SkyWest Airlines 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

$117.8 million, or $2.27 per diluted share, for the year ended December 31, 2015, compared to a net loss of

$24.2 million, or $(0.47) per diluted share, for the year ended December 31, 2014.

The significant items affecting our financial performance during the year ended December 31, 2015 are outlined

below:

Revenue

The number of aircraft we have in scheduled service and the number of block hours we generate on our flights

are primary drivers to our passenger revenues under our fixed-fee flying agreements. During 2015, we had a significant

change in the number of aircraft operating under fixed-fee agreements. Our primary objective in the fleet change is to

improve our profitability by adding new aircraft to fixed-fee agreements at improved economics, including the E175

aircraft, while removing aircraft that were operating under less profitable arrangements. As summarized under the Fleet

Activity Section below, from December 31, 2014 to December 31, 2015, we removed 103 aircraft from service that were

operating under less profitable flying contracts and added 46 aircraft to new or existing fixed-fee flying arrangements at

improved economics. The number of aircraft available for scheduled service decreased from 717 aircraft at December

31, 2014 to 660 at December 31, 2015, or by 8.6%. Our completed block hours decreased 8.8% primarily due to the

reduced fleet size during 2015.

The decrease in our total revenue passenger revenues from 2014 to 2015 of 4.4% was primarily attributable to a

decrease in revenue earned associated with the reduction to our fleet size of 8.8%, partially offset by higher

compensation we earned on aircraft placed into new agreements during 2015 and by an increase in fixed-fee contract

performance incentives we earned in 2015 primarily through higher flight completion rates.

Operating Expenses

The decrease in our operating expense from 2014 to 2015 of 10.9% was primarily attributable to a decrease in

direct operating costs associated with the reduction to our fleet size of 8.8% and the effect of $74.8 million of special

items in our 2014 operating expense (primarily attributable to the accelerated removal of certain aircraft from service).

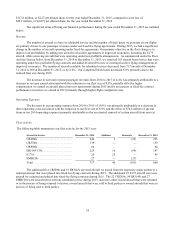

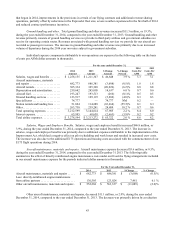

Fleet Activity

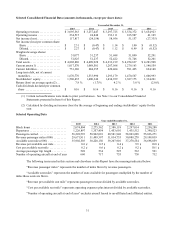

The following table summarizes our fleet activity for the 2015 year:

Aircraft in Service December 31, 2014 Additions Removals December 31, 2015

CRJ200s ........................ 242 5 (22) 225

CRJ700s ........................ 139

—

—

139

CRJ900s ........................ 64

—

—

64

ERJ145/135s ..................... 225 16 (54) 187

E175s ........................... 20 25

—

45

EMB120s ....................... 27

—

(27)

—

Total ........................... 717 46 (103) 660

The additional five CRJ200s and 16 ERJ145s are used aircraft we leased from the respective major partner at a

nominal amount that were placed into fixed-fee flying contracts during 2015. The additional 25 E175 aircraft were new

aircraft we acquired and placed into fixed-fee flying contracts during 2015. The 22 CRJ200s, 54 ERJ145s and 27

EMB120s were aircraft removed from scheduled service during 2015, and were either leased aircraft that were returned

or in the process of being returned to lessors, owned aircraft that were sold to third parties or owned aircraft that were in

process of being sold to third parties.