SkyWest Airlines 2015 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

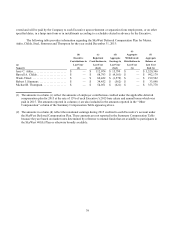

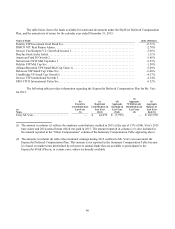

outstanding. Accordingly, the Executive is not entitled to vote or receive dividends on the shares underlying his

performance shares unless and until those performance shares vest.

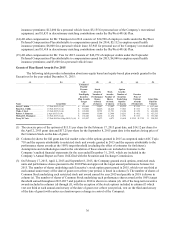

The Compensation Committee’s philosophy for setting performance share targets is to set maximum targets that

will be difficult for the Executives to achieve on a consistent basis. The 2015 to 2017 committee-designated combined

targeted pre-tax earnings over the three year period was set as $318 million (with a threshold of $249 million and max of

$382 million), combined cash flow from operations over the three year period was set as $803 million (with a threshold

of $642 million and max of $963 million) and combined increase in pre-tax return on equity over the three year period

was set as 6.96% (with a threshold of 5.46% and max of 8.37%), with the actual amount of performance shares granted

to each Executive to be adjusted in proportion to the extent to which the combined actual results varied from the target

levels of performance. The performance shares are allocated equally between each of the three metrics in determining the

actual awarded performance shares payable in Common Stock. Specifically, (i) if pre-tax earnings, cash flow from

operations and increase in pre-tax return on equity had been equal to or greater than the above listed targets, then 100%

or more of the performance shares would have been earned (up to a maximum of 150% of the performance shares) by

the Executive attributable to each identified target; (ii) if pre-tax earnings, cash flow from operations and increase in pre-

tax return on equity had ranged from the threshold to the target, then 50% to 100% of the performance shares would have

been earned by the Executive attributable to each identified target; and (iii) if pre-tax earnings, cash flow from operations

and increase in pre-tax return on equity had been less than the threshold, then no performance shares would have been

earned by the Executive attributable to each identified target.

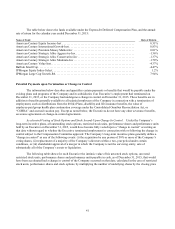

The 2015 to 2017 goals for each Executive were based on the combined Company’s targeted pre-tax earnings,

cash flow from operations and increase in pre-tax return on equity, and there were no alternative operating company

goals set for the Chief Operating Officers of the operating subsidiaries, thus encouraging teamwork and a collective

focus on the creation of long-term value for the Company’s shareholders. In determining the degree to which the targeted

pre-tax earnings, cash flow from operations and increase in pre-tax return on equity goals have been attained, the

Compensation Committee will adjust results during the three year period for unusual or non-recurring items.

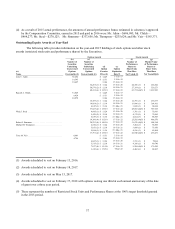

Actual results for performance shares awarded in 2015 are measured over a three year period including 2015 to

2017. Therefore, the degree to which performance shares granted in 2015 ultimately earned will not be determined

until the conclusion of the 2017 calendar year.

Long-Term Awards for 2016. The Compensation Committee determined to adjust the long-term incentive

metrics for performance shares awarded for 2016 in an effort to better align the incentive awards with the creation of

shareholder value and to align the compensation package of the Executives with those of other regional and major air

carrier executive compensation programs. The actual performance shares granted will be measured with respect to pre-

tax earnings, cumulative earnings per share and return on invested capital over the applicable three-year measurement

period.

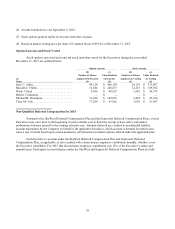

Retirement and Other Benefits.

The Company and SkyWest Airlines sponsor a 401(k) retirement plan for their eligible employees, including

the Executives other than Mr. Vais. ExpressJet also maintains a substantially equivalent 401(k) plan for its eligible

employees, including Mr. Vais. Both plans are broad based, tax-qualified retirement plans under which eligible

employees, including the Executives, may make annual pre-tax salary reduction contributions subject to the various

limits imposed under the Internal Revenue Code of 1986, as amended (the “Code”). The sponsoring employers make

matching contributions under the plans on behalf of eligible participants; however, the right of Executives and other

officers to such matching contributions is limited. The Compensation Committee believes that maintaining the 401(k)

retirement plans and providing a means to save for retirement is an essential part of a competitive compensation package

necessary to attract and retain talented executives.