Toyota 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2007 45

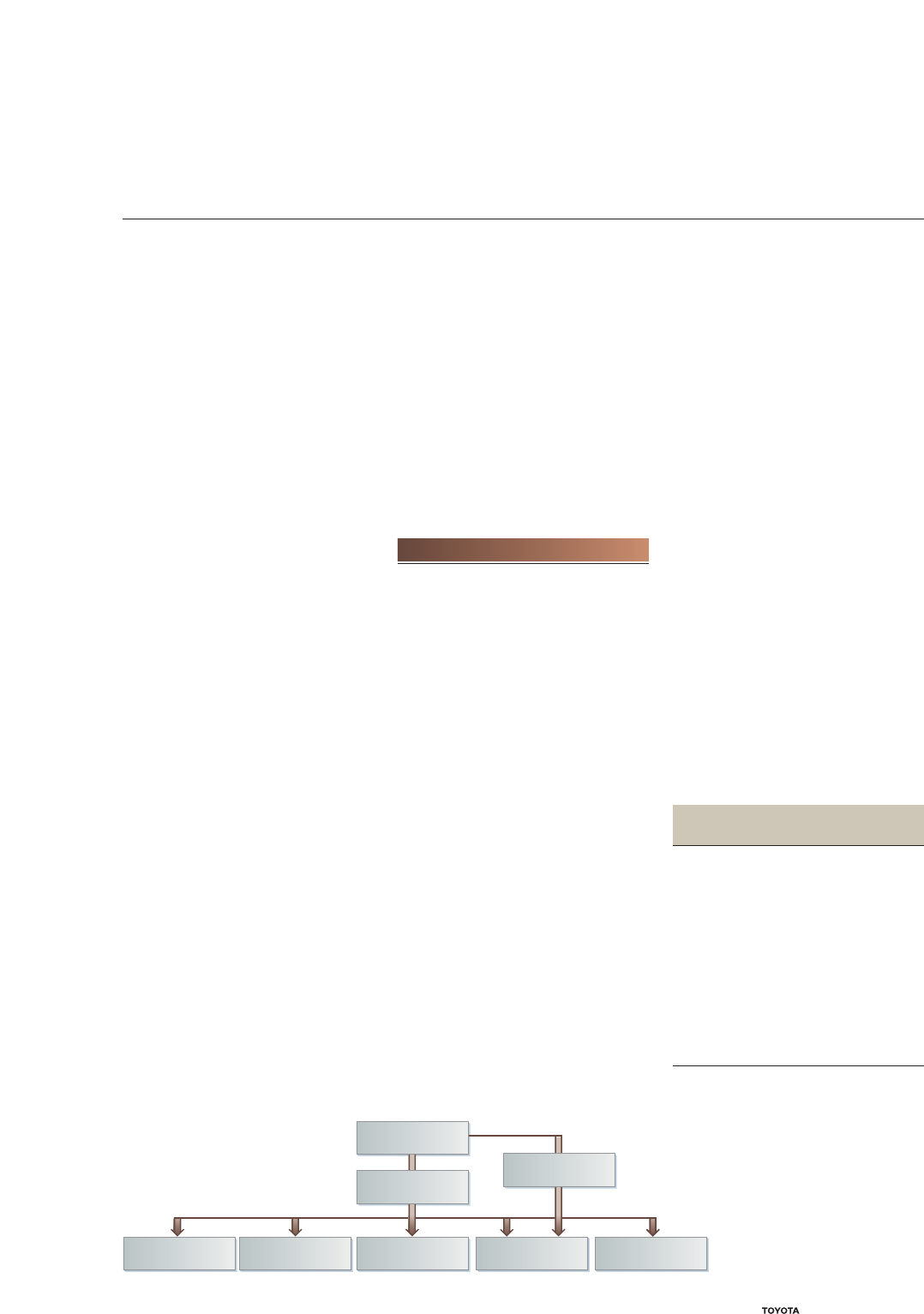

Financial Services Operations Organization

100

%

33.42

%

100% 100% 50% 50% 100%

Toyota Accounting

Service Co.

Overseas Sales

Finance Companies

Toyota Finance

Corporation

Toyota Financial Services

Securities Corporation

Toyota Financial

Services Corporation

Toyota Motor

Corporation

Toyota Asset

Management Co., Ltd.

Aioi Insurance

Co., Ltd.

system that will encompass more

than 60% of the market for Toyota-

brand vehicles. In fiscal 2007, the

TFS group extended its sales area

from Beijing to include Guangzhou,

Tianjin, Shenzhen, and Shanghai.

Plans call for further expansion to

Jiangsu, Zhejiang, and other areas

of Guangdong by the end of

March 2008. And, in its first year of

operation in Indonesia, the TFS

group increased its sales bases

from 7 to 14. We plan to enter other

regions with careful consideration

of management resource utiliza-

tion and regional characteristics.

Meanwhile, in such mainstay

markets as Europe, North America,

Australia, and Japan, the auto sales

financing environment is changing

significantly. Excess liquidity is

causing fierce competition among

banks. At the same time, cus-

tomers can easily access financial

information through the Internet.

We will respond to such changes

by fostering closer relationships

with customers. To that end, we

are advancing our Customer for

Life initiative to ensure long-term

growth. As part of that initiative,

we are issuing credit cards in

Japan and the United States.

Total cardholders of the TS

CUBIC CARD, issued by Toyota

Finance Corporation, passed 6 million

in fiscal 2007 thanks to a drive to

recruit members that focused on

Toyota dealers and to the expan-

sion of tie-up card services. In addi-

tion, we started QUICPay* service

in the small settlements market in

April 2006. The number of QUICPay

members exceeded one million in

12 months due to a drive to recruit

QUICPay dealers and members.

* QUICPay is a type of electronic money based

on a postpay service that does not require

prior cash deposits.

Business Strategy

Expand Customer Base and Target

Long-Term Earnings Growth

Under the slogan “Growth, Efficiency,

Change,” the TFS group steadily

continued to implement initiatives

from the previous fiscal year focus-

ing on the themes of always

putting the customer first, building

business in developing countries,

launching fresh initiatives to target

earnings growth, and shifting to a

low-cost business model.

In mainstay auto sales financing

business, we are strengthening

coordination among management

companies, distributors, and deal-

ers in regions worldwide. At the

same time, we are offering cus-

tomers easy payment plans

through long-term loans for younger

customers and fixed residual value

products. Also, we provide package

loans that include insurance and

maintenance. Among other products

catering to the needs of customers

and specific regions, we introduced

a lease for the Tundra in the United

States and the Auris key for key

product in Europe. Similarly, in Japan

we are marketing such demand-

generating products as the “Lexus

Owners’ Lease*” and “Rakuchin

Corolla Credit**.” In addition, the

TFS group is bolstering financing

products for fleets and used vehi-

cles to expand its customer base

and support Toyota’s vehicle sales

from a long-term perspective.

* Lexus Owners’ Lease is a lease plan that

lessens the burden of monthly payments by

fixing vehicles’ future trade-in prices.

** Rakuchin Corolla Credit is a payment plan

that lessens the burden of monthly pay-

ments by fixing vehicles’ trade-in prices

three or five years in advance.

Financial Services Operations

Overview of Toyota’s Financial Services

Operations FY 2007

Total assets of financial services

operations ............... ¥13,735.4 billion

Revenues from financial

services operations ...... ¥1,300.5 billion

Operating income........ ¥158.5 billion

Credit ratings ............. AAA /Aaa

Operating areas ......... 31 countries and

regions worldwide

Market coverage ......... approx. 90%

No. of customers ......... approx. 13 million

No. of employees ........ approx. 8,000

Note: Fiscal year ended March 31

Overview of Toyota’s Financial Services

Operations FY 2007