SkyWest Airlines 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

The following discussion and analysis presents factors that had a material effect on our results of operations

during the years ended December 31, 2015, 2014 and 2013. Also discussed is our financial position as of December 31,

2015 and 2014. You should read this discussion in conjunction with our consolidated financial statements, including the

notes thereto, appearing elsewhere in this Report or incorporated herein by reference. This discussion and analysis

contains forward-looking statements. Please refer to the sections of this Report entitled “Cautionary Statement

Concerning Forward-looking Statements” and “Item 1A. Risk Factors” for discussion of some of the uncertainties, risks

and assumptions associated with these statements.

Overview

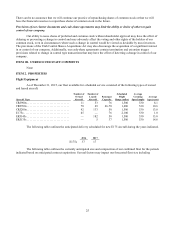

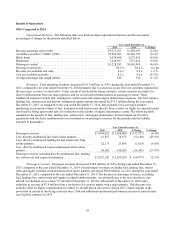

Through SkyWest Airlines and ExpressJet, we operate the largest regional airline in the United States. As of

December 31, 2015, SkyWest Airlines and ExpressJet offered scheduled passenger and air freight service with

approximately 3,600 total daily departures to destinations in the United States, Canada, Mexico and the Caribbean. As of

December 31, 2015, we had a combined fleet of 702 aircraft consisting of the following:

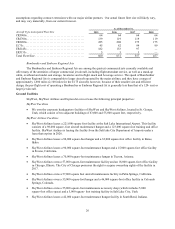

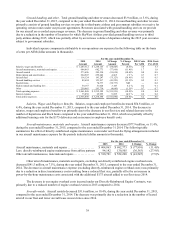

CRJ200 CRJ700 CRJ900 ERJ135 ERJ145 E175 EMB120 Total

United .................................

83 70 — 5 166 40 — 364

Delta ..................................

111 60 64 — — — — 235

American ..............................

31 — — — 16 — — 47

Alaska .................................

— 9 — — — 5 — 14

Aircraft in scheduled service ..............

225 139 64 5 182 45 — 660

Subleased to an un-affiliated entity .......

2 — — — — — — 2

Other* ..............................

10 — — 4 — — 26 40

Total ..................................

237 139 64 9 182 45 26 702

*Other aircraft consisted of leased aircraft removed from service that were in the process of being returned to

the lessor and owned aircraft removed from service that were held for sale.

For the year ended December 31, 2015, approximately 57.5% of our aggregate capacity was operated for

United, approximately 33.2% was operated for Delta, approximately 6.4% was operated for American and approximately

2.9% was operated for Alaska.

Under our fixed-fee arrangements, three components have a significant impact on comparability of revenue and

operating expense for the periods presented in this Report. The first item is the reimbursement of fuel expense, which is a

directly-reimbursed expense under all of our fixed-fee arrangements. If we purchase fuel directly from vendors, our

major partners reimburse us for fuel expense incurred under each respective fixed-fee contract, and we record such

reimbursement as passenger revenue. Thus, the price volatility of fuel and the volume of fuel expensed under our

fixed-fee arrangements during a particular period will impact our fuel expense and our passenger revenue during the

period equally, with no impact on our operating income. Over the past few years, some of our major airline partners have

purchased an increased volume of fuel directly from vendors on flights we operated under our fixed-fee contracts, which

has decreased both revenue and operating expenses compared to previous periods presented in this Report.

The second item is the reimbursement of landing fees and station rents, which is a directly-reimbursed expense

under all of our fixed-fee arrangements. Our major partners reimburse us for landing fees and station rent expense

incurred under each respective fixed-fee contract, and we record such reimbursement as passenger revenue. Over the past

few years, some of our major airline partners have paid an increased volume of landing fees and station rents directly to

our vendors on flights we operated under our flying contracts, which has also decreased both revenue and operating

expenses compared to previous periods presented in this Report.

The third item is the compensation we receive for engine maintenance under our fixed-fee arrangements. Under

our United CRJ and E175 fixed-fee contracts, American fixed-fee contracts, and Alaska fixed-fee contracts, a portion of

our compensation is based upon fixed hourly rates the aircraft is in operation, which is intended to cover various

operating costs, including engine maintenance costs (“Fixed-Rate Engine Contracts”). Under the compensation structure