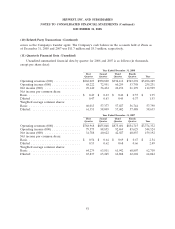

SkyWest Airlines 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2008

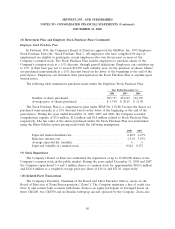

(7) Capital Transactions

Preferred Stock

The Company is authorized to issue 5,000,000 shares of preferred stock in one or more series

without shareholder approval. No shares of preferred stock are presently outstanding. The Company’s

Board of Directors is authorized, without any further action by the stockholders of the Company, to

(i) divide the preferred stock into series; (ii) designate each such series; (iii) fix and determine dividend

rights; (iv) determine the price, terms and conditions on which shares of preferred stock may be

redeemed; (v) determine the amount payable to holders of preferred stock in the event of voluntary or

involuntary liquidation; (vi) determine any sinking fund provisions; and (vii) establish any conversion

privileges.

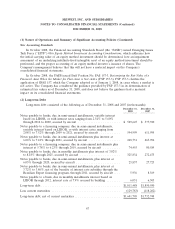

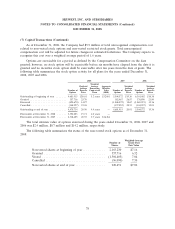

Stock Compensation

Effective January 1, 2001, the Company adopted two stock option plans: the Executive Stock

Incentive Plan (the ‘‘Executive Plan’’) and the 2001 Allshare Stock Option Plan (the ‘‘Allshare Plan’’).

These plans replaced the Company’s Combined Incentive and Non-Statutory Stock Option Plans (the

‘‘Prior Plans’’). There are no additional shares of common stock available for issuance under these

plans. However, as of December 31, 2008, options to purchase approximately 436,000 shares of the

Company’s common stock remained outstanding under the Prior Plans and 3,114,283 shares of the

Company’s common stock remained outstanding under the Executive Plan and the Allshare Plan.

On May 2, 2006, the Company’s shareholders approved the adoption of the SkyWest Inc.

Long-Term Incentive Plan, which provides for the issuance of up to 6,000,000 shares of common stock

to the Company’s directors, employees, consultants and advisors (the ‘‘2006 Incentive Plan’’). The 2006

Incentive Plan provides for awards in the form of options to acquire shares of common stock, stock

appreciation rights, restricted stock grants and performance awards. The 2006 Incentive Plan is

administered by the Compensation Committee of the Company’s Board of Directors (the

‘‘Compensation Committee’’) who is authorized to designate option grants as either incentive or

non-statutory. Incentive stock options are granted at not less than 100% of the market value of the

underlying common stock on the date of grant. Non-statutory stock options are granted at a price as

determined by the Compensation Committee.

Effective January 1, 2006, the Company adopted the fair value recognition provisions of SFAS

No. 123(R), using the modified-prospective transition method. Under the modified-prospective

transition method, compensation cost recognized during the years ended December 31, 2008, 2007 and

2006 includes compensation cost for all share-based payments granted to, but not yet vested as of

January 1, 2006, based on the grant date fair value estimated in accordance with the original provisions

of SFAS No. 123. Results for prior periods have not been restated.

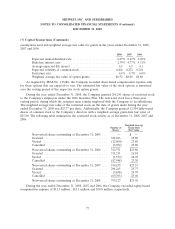

The fair value of stock options has been estimated as of the grant date using the Black-Scholes

option pricing model. The Company uses historical data to estimate option exercises and employee

termination in the option pricing model. The expected term of options granted is derived from the

output of the option pricing model and represents the period of time that options granted are expected

to be outstanding. The expected volatilities are based on the historical volatility of the Company’s

traded stock and other factors. During the year ended December 31, 2008, the Company granted

357,716 stock options to employees under the 2006 Incentive Plan. The following table shows the

76