SkyWest Airlines 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

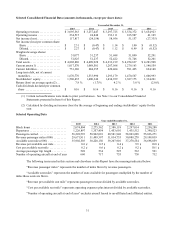

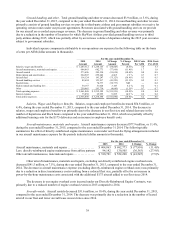

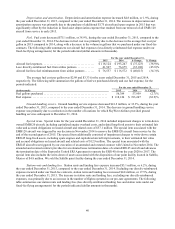

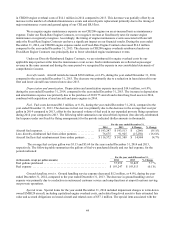

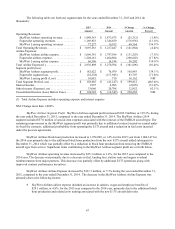

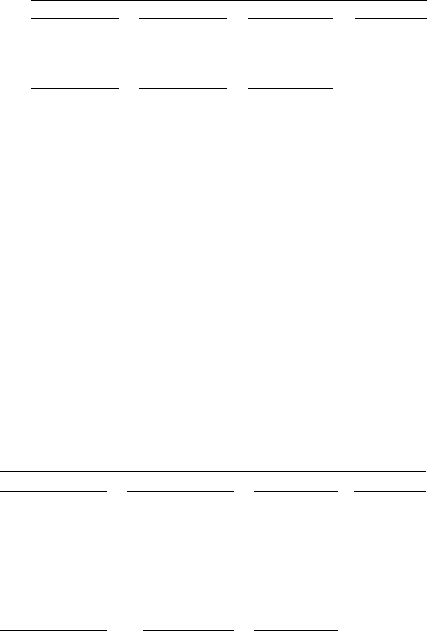

For the year ended December 31,

2015 2014 $ Change % Change

Station rents and landing fees ............................... $ 54,167 $ 51,024 $ 3,143 6.2%

Less: directly-reimbursed landing fee and station rent from airline

partners ................................................. 22,171 23,800 (1,629) (6.8)%

Station rents and landing fees less directly-reimbursed landing fee

and station rent from airline partners ......................... $ 31,996 $ 27,224 $ 4,772 17.5%

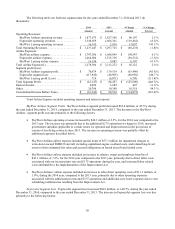

Other operating expenses. Other operating expenses, primarily consisting of property taxes, hull and liability

insurance, crew simulator training, and crew hotel costs, decreased $4.0 million, or 1.5%, during the year ended

December 31, 2015, compared to the year ended December 31, 2014. The decrease in other operating expenses was

primarily related to a reduction in fleet size, partially offset by additional training costs associated with E175 deliveries,

including the use of simulators, hotels and crew per diem costs.

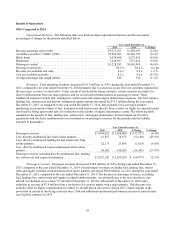

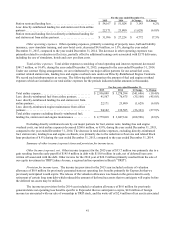

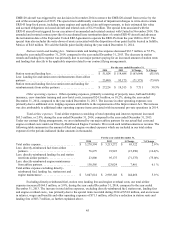

Total airline expenses. Total airline expenses (consisting of total operating and interest expenses) decreased

$341.7 million, or 10.4%, during the year ended December 31, 2015, compared to the year ended December 31, 2014.

Under our contract flying arrangements, we are reimbursed by our major airline partners for our actual fuel costs,

contract related station rents, landing fees and engine overhaul costs under our Directly-Reimbursed Engine Contracts.

We record such reimbursements as revenue. The following table summarizes the amount of fuel and engine overhaul

expenses which are included in our total airline expenses for the periods indicated (dollar amounts in thousands).

For the year ended December 31,

2015 2014 $ Change % Change

Total airline expense ................................... $ 2,936,898 $ 3,278,594 (341,696) (10.4)%

Less: directly-reimbursed fuel from airline partners . . . . . . . . . . 41,567 76,675 (35,108) (45.8)%

Less: directly-reimbursed landing fee and station rent from

airline partners ........................................ 22,171 23,800 (1,629) (6.8)%

Less: directly-reimbursed engine maintenance from airline

partners .............................................. 94,142 130,505 (36,363) (27.9)%

Total airline expense excluding directly-reimbursed fuel,

landing fee, station rent and engine maintenance . . . . . . . . . . . . $ 2,779,018 $ 3,047,614 (268,596) (8.8)%

Excluding directly reimbursed costs by our major partners for fuel, station rents, landing fees and engine

overhaul costs, our total airline expenses decreased $268.6 million, or 8.8%, during the year ended December 31, 2015,

compared to the year ended December 31, 2014. The decrease in total airline expenses, excluding directly-reimbursed

fuel, station rents, landing fees and engine overhauls, was primarily due to the reduction in fleet size and related block

hour production of 8.8% during the year ended December 31, 2015, compared to the year ended December 31, 2014.

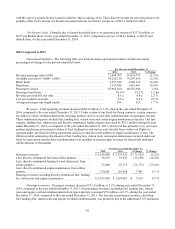

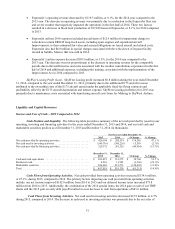

Summary of other income (expense) items and provision for income taxes:

Other Income (expense), net. Other income (expense) for the 2015 year of $33.7 million was primarily due to a

gain resulting from the early payoff of $145.4 million in debt with $110.8 million in cash, net of deferred loan costs

written off associated with the debt. Other income for the 2014 year of $24.9 million primarily resulted from the sale of

our equity investment in TRIP Linhas Arereas, a regional airline operation in Brazil (“TRIP”).

Provision for income taxes. The income tax provision for the 2015 year included a release of valuation

allowance of $0.9 million for previously generated state net operating loss benefits primarily for ExpressJet that we

previously anticipated would expire. The release of the valuation allowance was based on the gain related to early

retirement of certain long term debt which reduced the amount of deferred tax assets that we anticipate will expire before

the deferred tax assets may be utilized.

The income tax provision for the 2014 year included a valuation allowance of $6.0 million for previously

generated state net operating loss benefits specific to ExpressJet that we anticipate to expire, $2.0 million of foreign

income tax associated with our sale of ownership in TRIP stock, and the write-off of $2.4 million of tax assets associated