SkyWest Airlines 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

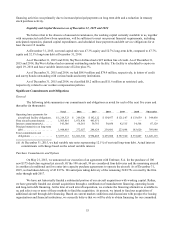

43

that began in 2014, improvements in the provisions in certain of our flying contracts and additional revenue sharing

operations, partially offset by reductions in the ExpressJet fleet size, severe weather experienced in the first half of 2014

and reduced contract performance incentives.

Ground handling and other. Total ground handling and other revenues increased $11.3 million, or 19.3%,

during the year ended December 31, 2014, compared to the year ended December 31, 2013. Ground handling and other

revenue primarily consists of ground handling services we provide to third-party airlines and government subsidies we

receive for operating certain routes. Revenues associated with ground handling services we provide for our aircraft are

recorded as passenger revenues. The increase in ground handling and other revenue was primarily due to an increased

volume of departures during the 2014 year on routes subject to government subsidies.

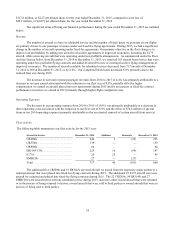

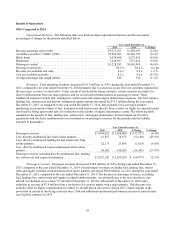

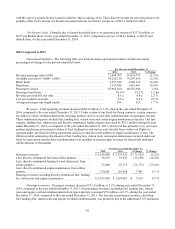

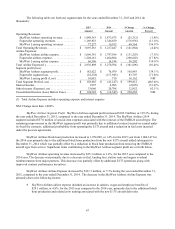

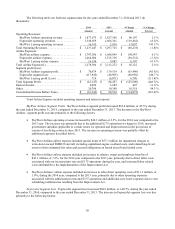

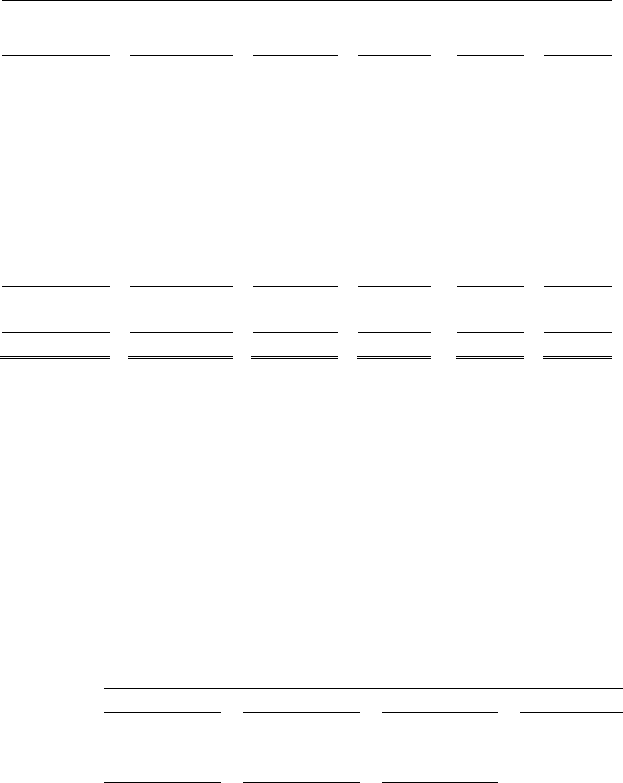

Individual expense components attributable to our operations are expressed in the following table on the basis

of cents per ASM (dollar amounts in thousands).

For the year ended December 31,

2014 2013

2014 2013 $ Change % Change Cents Per Cents Per

Amount Amount Amount Percent ASM ASM

Salaries, wages and benefits ........ $ 1,258,155 $ 1,211,307 $ 46,848 3.9 % 3.3 3.1

Aircraft maintenance, materials

and repairs ...................... 682,773 686,381 (3,608) (0.5)% 1.8 1.8

Aircraft rentals ................... 305,334 325,360 (20,026) (6.2)% 0.8 0.8

Depreciation and amortization . . . . . . 259,642 245,005 14,637 6.0 % 0.7 0.6

Aircraft fuel ..................... 193,247 193,513 (266) (0.1)% 0.5 0.5

Ground handling services .......... 123,917 129,119 (5,202) (4.0)% 0.3 0.3

Special Items .................... 74,777 — 74,777 NM 0.2 —

Station rentals and landing fees . . . . . 51,024 114,688 (63,664) (55.5)% 0.1 0.3

Other ........................... 263,730 239,241 24,489 10.2 % 0.7 0.6

Total operating expenses ........... 3,212,599 3,144,614 67,985 2.2 % 8.4 8.0

Interest expense .................. 65,995 68,658 (2,663) (3.9)% 0.2 0.2

Total airline expenses ............. $ 3,278,594 $ 3,213,272 $ 65,322 2.0 % 8.6 8.2

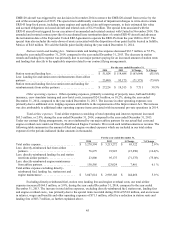

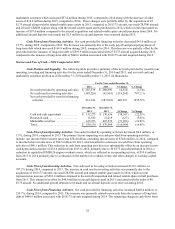

Salaries, Wages and Employee Benefits. Salaries, wages and employee benefits increased $46.8 million, or

3.9%, during the year ended December 31, 2014, compared to the year ended December 31, 2013. The increase in

salaries, wages and employee benefits was primarily due to additional expenses attributable to the implementation of the

Improvement Act, which had a negative effect on pilot scheduling and work hours and resulted in increased crew costs.

The increase was also due to the additional E175 operations and training costs associated with the commencement of our

E175 flight operations during 2014.

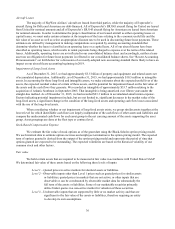

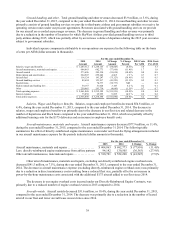

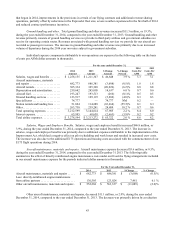

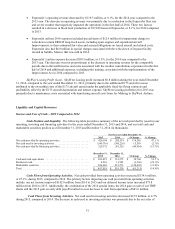

Aircraft maintenance, materials and repairs. Aircraft maintenance expense decreased $3.6 million, or 0.5%,

during the year ended December 31, 2014, compared to the year ended December 31 2013. The following table

summarizes the effect of directly reimbursed engine maintenance costs under our fixed-fee flying arrangements included

in our aircraft maintenance expense for the periods indicated (dollar amounts in thousands).

For the Year ended December 31,

2014

2013

$ Change

% Change

Aircraft maintenance, materials and repairs . . . . . $ 682,773 $ 686,381 $ (3,608) (0.5)%

Less: directly-reimbursed engine maintenance

from airline partners ........................ 130,505 123,024 7,481 6.1%

Other aircraft maintenance, materials and repairs . $ 552,268 $ 563,357 $ (11,089) (2.0)%

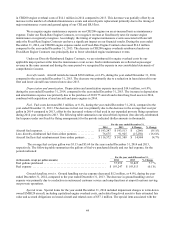

Other aircraft maintenance, materials and repairs, decreased $11.1 million, or 2.0%, during the year ended

December 31, 2014, compared to the year ended December 31, 2013. The decrease was primarily driven by a reduction