and liabilities that comprise the net deferred tax liability are included in the consolidated balance sheets

as follows:

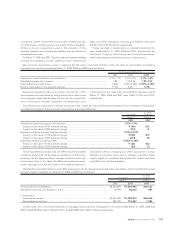

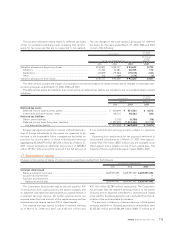

U.S. dollars

Yen in millions in millions

March 31, March 31,

2006 2007 2007

Deferred tax assets

Deferred income taxes (Current assets)........................................................................... ¥ 520,494 ¥ 551,503 $ 4,672

Investments and other assets – other .............................................................................. 106,715 98,043 830

Deferred tax liabilities

Other current liabilities...................................................................................................... (7,120) (6,788) (58)

Deferred income taxes (Long-term liabilities)................................................................. (1,092,995) (1,312,400) (11,117)

Net deferred tax liability ............................................................................................... ¥ (472,906) ¥ (669,642) $ (5,673)

Because management intends to reinvest undistributed earn-

ings of foreign subsidiaries to the extent not expected to be

remitted in the foreseeable future, management has made no

provision for income taxes on those undistributed earnings

aggregating ¥2,506,679 million ($21,234 million) as of March 31,

2007. Toyota estimates an additional tax provision of ¥229,863

million ($1,947 million) would be required if the full amount of

those undistributed earnings became subject to Japanese

taxes.

Operating loss carryforwards for tax purposes attributed to

consolidated subsidiaries as of March 31, 2007 were approxi-

mately ¥101,156 million ($857 million) and are available as an

offset against future taxable income of such subsidiaries. The

majority of these carryforwards expire in years 2008 to 2027.

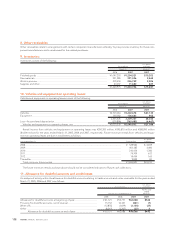

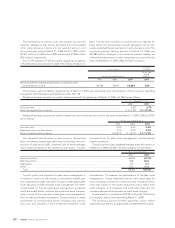

Changes in the number of shares of common stock issued have resulted from the following:

For the years ended March 31,

2005 2006 2007

Common stock issued

Balance at beginning of year................................................................................... 3,609,997,492 3,609,997,492 3,609,997,492

Issuance during the year .......................................................................................... — — —

Purchase and retirement .......................................................................................... — — —

Balance at end of year.......................................................................................... 3,609,997,492 3,609,997,492 3,609,997,492

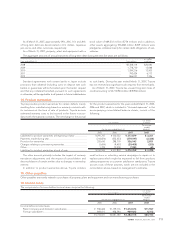

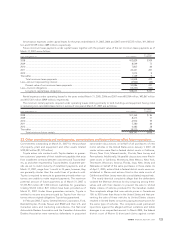

17. Shareholders’ equity:

The Corporation Act provides that an amount equal to 10%

of distributions from surplus paid by the parent company and

its Japanese subsidiaries be appropriated as a capital reserve or

a retained earnings reserve. No further appropriations are

required when the total amount of the capital reserve and the

retained earnings reserve reaches 25% of stated capital.

The retained earnings reserve included in retained earnings

as of March 31, 2006 and 2007 was ¥145,103 million and

¥151,102 million ($1,280 million), respectively. The Corporation

Act provides that the retained earnings reserve of the parent

company and its Japanese subsidiaries is restricted and unable

to be used for dividend payments, and is excluded from the cal-

culation of the profit available for dividend.

The amounts of statutory retained earnings of the parent

company available for dividend payments to shareholders were

¥5,255,265 million and ¥5,680,249 million ($48,117 million) as of