SkyWest Airlines 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

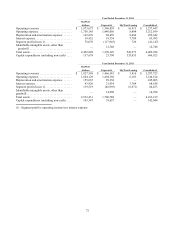

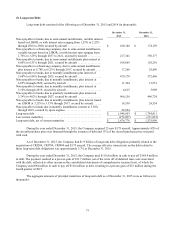

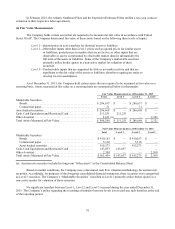

(3) Long-term Debt

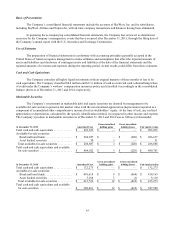

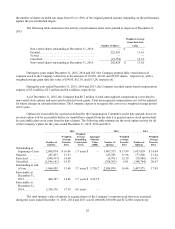

Long-term debt consisted of the following as of December 31, 2015 and 2014 (in thousands):

December 31,

December 31,

2015

2014

N

otes payable to banks, due in semi-annual installments, variable interest

based on LIBOR, or with interest rates ranging from 1.29% to 2.22%

through 2016 to 2020, secured by aircraft ........................ $ 108,348 $ 174,159

N

otes payable to a financing company, due in semi-annual installments,

variable interest based on LIBOR, or with interest rates ranging from

1.76% to 3.25% through 2017 to 2021, secured by aircraft .......... 217,341 350,177

N

otes payable to banks, due in semi-annual installments plus interest at

6.06% to 6.51% through 2021, secured by aircraft ................. 108,069 129,201

N

otes payable to a financing company, due in semi-annual installments

plus interest at 5.78% to 6.23% through 2017, secured by aircraft . . . . . 17,208 25,090

N

otes payable to banks, due in monthly installments plus interest of

2.68% to 6.86% through 2025, secured by aircraft ................. 479,170 572,446

N

otes payable to banks, due in monthly installments, plus interest at

6.05% through 2020, secured by aircraft ......................... 11,304 13,551

N

otes payable to banks, due in monthly installments, plus interest at

3.10% through 2019, secured by aircraft ......................... 4,615 5,909

N

otes payable to banks, due in quarterly installments plus interest at

3.39% to 4.02% through 2027, secured by aircraft ................. 966,156 446,724

N

otes payable to banks, due in monthly installments, plus interest based

on LIBOR at 3.21% to 3.33% through 2017, secured by aircraft . . . . . . 14,538 28,554

N

otes payable to banks due in monthly installments, interest at 3.30%

through 2019, secured by spare engines .......................... 22,054 —

Long-term debt ............................................... $ 1,948,803 $ 1,745,811

Less current maturities ......................................... (272,027) (211,821)

Long-term debt, net of current maturities . . . . . . . . . . . . . . . . . . . . ...... $ 1,676,776 $ 1,533,990

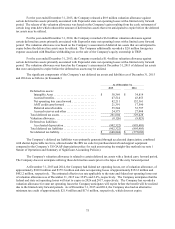

During the year ended December 31, 2015, the Company acquired 25 new E175 aircraft. Approximately 85% of

the aircraft purchase price was financed through the issuance of debt and 15% of the aircraft purchase price was paid

with cash.

As of December 31, 2015, the Company had $1.9 billion of long-term debt obligations primarily related to the

acquisition of CRJ200, CRJ700, CRJ900 and E175 aircraft. The average effective interest rate on the debt related to

those long-term debt obligations was approximately 3.7% at December 31, 2015.

During the year ended December 31, 2015, the Company used $110.8 million in cash to pay off $145.4 million

in debt. The payment resulted in a pre-tax gain of $33.7 million, net of the write off of deferred loan costs associated

with the debt, reflected as other income in the consolidated statements of comprehensive income (loss), of which the

Company used $94 million in cash to pay off $128 million in debt, resulting in a pre-tax gain of $33 million during the

fourth quarter of 2015.

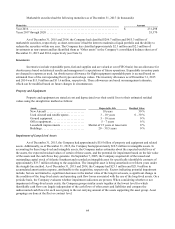

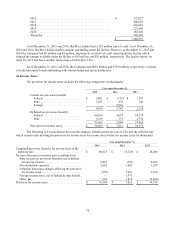

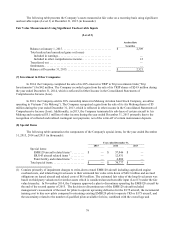

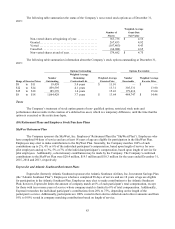

The aggregate amounts of principal maturities of long-term debt as of December 31, 2015 were as follows (in

thousands):