SkyWest Airlines 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

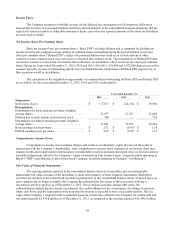

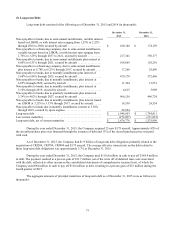

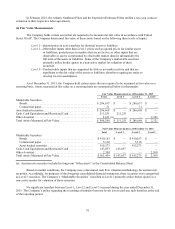

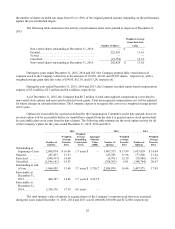

The following table presents the Company’s assets measured at fair value on a recurring basis using significant

unobservable inputs (Level 3) at December 31, 2015 (in thousands):

Fair Value Measurements Using Significant Unobservable Inputs

(Level 3)

Auction Rate

Securities

Balance at January 1, 2015 ................................... $ 2,309

Total realized and unrealized gains or (losses)

Included in earnings ...................................... —

Included in other comprehensive income ..................... 12

Transferred out ............................................ —

Settlements ................................................ —

Balance at December 31, 2015 . . . . . . . . . . . . . . . . . . . ............. $ 2,321

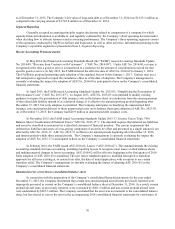

(7) Investment in Other Companies

In 2014, the Company completed the sale of its 20% interest in TRIP to Trip investments Ltda (“Trip

Investimentos”) for $42 million. The Company recorded a gain from the sale of its TRIP shares of $24.9 million during

the year ended December 31, 2014, which is reflected in Other Income in the Consolidated Statements of

Comprehensive Income (Loss).

In 2013, the Company sold its 30% ownership interest in Mekong Aviation Joint Stock Company, an airline

operating in Vietnam (“Air Mekong”). The Company recognized a gain from the sale of its Air Mekong shares of $5

million during the year ended December 31, 2013, which is reflected in other income in the Consolidated Statements of

Comprehensive Income (Loss). Additionally, in 2013, the Company terminated its sub-lease of certain aircraft to Air

Mekong and recognized $5.1 million of other income during the year ended December 31, 2013 primarily due to the

recognition of collected and realized contingent rent payments, net of the write-off of certain maintenance deposits.

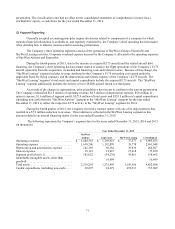

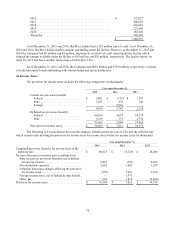

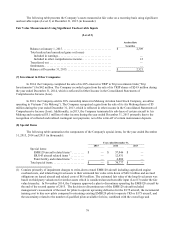

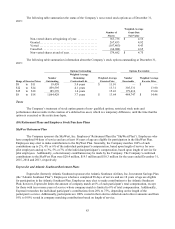

(8) Special Items

The following table summarizes the components of the Company's special items, for the year ended December

31, 2015, 2014 and 2013 (in thousands):

Year ended December 31,

2015 2014 2013

Special items:

EMB120 aircraft related items

1

......... $ — $ 57,046 $ —

ERJ145 aircraft related items

2

.......... — 12,931 —

Paint facility and related items

3

......... — 4,800 —

Total special items ....................... $ — $ 74,777 $ —

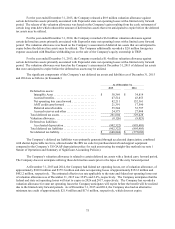

(1) Consists primarily of impairment charges to write-down owned EMB120 aircraft including capitalized engine

overhaul costs, and related long-lived assets to their estimated fair value write down of $48.3 million and accrued

obligations on leased aircraft and related costs of $8.8 million. The estimated fair value of the long-lived assets was

based on third party valuations for similar assets which is considered an unobservable input (Level 3) under the fair

value hierarchy. In November 2014, the Company approved a plan to discontinue operating the EMB120 aircraft by

the end of the second quarter of 2015. The decision to discontinue use of the EMB120 aircraft included

management’s assessment of the need for pilots to operate upcoming deliveries for the E175 aircraft, the incremental

training cost to hire new pilots compared to retraining existing EMB120 pilots to operate CRJ or E175 aircraft, and

the uncertainty related to the number of qualified pilots available for hire, combined with the overall age and