SkyWest Airlines 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

as of December 31, 2015. The Company’s fair value of long-term debt as of December 31, 2014 was $1,813.1 million as

compared to the carrying amount of $1,745.8 million as of December 31, 2014.

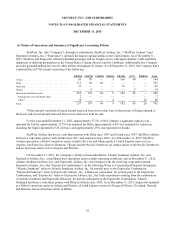

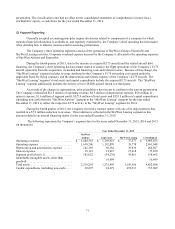

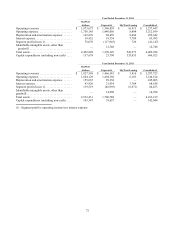

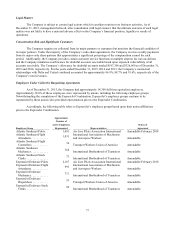

Segment Reporting

Generally accepted accounting principles require disclosures related to components of a company for which

separate financial information is available to, and regularly evaluated by, the Company’s chief operating decision maker

when deciding how to allocate resources and in assessing performance. The Company’s three operating segments consist

of the operations conducted by SkyWest Airlines and ExpressJet, as well as other activities. Information pertaining to the

Company’s reportable segments is presented in Note 2, Segment Reporting.

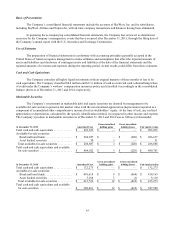

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update

No. 2014-09, “Revenue from Contracts with Customers” (“ASU No. 2014-09”). Under ASU No. 2014-09, revenue is

recognized at the time a good or service is transferred to a customer for the amount of consideration received for that

specific good or service. In July 2015, the FASB deferred the effective date of ASU No. 2014-09 to January 1, 2018.

The FASB also proposed permitting early adoption of the standard, but not before January 1, 2017. Entities may use a

full retrospective approach or report the cumulative effect as of the date of adoption. The Company’s management is

currently evaluating the impact the adoption of ASU No. 2014-09 is anticipated to have on the Company’s consolidated

financial statements.

In April 2015, the FASB issued Accounting Standards Update No. 2015-03, “Simplifying the Presentation of

Debt Issuance Costs” (“ASU No. 2015-03”). In August 2015, ASU No. 2015-03 was amended to modify existing

guidance to require the presentation of debt issuance costs in the balance sheet as a deduction from the carrying amount

of the related debt liability instead of as a deferred charge. It is effective for annual reporting periods beginning after

December 15, 2015, but early adoption is permitted. The Company anticipates reclassifying the unamortized debt

issuance costs and present debt net of those unamortized costs on its balance sheet upon adoption of ASU No. 2015-03.

As of December 31, 2015, the Company had $20.9 million in unamortized debt issuance costs.

In November 2015, the FASB issued Accounting Standards Update 2015-17, Income Taxes (Topic 740):

Balance Sheet Classification of Deferred Taxes (“ASU No. 2015-17”). The standard requires that deferred tax liabilities

and assets be classified as noncurrent in a classified statement of financial position. The current requirement that

deferred tax liabilities and assets of a tax-paying component of an entity be offset and presented as a single amount is not

affected by ASU No. 2015-17. ASU No. 2015-17 is effective for annual periods beginning after December 15, 2016,

and interim periods within those annual periods. The Company’s management is currently evaluating the impact the

adoption of ASU No. 2015-17 is anticipated to have on the Company’s consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, Leases (“ASU 2016-02”). The standard amends the existing

accounting standards for lease accounting, including requiring lessees to recognize most leases on their balance sheets

and making targeted changes to lessor accounting. ASU 2016-02 will be effective beginning in the first quarter of 2019.

Early adoption of ASU 2016-02 is permitted. The new leases standard requires a modified retrospective transition

approach for all leases existing at, or entered into after, the date of initial application, with an option to use certain

transition relief. The Company’s management is currently evaluating the impact of adopting ASU 2016-02 on the

Company’s consolidated financial statements.

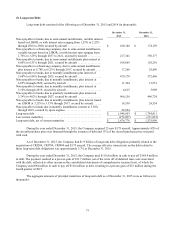

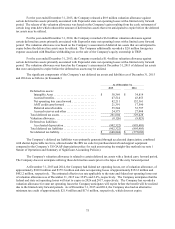

Immaterial error correction to consolidated balance sheet

In connection with the preparation of the Company’s consolidated financial statements for the year ended

December 31, 2015, the Company determined that certain non-current prepaid aircraft rents previously reported were

improperly presented as current on the Company’s consolidated balance sheet at December 31, 2014. As a result, current

prepaid aircraft rents, as previously reported, were overstated by $201.5 million and non-current prepaid aircraft rents

were understated by $201.5 million. The Company concluded that the error was not material to the consolidated balance

sheet, but has elected to correct the error in the accompanying 2014 consolidated financial statements for consistency of