SkyWest Airlines 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

Income Taxes

The Company recognizes a liability or asset for the deferred tax consequences of all temporary differences

between the tax basis of assets and liabilities and their reported amounts in the consolidated financial statements that are

expected to result in taxable or deductible amounts in future years when the reported amounts of the assets and liabilities

are recovered or settled.

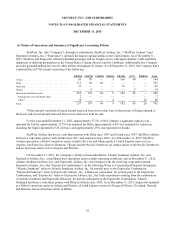

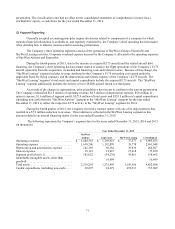

Net Income (Loss) Per Common Share

Basic net income (loss) per common share (“Basic EPS”) excludes dilution and is computed by dividing net

income (loss) by the weighted average number of common shares outstanding during the period. Diluted net income

(loss) per common share (“Diluted EPS”) reflects the potential dilution that could occur if stock options or other

contracts to issue common stock were exercised or converted into common stock. The computation of Diluted EPS does

not assume exercise or conversion of securities that would have an anti-dilutive effect on net income (loss) per common

share. During the years ended December 31, 2015, 2014 and 2013, 505,000, 3,191,000 and 3,072,000 shares reserved for

issuance upon the exercise of outstanding options were excluded from the computation of Diluted EPS respectively, as

their inclusion would be anti-dilutive.

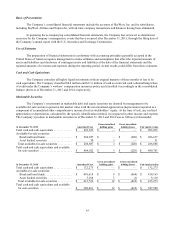

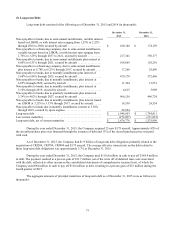

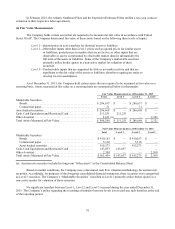

The calculation of the weighted average number of common shares outstanding for Basic EPS and Diluted EPS

are as follows for the years ended December 31, 2015, 2014 and 2013 (in thousands):

Year Ended December 31,

2015

2014

2013

Numerator:

N

et Income (Loss) ................................. $ 117,817 $ (24,154) $ 58,956

Denominator:

Denominator for basic earnings per-share weighted

average shares ..................................... 51,077 51,237 51,688

Dilution due to stock options and restricted stock . . . . . . . . 748 — 734

Denominator for diluted earnings per-share weighted

average shares ..................................... 51,825 51,237 52,422

Basic earnings (loss) per-share ....................... $ 2.31 $ (0.47) $ 1.14

Diluted earnings (loss) per-share ...................... $ 2.27 $ (0.47) $ 1.12

Comprehensive Income (Loss)

Comprehensive income (loss) includes charges and credits to stockholders’ equity that are not the result of

transactions with the Company’s shareholders. Also, comprehensive income (loss) consisted of net income (loss) plus

changes in unrealized appreciation (depreciation) on marketable securities and unrealized gain (loss) on foreign currency

translation adjustment related to the Company’s equity investment in Trip Linhas Aereas, a regional airline operating in

Brazil (“TRIP”) and Mekong Aviation Joint Stock Company, an airline operating in Vietnam (“Air Mekong”).

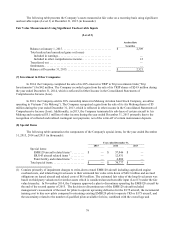

Fair Value of Financial Instruments

The carrying amounts reported in the consolidated balance sheets for receivables and accounts payable

approximate fair values because of the immediate or short-term maturity of these financial instruments. Marketable

securities are reported at fair value based on market quoted prices in the consolidated balance sheets. If quoted prices in

active markets are no longer available, the Company has estimated the fair values of these securities utilizing a

discounted cash flow analysis as of December 31, 2015. These analyses consider, among other items, the

collateralization underlying the security investments, the creditworthiness of the counterparty, the timing of expected

future cash flows, and the expectation of the next time the security is expected to have a successful auction. The fair

value of the Company’s long-term debt is estimated based on current rates offered to the Company for similar debt and

was approximately $1,939.8 million as of December 31, 2015, as compared to the carrying amount of $1,948.8 million