SkyWest Airlines 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

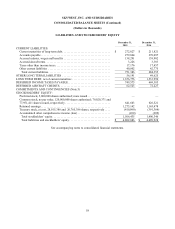

acquisitions, as well as additional aircraft, without materially reducing the amount of working capital available for our

operating activities.

Aircraft Lease and Facility Obligations

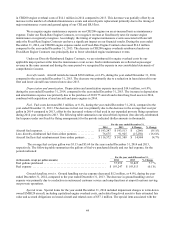

We also have significant long-term lease obligations, primarily relating to our aircraft fleet. At December 31,

2015, we had 470 aircraft under lease with remaining terms ranging from less than one year to 10 years. Future minimum

lease payments due under all long-term operating leases were approximately $1.2 billion at December 31, 2015.

Assuming a 4.89% discount rate, which is the average rate used to approximate the implicit rates within the applicable

aircraft leases, the present value of these lease obligations would have been equal to approximately $1.0 billion at

December 31, 2015.

Long-term Debt Obligations

As of December 31, 2015, we had $1.9 billion of long-term debt obligations related to the acquisition of

CRJ200, CRJ700, CRJ900 and E175 aircraft. The average effective interest rate on those long-term debt obligations was

approximately 3.7% at December 31, 2015.

Under our fixed-fee arrangements, the major airline partners compensate us for our costs of owning or leasing

the aircraft on a monthly basis. The aircraft compensation structure varies by agreement, but is intended to cover either

our aircraft principal and interest debt service costs, our aircraft depreciation and interest expense or our aircraft lease

expense costs while the aircraft is under contract.

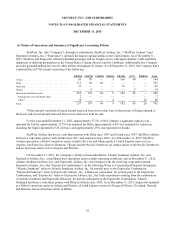

Guarantees

We have guaranteed the obligations of SkyWest Airlines under the SkyWest Airlines Delta Connection

Agreement and the SkyWest Airlines United Express Agreement for the E175 aircraft. We have also guaranteed the

obligations of ExpressJet under the ExpressJet Delta Connection Agreement and the ExpressJet United ERJ Agreement.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

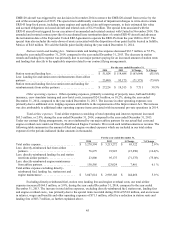

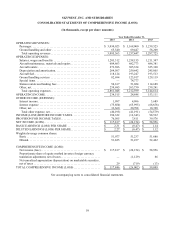

Aircraft Fuel

In the past, we have not experienced difficulties with fuel availability and we currently expect to be able to

obtain fuel at prevailing prices in quantities sufficient to meet our future needs. Pursuant to our contract flying

arrangements, United, Delta, Alaska and American have agreed to bear the economic risk of fuel price fluctuations on

our contracted flights. We bear the economic risk of fuel price fluctuations on our pro-rate operations. For each of the

years ended December 31, 2015, 2014 and 2013, approximately 4%, 3% and 3% of our ASMs were flown under pro-rate

arrangements. For the years ended December 31, 2015, 2014 and 2013, the average price per gallon of aircraft fuel was

$2.09, $3.33 and $3.45, respectively. For illustrative purposes only, we have estimated the impact of the market risk of

fuel on our pro-rate operations using a hypothetical increase of 25% in the price per gallon we purchase. Based on this

hypothetical assumption, we would have incurred an additional $19.1 million, $29.1 million and $25.3 million in fuel

expense for the years ended December 31, 2015, 2014 and 2013, respectively.

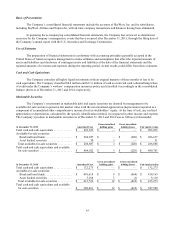

Interest Rates

Our earnings are affected by changes in interest rates due to the amounts of variable rate long-term debt and the

amount of cash and securities held. The interest rates applicable to variable rate notes may rise and increase the amount

of interest expense. We would also receive higher amounts of interest income on cash and securities held at the time;

however, the market value of our available-for-sale securities would likely decline. At December 31, 2015, 2014 and

2013, we had variable rate notes representing 12.1%, 41.3% and 29.5% of our total long-term debt, respectively. For

illustrative purposes only, we have estimated the impact of market risk using a hypothetical increase in interest rates of

one percentage point for both variable rate long-term debt and cash and securities. Based on this hypothetical

assumption, we would have incurred an additional $3.5 million in interest expense and received $5.2 million in

additional interest income for the year ended December 31, 2015; we would have incurred an additional $5.8 million in

interest expense and received $5.5 million in additional interest income for the year ended December 31, 2014; and we

would have incurred an additional $4.8 million in interest expense and received $6.7 million in additional interest

income for the year ended December 31, 2013. However, under our contractual arrangement with our major partners, the

majority of the increase in interest expense would be passed through and recorded as passenger revenue in our