SkyWest Airlines 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

case of accelerated vesting upon a change in control of the Company, long-term incentive awards currently vest only if

the Executive remains employed by the Company for three years from the date of grant, with the exception of stock

options which vest one third at each annual anniversary of the date of grant over a three year period. The Compensation

Committee believes the three-year cliff-vesting schedule for non-stock option grants and pro rata vesting over three years

for stock options assists in retaining Executives and encourages the Executives to focus on the Company’s long-term

performance.

In granting stock options, restricted stock units and performance shares to the Executives, the Compensation

Committee also considers the impact of the grant on the Company’s financial performance, as determined in accordance

with the requirements of Financial Accounting Standards Board Accounting Standards Codification Topic 718

(ASC Topic 718). For long-term equity awards, the Company records expense in accordance with ASC Topic 718. The

amount of expense recorded pursuant to ASC Topic 718 may vary from the corresponding compensation value used in

determining the amount of the awards.

Amount and allocation of grant—For 2015 the total annual targeted long-term incentive grant value was 125%

of salary and targeted annual bonus for Messrs. Atkin and Childs and 100% of salary and targeted annual bonus for

Messrs. Steel, Simmons and Thompson. Mr. Vais’ targeted long-term incentive grant value was awarded on a pro-rata

basis at 70% of salary and targeted annual bonus through his September 2015 appointment as executive officer of

ExpressJet and at 100% of salary and targeted annual bonus following his appointment. The Compensation Committee

established these annual targeted amounts to provide a competitive pay package and to ensure that a large portion of each

Executive’s compensation was based on continuing long-term service and correlated to the creation of shareholder value.

This has been the Compensation Committee’s policy for several years, but is subject to review and continuation or

modification each year by the Compensation Committee. The targeted levels of long-term incentive awards for

Messrs. Atkin and Childs are higher than the targeted levels of long-term incentive awards for other Executives as a

result of their overall responsibility for the long-term success of the Company. Each Executive’s 2015 long-term

incentive award was allocated among three types of long-term awards as follows: stock options, restricted stock units and

performance shares.

The value of stock options, restricted stock units and performance shares is directly related to the value of the

Common Stock and correlates to long-term shareholder value. Stock options, restricted stock unit and performance share

grants in 2015 were made pursuant to the Company’s 2010 Plan, as shown in greater detail below and in the table labeled

“Grants of Plan Based Awards.”

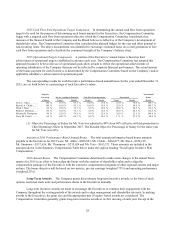

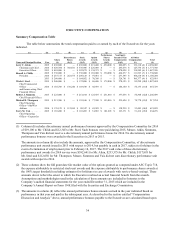

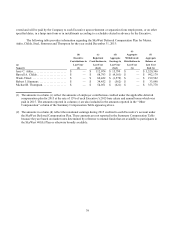

The following table summarizes the number and nature of long-term awards granted to the Executives by the

Company on February 17, 2015, and in the case of mid-year position changes, April 2, 2015 and September 9, 2015,

under the 2010 Plan.

Time Vested LTI Performance-Contingent LTI

Shares/Stoc

k

Shares/Stoc

k

Other Units

Options

Units Options

Units(1)

(Cash)

Jerry C. Atkin ...................................... 48,332 31,887 — 31,887 $ —

Russell A. Childs ................................... 37,023 24,426 — 24,426 $ —

Wade J. Steel ...................................... 19,386 12,791 — 12,791 $ —

Robert J. Simmons ................................. 24,233 15,988 — 15,988 $ —

Michael B. Thompson ............................... 17,391 11,474 — 11,474 $ —

Terry M. Vais ...................................... 10,418 6,873 — 6,873 $ —

(1) Number of performance shares if 100% of target is achieved.