Toyota 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

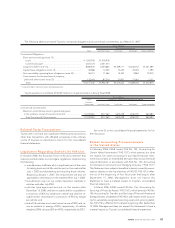

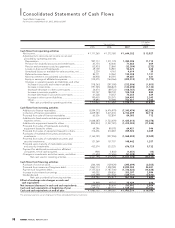

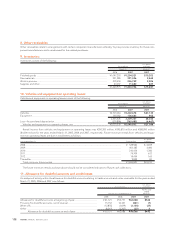

98 ANNUAL REPORT 200798 ANNUAL REPORT 2007

U.S. dollars

Yen in millions in millions

2005 2006 2007 2007

Cash flows from operating activities

Net income.................................................................................. ¥ 1,171,260 ¥ 1,372,180 ¥ 1,644,032 $ 13,927

Adjustments to reconcile net income to net cash

provided by operating activities

Depreciation............................................................................ 997,713 1,211,178 1,382,594 11,712

Provision for doubtful accounts and credit losses ............... 63,154 62,646 71,862 609

Pension and severance costs, less payments....................... (52,933) 23,860 (32,054) (272)

Losses on disposal of fixed assets......................................... 49,159 54,981 50,472 428

Unrealized losses on available-for-sale securities, net ........ 2,324 4,163 4,614 39

Deferred income taxes........................................................... 84,711 33,262 132,308 1,121

Minority interest in consolidated subsidiaries...................... 64,938 84,393 49,687 421

Equity in earnings of affiliated companies ........................... (139,471) (164,366) (209,515) (1,775)

Changes in operating assets and liabilities, and other

Increase in accounts and notes receivable....................... (178,363) (297,598) (212,856) (1,803)

Increase in inventories........................................................ (191,545) (248,823) (133,698) (1,133)

(Increase) decrease in other current assets ...................... 34,674 (89,723) (108,767) (921)

Increase in accounts payable............................................. 153,747 188,702 104,188 883

Increase (decrease) in accrued income taxes................... 41,228 54,052 74,255 629

Increase in other current liabilities .................................... 190,450 203,075 264,490 2,240

Other.................................................................................... 79,894 23,498 156,561 1,326

Net cash provided by operating activities ................... 2,370,940 2,515,480 3,238,173 27,431

Cash flows from investing activities

Additions to finance receivables ............................................... (5,594,375) (6,476,979) (7,343,474) (62,206)

Collection of finance receivables .............................................. 4,609,383 5,615,276 6,152,499 52,118

Proceeds from sale of finance receivables ............................... 65,536 102,854 84,083 712

Additions to fixed assets excluding equipment

leased to others ........................................................................ (1,068,287) (1,523,459) (1,425,814) (12,078)

Additions to equipment leased to others ................................ (854,953) (1,247,781) (1,410,003) (11,944)

Proceeds from sales of fixed assets excluding

equipment leased to others..................................................... 69,396 89,578 64,421 546

Proceeds from sales of equipment leased to others............... 316,456 410,683 359,923 3,049

Purchases of marketable securities and security

investments ............................................................................... (1,165,791) (957,296) (1,068,205) (9,049)

Proceeds from sales of marketable securities and

security investments ................................................................. 121,369 157,707 148,442 1,257

Proceeds upon maturity of marketable securities

and security investments.......................................................... 452,574 533,325 676,729 5,732

Payment for additional investments in affiliated

companies, net of cash acquired............................................. (901) (1,802) (1,651) (14)

Changes in investments and other assets, and other.............. (11,603) (77,606) (51,328) (435)

Net cash used in investing activities ............................. (3,061,196) (3,375,500) (3,814,378) (32,312)

Cash flows from financing activities

Purchase of common stock........................................................ (264,106) (129,629) (295,699) (2,505)

Proceeds from issuance of long-term debt.............................. 1,863,710 1,928,788 2,890,000 24,481

Payments of long-term debt...................................................... (1,155,223) (1,187,506) (1,726,823) (14,628)

Increase in short-term borrowings ............................................ 140,302 509,826 353,397 2,994

Dividends paid ............................................................................ (165,299) (244,568) (339,107) (2,873)

Net cash provided by financing activities..................... 419,384 876,911 881,768 7,469

Effect of exchange rate changes on cash and

cash equivalents .......................................................................... 24,849 68,743 25,429 216

Net increase (decrease) in cash and cash equivalents............ (246,023) 85,634 330,992 2,804

Cash and cash equivalents at beginning of year ..................... 1,729,776 1,483,753 1,569,387 13,294

Cash and cash equivalents at end of year ................................ ¥ 1,483,753 ¥ 1,569,387 ¥ 1,900,379 $ 16,098

The accompanying notes are an integral part of these consolidated financial statements.

Consolidated Statements of Cash Flows

Toyota Motor Corporation

For the years ended March 31, 2005, 2006 and 2007