SkyWest Airlines 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

in CRJ200 engine overhaul costs of $14.1 million in 2014 compared to 2013. This decrease was partially offset by an

increase in the number of scheduled maintenance events and aircraft parts replacement primarily due to the timing of

major maintenance events and general aging of our CRJ and ERJ fleet.

We recognize engine maintenance expense on our CRJ200 engines on an as-incurred basis as maintenance

expense. Under our Fixed-Rate Engine Contracts, we recognize revenue at fixed hourly rates for mature engine

maintenance on regional jet engines. Accordingly, the timing of engine maintenance events associated with aircraft

under the Fixed-Rate Engine Contracts can have a significant impact on our financial results. During the year ended

December 31, 2014, our CRJ200 engine expense under our Fixed-Rate Engine Contracts decreased $14.2 million

compared to the year ended December 31, 2013. The decrease in CRJ200 engine overhauls reimbursed under our

Fixed-Rate Engine Contracts was principally due to fewer scheduled engine maintenance events.

Under our Directly-Reimbursed Engine Contracts, we are reimbursed for engine overhaul costs by our

applicable major partner at the time the maintenance event occurs. Such reimbursements are reflected as passenger

revenue in the same amount and during the same period we recognized the expense in our consolidated statements of

comprehensive income.

Aircraft rentals. Aircraft rentals decreased $20.0 million, or 6.2%, during the year ended December 31, 2014,

compared to the year ended December 31, 2013. The decrease was primarily due to a reduction in leased aircraft in our

fleet and lower aircraft lease renewal rates since 2013.

Depreciation and amortization. Depreciation and amortization expense increased $14.6 million, or 6.0%,

during the year ended December 31, 2014, compared to the year ended December 31, 2013. The increase in depreciation

and amortization expense was primarily due to the purchase of 20 E175 aircraft and related long lived assets in 2014,

combined with acquisition of used aircraft and spare engines in 2014.

Fuel. Fuel costs decreased $0.3 million, or 0.1%, during the year ended December 31, 2014, compared to the

year ended December 31, 2013. The decrease in fuel cost was primarily due to the decrease in the average fuel cost per

gallon in 2014 compared to 2013, offset by the increased volume of fuel used in our expanded pro-rate flying operations

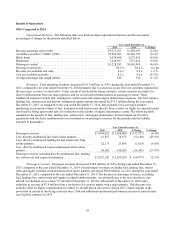

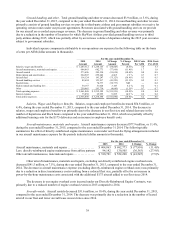

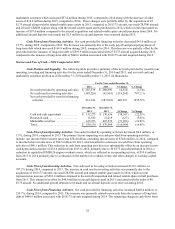

during 2014 year compared to 2013. The following table summarizes our aircraft fuel expenses (less directly-reimbursed

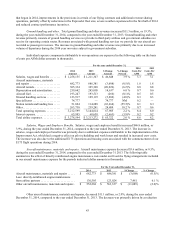

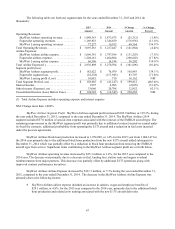

fuel expense under our fixed-fee flying arrangements) for the periods indicated (dollar amounts in thousands).

4

For the year ended December 31,

2014 2013 $ Change % Change

Aircraft fuel expenses ..................................... $ 193,247 $ 193,513 $ (266) (0.1)%

Less: directly-reimbursed fuel from airline partners ............. 76,675 91,925 (15,250) (16.6)%

Aircraft fuel less fuel reimbursement from airline partners ....... $ 116,572 $ 101,588 $ 14,984 14.7%

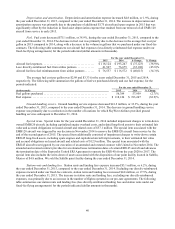

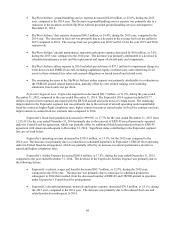

The average fuel cost per gallon was $3.33 and $3.60 for the years ended December 31, 2014 and 2013,

respectively. The following table summarizes the gallons of fuel we purchased directly and our fuel expense, for the

periods indicated:

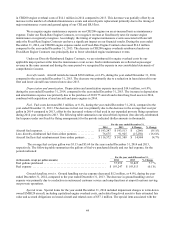

For the year ended December 31,

(in thousands, except per gallon amounts) 2014 2013 % Change

Fuel gallons purchased ............................................ 57,959 53,825 7.7%

Fuel expense .................................................... $ 193,247 $ 193,513 (0.1)%

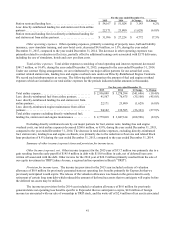

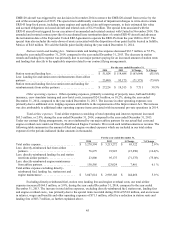

Ground handling service. Ground handling service expense decreased $5.2 million, or 4.0%, during the year

ended December 31, 2014, compared to the year ended December 31, 2013. The decrease in ground handling service

expense was primarily due to a reduction in outsourced customer service and ramp functions at airport locations serving

our pro-rate operations.

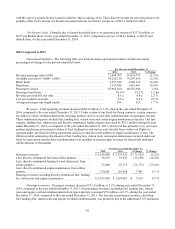

Special items. Special items for the year ended December 31, 2014 included impairment charges to write-down

owned EMB120 aircraft, including capitalized engine overhaul costs, and related long-lived assets to their estimated fair

value and accrued obligations on leased aircraft and related costs of $57.1 million. The special item associated with the