SkyWest Airlines 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

service each month with additional incentives based on completion of flights, on- time performance and

other operating metrics. In addition, the major and regional airline often enter into an arrangement pursuant

to which the major airline bears the risk of changes in the price of fuel and other such costs that are passed

through to the major airline partner. Regional airlines benefit from a fixed-fee arrangement because they

are sheltered from some of the elements that cause volatility in airline financial performance, including

variations in ticket prices, number of passengers and fuel prices. However, regional airlines in fixed-fee

arrangements generally do not benefit from positive trends in ticket prices (including ancillary revenue

programs), the number of passengers enplaned or fuel prices because the major airlines retain passenger

fare volatility risk and fuel costs associated with the regional airline flight.

• Revenue-Sharing Arrangements. Under a revenue-sharing arrangement (referenced in this report as a

“revenue-sharing” arrangement or “pro-rate” arrangement), the major airline and regional airline negotiate

a passenger fare proration formula, pursuant to which the regional airline receives a percentage of the ticket

revenues for those passengers traveling for one portion of their trip on the regional airline and the other

portion of their trip on the major airline. Substantially all costs associated with the regional airline flight are

borne by the regional airline. In such a revenue-sharing arrangement, the regional airline may realize

increased profits as ticket prices and passenger loads increase or fuel prices decrease and, correspondingly,

the regional airline realizes decreased profits as ticket prices and passenger loads decrease or fuel prices

increase.

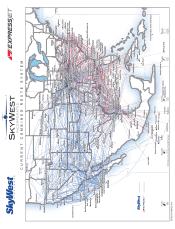

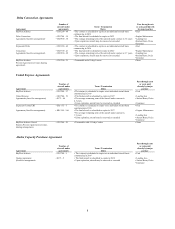

SkyWest Airlines has code-share agreements with United, Delta, American and Alaska. ExpressJet has

code-share agreements with United, Delta and American.

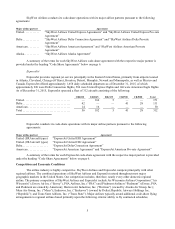

During the year ended December 31, 2015, approximately 86.3% of our passenger revenues related to fixed-fee

contract flights, where Delta, United, Alaska and American controlled scheduling, ticketing, pricing and seat inventories.

The remainder of our passenger revenues during the year ended December 31, 2015 related to pro-rate flights for Delta,

United or American, where we controlled scheduling, pricing and seat inventories, and shared passenger fares with

Delta, United or American according to pro-rate formulas. The following summaries of our code-share agreements do

not purport to be complete and are qualified in their entirety by reference to the applicable agreement.

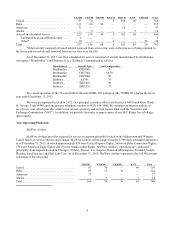

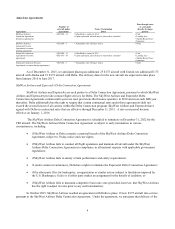

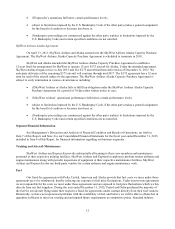

Under our fixed-fee arrangements, the major airline partners compensate us for our costs of owning or leasing

the aircraft on a monthly basis. The aircraft compensation structure varies by agreement, but is intended to cover either

our aircraft principal and interest debt service costs, our aircraft depreciation and interest expense or our aircraft lease

expense costs while the aircraft is under contract. Under our ExpressJet United ERJ Agreement and our ExpressJet

American ERJ145 Agreement, the major partner provides the aircraft to us for a nominal amount. The number of aircraft

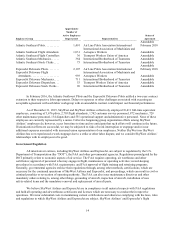

under our fixed-fee arrangements and our pro-rate arrangements as of December 31, 2015 is reflected in the summary

below.