Toyota 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 ANNUAL REPORT 2007

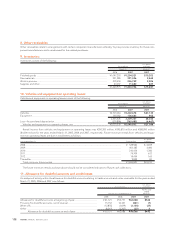

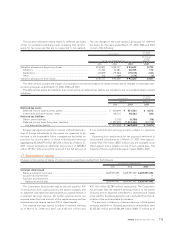

March 31, 2006 and 2007, respectively. In accordance with cus-

tomary practice in Japan, the distributions from surplus are not

accrued in the financial statements for the corresponding peri-

od, but are recorded in the subsequent accounting period after

shareholders’ approval has been obtained. Retained earnings at

March 31, 2007 include amounts representing year-end cash

dividends of ¥223,856 million ($1,896 million), ¥70 ($0.59) per

share, which were approved at the Ordinary General

Shareholders’ Meeting, held on June 22, 2007.

Retained earnings at March 31, 2007 include ¥1,232,413 mil-

lion ($10,440 million) relating to equity in undistributed earnings

of companies accounted for by the equity method.

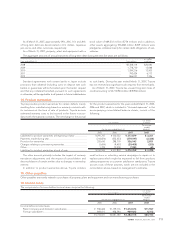

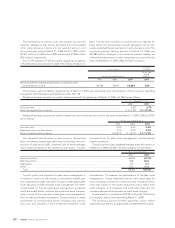

On June 23, 2004, at the Ordinary General Shareholders’

Meeting, the shareholders of the parent company approved to

purchase up to 65 million shares of its common stock at a cost

up to ¥250,000 million during the period until the next Ordinary

General Shareholders’ Meeting which was held on June 23,

2005, and in accordance with former Japanese Commercial

Code, also approved to change the Articles of Incorporation to

authorize the Board of Directors to repurchase treasury stock on

the basis of its resolution. During this approved period of time,

the parent company purchased approximately 59 million of

shares.

On June 23, 2005, the shareholders of the parent company

approved to purchase up to 65 million shares of its common

stock at a cost up to ¥250,000 million during the period until the

next Ordinary General Shareholders’ Meeting which was held

on June 23, 2006. As a result, the parent company repurchased

approximately 38 million shares during the approved period

of time.

On June 23, 2006, at the Ordinary General Shareholders’

Meeting, the shareholders of the parent company approved to

purchase up to 30 million shares of its common stock at a cost

up to ¥200,000 million during the purchase period of one year

from the following day. As a result, the parent company repur-

chased approximately 28 million shares during the approved

period of time.

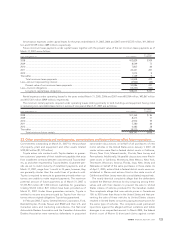

On June 22, 2007, at the Ordinary General Shareholders’

Meeting, the shareholders of the parent company approved to

purchase up to 30 million shares of its common stock at a cost

up to ¥250,000 million during the purchase period of one year

from the following day. These approvals by the shareholders

are not required under the current regulation.

In years prior to 1997 (beginning of preparation for consoli-

dated financial statements in accordance with accounting prin-

ciples generally accepted in the United States of America),

Toyota had made free distributions of shares to its shareholders

for which no accounting entry is required in Japan. Had the

distributions been accounted for in a manner used by compa-

nies in the United States of America, ¥2,576,606 million ($21,826

million) would have been transferred from retained earnings to

the appropriate capital accounts.

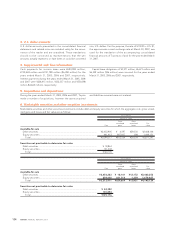

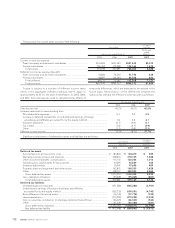

Detailed components of accumulated other comprehensive income at March 31, 2006 and 2007 and the related changes, net of

taxes for the years ended March 31, 2005, 2006 and 2007 consist of the following:

Yen in millions

Foreign Minimum Accumulated

currency Unrealized pension Pension other

translation gains on liability liability comprehensive

adjustments securities adjustments adjustments income (loss)

Balances at March 31, 2004 .................................. ¥(515,030) ¥336,924 ¥(26,486) ¥ — ¥ (204,592)

Other comprehensive income ................................. 75,697 38,455 9,780 — 123,932

Balances at March 31, 2005 .................................. (439,333) 375,379 (16,706) — (80,660)

Other comprehensive income ................................. 268,410 244,629 4,937 — 517,976

Balances at March 31, 2006 .................................. (170,923) 620,008 (11,769) — 437,316

Other comprehensive income ................................. 130,746 38,800 3,499 — 173,045

Adjustment to initially apply FAS 158...................... — — 8,270 82,759 91,029

Balances at March 31, 2007 ..................................

¥(40,177) ¥658,808 ¥ — ¥82,759 ¥ 701,390

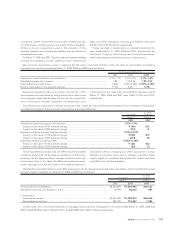

U.S. dollars in millions

Foreign Minimum Accumulated

currency Unrealized pension Pension other

translation gains on liability liability comprehensive

adjustments securities adjustments adjustments income (loss)

Balances at March 31, 2006 .................................. $(1,448) $5,252 $(99) $ — $3,705

Other comprehensive income ................................. 1,107 329 29 — 1,465

Adjustment to initially apply FAS 158...................... — — 70 701 771

Balances at March 31, 2007 ..................................

$ (341) $5,581 $ — $701 $5,941