SkyWest Airlines 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

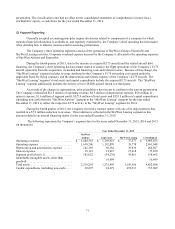

81

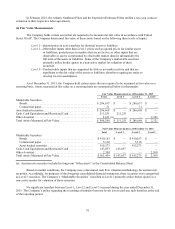

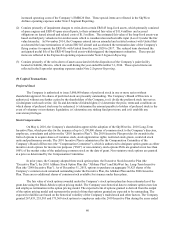

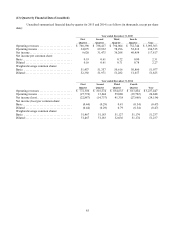

December 31, 2015, 2014 and 2013, respectively. Stock options granted in 2015 vest in three equal installments over a

three-year period. Stock options granted in 2014 and 2013 have three-year vesting periods. The following table shows

the assumptions used and weighted average fair value for grants in the years ended December 31, 2015, 2014 and 2013.

2015

2014

2013

Expected annual dividend rate .................................. 1.18% 1.32 % 1.21%

Risk-free interest rate ......................................... 1.62% 1.50 % 0.92%

Average expected life (years) ................................... 5.7 5.8 6.0

Expected volatility of common stock ............................. 0.401 0.431 0.446

Forfeiture rate ............................................... 0.0% 0.0 % 0.0%

Weighted average fair value of option grants ...................... $ 4.75 $ 4.47 $ 5.04

The Company recorded share-based compensation expense only for those options that are expected to vest. The

estimated fair value of the stock options is amortized over the vesting period of the respective stock option grants.

During the year ended December 31, 2015, the Company granted 408,163 shares of restricted stock units to

certain Company’s employees under the 2010 Incentive Plan. The restricted stock units granted during the year ended

December 31, 2015 have a three-year vesting period, during which the recipient must remain employed with the

Company or its subsidiaries. The weighted average fair value of the restricted stock units the date of grants made during

the year ended December 31, 2015 was $13.57 per share.

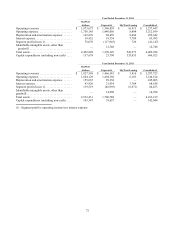

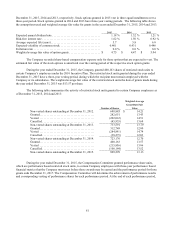

The following table summarizes the activity of restricted stock units granted to certain Company employees as

of December 31, 2015, 2014 and 2013:

Weighted-Average

Grant-Date Fair

Number of Shares

Value

N

on-vested shares outstanding at December 31, 2012 . 698,885 $ 14.21

Granted ....................................... 282,651 13.43

Vested ....................................... (202,012) 14.51

Cancelled ..................................... (45,933) 13.69

N

on-vested shares outstanding at December 31, 2013 . 733,591 13.79

Granted ....................................... 312,749 12.00

Vested ....................................... (284,891) 14.74

Cancelled ..................................... (38,273) 12.83

N

on-vested shares outstanding at December 31, 2014 . 723,176 12.70

Granted ....................................... 408,163 13.57

Vested ....................................... (215,856) 13.06

Cancelled ..................................... (106,184) 13.52

N

on-vested shares outstanding at December 31, 2015 . 809,299 13.13

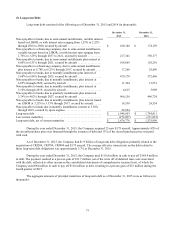

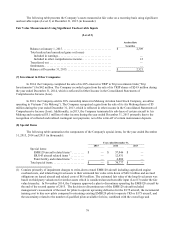

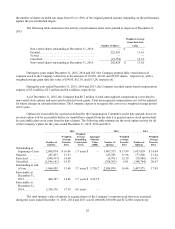

During the year ended December 31, 2015, the Compensation Committee granted performance share units,

which are performance based restricted stock units, to certain Company employees with three-year performance based

financial metrics that the Company must meet before those awards may be earned and the performance period for those

grants ends December 31, 2017. The Compensation Committee will determine the achievement of performance results

and corresponding vesting of performance shares for each performance period. At the end of each performance period,