SkyWest Airlines 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

availability of labor resources, including pilots, low operating cost, financial resources, geographical infrastructure,

overall customer service levels relating to on-time arrival and flight completion percentages and the overall image of the

regional airline.

The principal competitive factors for regional airline code-share arrangements include labor resources,

code-share agreement terms, reliable flight operations, operating cost structure, certification to operate certain aircraft

types, geographical infrastructure and markets and routes served.

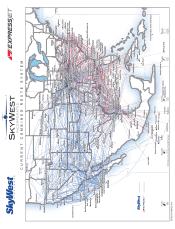

The combined operations of SkyWest Airlines and ExpressJet represent the largest regional airline operations

in the United States. However, regional carriers owned by major airlines may have access to greater resources through

their parent companies than SkyWest Airlines and ExpressJet.

Generally, the airline industry is highly sensitive to changes in general economic conditions. Economic

downturns, combined with competitive pressures, have contributed to a number of reorganizations, bankruptcies,

liquidations and business combinations among major and regional carriers. The effect of economic downturns may be

somewhat mitigated by the predominantly contract based flying arrangements of SkyWest Airlines and ExpressJet. If,

however, any of our code share partners experience a prolonged decline in the number of passengers or are negatively

affected by low ticket prices or high fuel prices, they may seek to renegotiate their code share agreements with SkyWest

Airlines or ExpressJet, or materially reduce scheduled flights in order to reduce their costs. In addition, adverse weather

conditions can impact our ability to complete scheduled flights and have a negative impact on our operations and

financial condition.

Industry Overview

Major and Regional Airlines

The airline industry in the United States has traditionally been comprised of several major airlines, including

American, Delta and United. The major airlines offer scheduled flights to most major U.S. cities, numerous smaller U.S.

cities, and cities throughout the world through a hub and spoke network.

Regional airlines, such as SkyWest Airlines, ExpressJet, Mesa, Air Wisconsin, Endeavor, Trans State and

Republic, typically operate smaller aircraft on lower-volume routes than major and low-cost carriers. Several regional

airlines, including Envoy, Endeavor, PSA, Piedmont and Horizon, are wholly-owned subsidiaries of major airlines.

Regional airlines generally do not try to establish an independent route system to compete with the major

airlines. Rather, regional airlines typically enter into relationships with one or more major airlines, pursuant to which the

regional airline agrees to use its smaller, lower-cost aircraft to carry passengers booked and ticketed by the major airline

between a hub of the major airline and a smaller outlying city. In exchange for such services, the major airline pays the

regional airline either a fixed flight fee, termed “contract” or “fixed-fee” flights, or receives a percentage of applicable

passenger ticket revenues, termed “pro-rate” or “revenue-sharing” flights as described in more detail below.

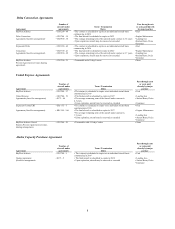

Code-Share Agreements

Regional airlines generally enter into code-share agreements with major airlines, pursuant to which the regional

airline is authorized to use the major airline’s two-letter flight designator codes to identify the regional airline’s flights

and fares in the central reservation systems, to paint its aircraft with the colors and/or logos of its code-share partner and

to market and advertise its status as a carrier for the code-share partner. Code-share agreements also generally obligate

the major airline to provide services such as reservations, ticketing, ground support and gate access to the regional

airline, and the major partners often coordinate marketing, advertising and other promotional efforts. In exchange, the

regional airline provides a designated number of low-capacity (usually between 50 and 76 seats) flights between larger

airports served by the major airline and surrounding cities, usually in lower-volume markets. The financial arrangements

between the regional airlines and their code-share partners usually involve either fixed-fee arrangements or

revenue-sharing arrangements as explained below:

• Fixed-Fee Arrangements. Under a fixed-fee arrangement (referenced in this report as a “fixed-fee

arrangement,” “contract flying” or a “capacity purchase agreement”), the major airline generally pays the

regional airline a fixed-fee for each departure, flight or block hours incurred, and an amount per aircraft in