SkyWest Airlines 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

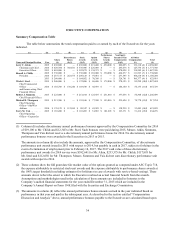

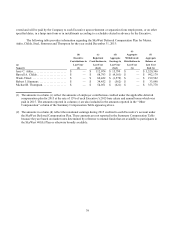

the financial performance of the Company or its subsidiaries and also the achievement of individual goals. The

target amount of each Executive’s annual performance bonus opportunity for 2015 is reported in the “Grants of

Plan-Based Awards for 2015” table below, and included in the applicable amount shown in the column(c) of that

table. The amounts of such annual performance bonuses, excluding discretionary bonuses reported in column (d),

actually earned in 2015 and paid in 2016 were: Mr. Atkin—$606,093; Mr. Childs—$464,277; Mr. Steel—$270,125;

Mr. Simmons—$337,656; Mr. Thompson—$235,624; and Mr. Vais—$163,371.

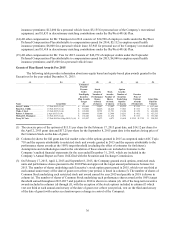

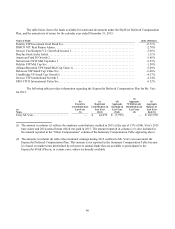

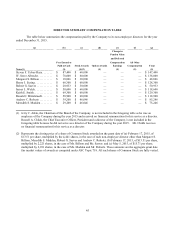

(4) All other compensation for Mr. Atkin for 2015 consists of $112,074 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2015; $4,557 in employer-paid health

insurance premiums; $12,728 for a personal vehicle lease; $5,155 for personal use of the Company’s recreational

equipment; and $1,596 in discretionary matching contributions under the SkyWest 401(k) Plan.

(5) All other compensation for Mr. Atkin for 2014 consists of $100,834 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2014; $4,077 in employer-paid health

insurance premiums; $11,660 for a personal vehicle lease; $5,943 for personal use of the Company’s recreational

equipment; and $1,222 in discretionary matching contributions under the SkyWest 401(k) Plan.

(6) All other compensation for Mr. Atkin for 2013 consists of $112,695 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2013; $3,992 in employer-paid health

insurance premiums; $15,761 for a personal vehicle lease; $4,362 for personal use of the Company’s recreational

equipment; and $1,432 in discretionary matching contributions under the SkyWest 401(k) Plan.

(7) All other compensation for Mr. Childs for 2015 consists of: $88,793 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2015; $5,887 in employer-paid health

insurance premiums; $10,505 for a personal vehicle lease; $5,155 for personal use of the Company’s recreational

equipment; and $1,223 in discretionary matching contributions under the SkyWest 401(k) Plan.

(8) All other compensation for Mr. Childs for 2014 consists of: $77,440 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2014; $5,289 in employer-paid health

insurance premiums; $14,727 for a personal vehicle lease; $5,943 for personal use of the Company’s recreational

equipment; and $811 in discretionary matching contributions under the SkyWest 401(k) Plan.

(9) All other compensation for Mr. Childs for 2013 consists of: $73,494 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2013; $5,195 in employer-paid health

insurance premiums; $15,727 for a personal vehicle lease; $4,362 for personal use of the Company’s recreational

equipment; and $1,599 in discretionary matching contributions under the SkyWest 401(k) Plan.

(10) All other compensation for Mr. Steel for 2015 consists of: $60,422 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2015; $5,887 in employer-paid health insurance

premiums; $12,000 for a personal vehicle lease; $5,155 for personal use of the Company’s recreational equipment;

and $1,835 in discretionary matching contributions under the SkyWest 401(k) Plan.

(11) All other compensation for Mr. Steel for 2014 consists of: $37,640 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2014; $5,132 in employer-paid health insurance

premiums; $6,000 for a personal vehicle lease; $5,943 for personal use of the Company’s recreational equipment;

and $1,418 in discretionary matching contributions under the SkyWest 401(k) Plan.

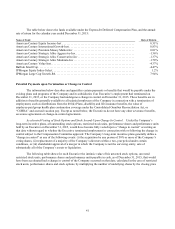

(12) All other compensation for Mr. Simmons for 2015 consists of: $34,452 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2015; $5,887 in employer-paid health

insurance premiums; $10,814 for a personal vehicle allowance; and $5,155 for personal use of the Company’s

recreational equipment.

(13) All other compensation for Mr. Thompson for 2015 consists of: $54,051 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2015; $5,729 in employer-paid health