SkyWest Airlines 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

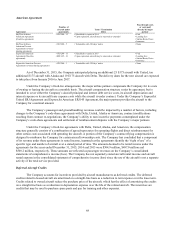

68

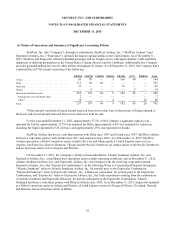

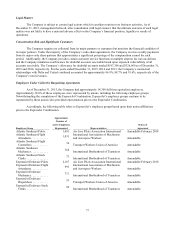

American Agreement

Pass through costs

Number of or costs paid

aircraft under Term / Termination directly by major

Agreement agreements Dates partner

SkyWest Airlines • CRJ 200 - 12 • Scheduled to expire in 2016 • Fuel

American Agreement • Upon expiration, aircraft may be renewed or extended • Landing fees

(fixed-fee agreement) • Station Rents, Deice

• Insurance

SkyWest Airlines • CRJ 200 - 5 • Terminable with 120 days' notice • None

American Pro-rate

Agreement (revenue-

sharing agreement)

ExpressJet American • CRJ 200 - 11 • Scheduled to expire in 2017 • Fuel

Agreement (fixed-fee • ERJ 145 - 16 • Upon expiration, aircraft may be renewed or extended • Landing fees

agreement) • Station Rents, Deice

• Insurance

ExpressJet American Pro-rate • CRJ 200 - 3 • Terminable with 120 days' notice • None

Agreement (revenue-sharing agreement)

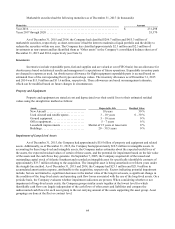

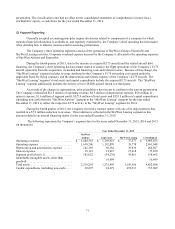

As of December 31, 2015, the Company anticipated placing an additional 25 E175 aircraft with United, ten

additional E175 aircraft with Alaska and 19 E175 aircraft with Delta. The delivery dates for the new aircraft are expected

to take place from January 2016 to June 2017.

Under the Company’s fixed-fee arrangements, the major airline partners compensate the Company for its costs

of owning or leasing the aircraft on a monthly basis. The aircraft compensation structure varies by agreement, but is

intended to cover either the Company’s aircraft principal and interest debt service costs, its aircraft depreciation and

interest expense or its aircraft lease expense costs while the aircraft is under contract. Under the Company’s ExpressJet

United ERJ Agreement and ExpressJet American ERJ145 Agreement, the major partner provides the aircraft to the

Company for a nominal amount.

The Company’s passenger and ground handling revenues could be impacted by a number of factors, including

changes to the Company’s code-share agreements with Delta, United, Alaska or American, contract modifications

resulting from contract re-negotiations, the Company’s ability to earn incentive payments contemplated under the

Company’s code-share agreements and settlement of reimbursement disputes with the Company’s major partners.

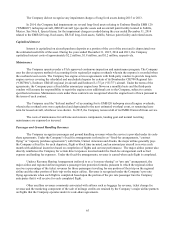

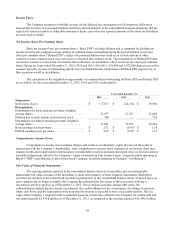

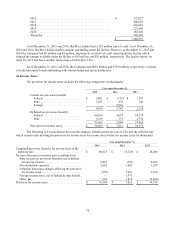

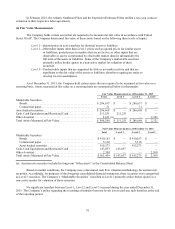

Under the Company’s fixed-fee agreements with Delta, United, Alaska, and American, the compensation

structure generally consists of a combination of agreed-upon rates for operating flights and direct reimbursement for

other certain costs associated with operating the aircraft. A portion of the Company’s contract flying compensation is

designed to reimburse the Company for certain aircraft ownership costs. The Company has concluded that a component

of its revenue under these agreements is rental income, inasmuch as the agreements identify the “right of use” of a

specific type and number of aircraft over a stated period of time. The amounts deemed to be rental income under the

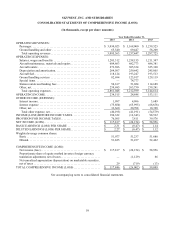

agreements for the years ended December 31, 2015, 2014 and 2013 were $504.9 million, $497.0 million and

$500.2 million, respectively. These amounts are reflected as passenger revenues on the Company’s consolidated

statements of comprehensive income (loss). The Company has not separately stated aircraft rental income and aircraft

rental expense in the consolidated statement of comprehensive income (loss) since the use of the aircraft is not a separate

activity of the total service provided.

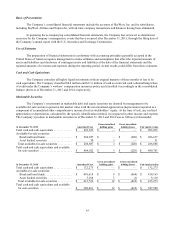

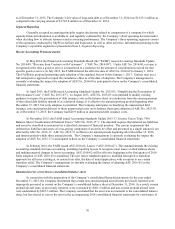

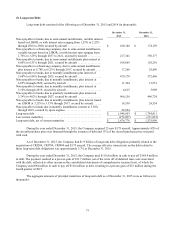

Deferred Aircraft Credits

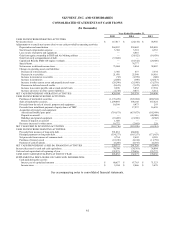

The Company accounts for incentives provided by aircraft manufacturers as deferred credits. The deferred

credits related to leased aircraft are amortized on a straight-line basis as a reduction to rent expense over the lease term.

Credits related to owned aircraft reduce the purchase price of the aircraft, which has the effect of amortizing the credits

on a straight-line basis as a reduction in depreciation expense over the life of the related aircraft. The incentives are

credits that may be used to purchase spare parts and pay for training and other expenses.