SkyWest Airlines 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

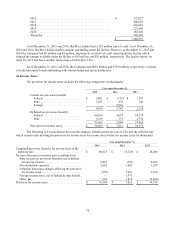

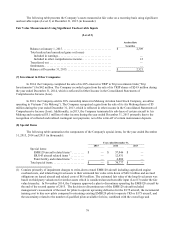

74

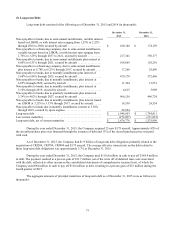

2016 . . . . . .............................................. $ 272,027

2017 . . . . . .............................................. 248,629

2018 . . . . . .............................................. 230,681

2019 . . . . . .............................................. 223,898

2020 . . . . . .............................................. 183,620

Thereafter ............................................... 789,948

$ 1,948,803

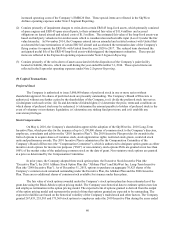

As of December 31, 2015 and 2014, SkyWest Airlines had a $25 million line of credit. As of December 31,

2015 and 2014, SkyWest Airlines had no amount outstanding under the facility. However, at December 31, 2015 and

2014 the Company had $6 million and $5 million, respectively, in letters of credit issued under the facility which

reduced the amount available under the facility to $19 million and $20 million, respectively. The facility expires on

April 19, 2016 and has a variable interest rate of Libor plus 3.0%.

As of December 31, 2015 and 2014, the Company had $88.9 million and $79.9 million, respectively, in letters

of credit and surety bonds outstanding with various banks and surety institutions.

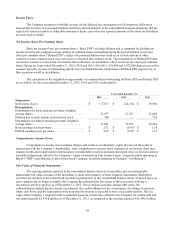

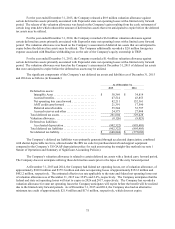

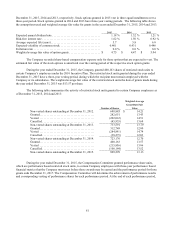

(4) Income Taxes

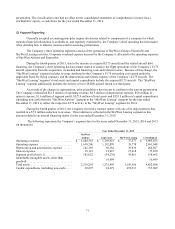

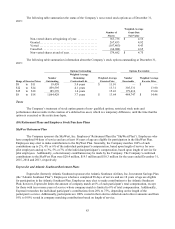

The provision for income taxes includes the following components (in thousands):

Year ended December 31,

2015 2014

2013

Current tax provision (benefit):

Federal............................ $ 3,801 $ (176) $ 1,767

State .............................. 1,035 838 343

Foreign ........................... — 2,081 —

4,836 2,743 2,110

Deferred tax provision (benefit):

Federal............................ 66,430 4,697 34,728

State .............................. 5,239 371 2,738

71,669 5,068 37,466

Provision for income taxes .............. $ 76,505 $ 7,811 $ 39,576

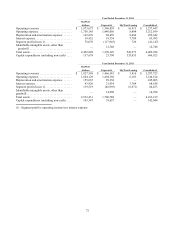

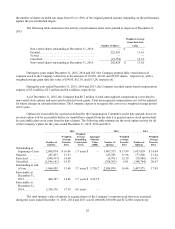

The following is a reconciliation between the statutory federal income tax rate of 35% and the effective rate

which is derived by dividing the provision for income taxes by income (loss) before for income taxes (in thousands):

Year ended December 31,

2015

2014

2013

Computed provision (benefit) for income taxes at the

statutory rate .................................. $ 68,013 $ (5,720) $ 34,486

Increase (decrease) in income taxes resulting from:

State income tax provision (benefit), net of federal

income tax benefit ........................... 5,416 (107) 2,867

Non-deductible expenses ....................... 3,641 3,865 3,257

Valuation allowance changes affecting the provision

for income taxes ............................ (899) 5,981 1,430

Foreign income taxes, net of federal & state benefit . — 1,973

Other, net .................................... 334 1,819 (2,464)

Provision for income taxes ........................ $ 76,505 $ 7,811 $ 39,576