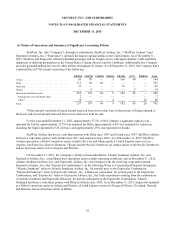

SkyWest Airlines 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

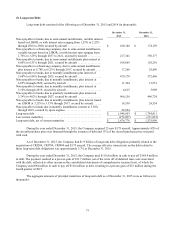

The Company did not recognize any impairment charges of long lived assets during 2015 or 2013.

In 2014, the Company had impairments on several long-lived assets relating to Embraer Brasilia EMB 120

(“EMB120”) turboprop aircraft, ERJ145 aircraft type specific assets and an aircraft paint facility located in Saltillo,

Mexico. See Note 8, Special items, for the impairment charges recorded during the year ended December 31, 2014

related to the EMB120 long-lived assets, ERJ145 long-lived assets, Saltillo, Mexico paint facility and related assets.

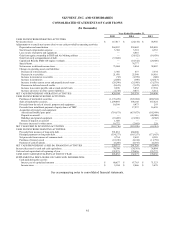

Capitalized Interest

Interest is capitalized on aircraft purchase deposits as a portion of the cost of the asset and is depreciated over

the estimated useful life of the asset. During the years ended December 31, 2015, 2014 and 2013, the Company

capitalized interest costs of approximately $2.2 million, $1.8 million, and $1.2 million, respectively.

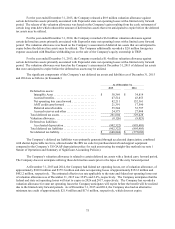

Maintenance

The Company operates under a FAA approved continuous inspection and maintenance program. The Company

uses the direct expense method of accounting for its regional jet engine overhauls wherein the expense is recorded when

the overhaul event occurs. The Company has engine services agreements with third-party vendors to provide long-term

engine services covering the scheduled and unscheduled repairs for certain of its Bombardier CRJ700 Regional Jets

(“CRJ700s”), Embraer ERJ145 regional jet aircraft and Embraer E-175 jet (“E175”) aircraft. Under the terms of the

agreements, the Company pays a fixed dollar amount per engine hour flown on a monthly basis and the third-party

vendors will assume the responsibility to repair the engines at no additional cost to the Company, subject to certain

specified exclusions. Maintenance costs under these contracts are recognized when the engine hour is flown pursuant to

the terms of each contract.

The Company used the “deferral method” of accounting for its EMB120 turboprop aircraft engine overhauls,

wherein the overhaul costs were capitalized and depreciated to the next estimated overhaul event, or remaining lease

term for leased aircraft, whichever was shorter. In 2015, the Company removed all of its EMB120 aircraft from service.

The costs of maintenance for airframe and avionics components, landing gear and normal recurring

maintenance are expensed as incurred.

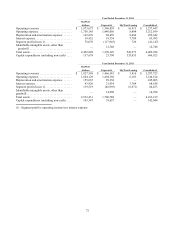

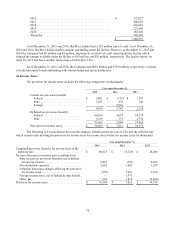

Passenger and Ground Handling Revenues

The Company recognizes passenger and ground handling revenues when the service is provided under its code-

share agreements. Under the Company’s fixed fee arrangements (referred to as “fixed-fee arrangements, “contract

flying” or “capacity purchase agreements”) with Delta, United, American and Alaska, the major airline generally pays

the Company a fixed fee for each departure, flight or block time incurred, and an amount per aircraft in service each

month with additional incentives based on completion of flights and on time performance. The major airline partner also

directly reimburses the Company for certain direct expenses incurred under the fixed-fee arrangement such as fuel

expense and landing fee expenses. Under the fixed-fee arrangements, revenue is earned when each flight is completed.

Under a Revenue Sharing Arrangement (referred to as a “revenue-sharing” or “pro rate” arrangement), the

major airline and regional airline negotiate a passenger fare proration formula, pursuant to which the regional airline

receives a percentage of the ticket revenues for those passengers traveling for one portion of their trip on the regional

airline and the other portion of their trip on the major airline. Revenue is recognized under the Company’s pro rate

flying agreements when each flight is completed based upon the portion of the pro rate passenger fare the Company

anticipates that it will receive for each completed flight.

Other ancillary revenues commonly associated with airlines such as baggage fee revenue, ticket change fee

revenue and the marketing component of the sale of mileage credits are retained by the Company’s major airline partners

on flights that the Company operates under its code-share agreements.