SkyWest Airlines 2008 Annual Report Download - page 11

Download and view the complete annual report

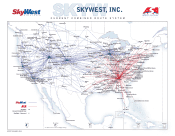

Please find page 11 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The principal competitive factors for code-share partner regional airlines are code-share agreement

terms, customer service, aircraft types, fare pricing, flight schedules and markets and routes served. The

combined operations of SkyWest Airlines and ASA represent the largest regional airline operation in

the United States. However, some of the major and low-cost carriers are larger, and may have greater

financial and other resources than SkyWest Airlines and ASA. Additionally, regional carriers owned by

major airlines, such as American Eagle, Comair, Compass and Mesaba, may have access to greater

resources at the parent level than SkyWest Airlines and ASA, and may have enhanced competitive

advantages since they are subsidiaries of major airlines. Moreover, federal deregulation of the industry

allows competitors to rapidly enter our markets and to quickly discount and restructure fares. The

airline industry is particularly susceptible to price discounting because airlines incur only nominal costs

to provide service to passengers occupying otherwise unsold seats.

Generally, the airline industry is highly sensitive to general economic conditions, in large part due

to the discretionary nature of a substantial percentage of both business and leisure travel. Many airlines

have historically reported lower earnings or substantial losses during periods of economic recession,

heavy fare discounting, high fuel costs and other disadvantageous environments. Economic downturns

combined with competitive pressures have contributed to a number of reorganizations, bankruptcies,

liquidations and business combinations among major and regional carriers. The effect of economic

downturns may be somewhat mitigated by the predominantly contract-based flying arrangements of

SkyWest Airlines and ASA. Nevertheless, the per passenger component in such fee structure would be

affected by an economic downturn. In addition, if Delta, United or Midwest, or one or more other

code-share partners we may secure in the future, experience a prolonged decline in passenger load or

are harmed by low ticket prices or high fuel prices, they will likely seek to renegotiate their code-share

agreements with SkyWest Airlines and ASA or cancel flights in order to reduce their costs.

Industry Overview

Majors, Low Cost Carriers and Regional Airlines

The airline industry in the United States has traditionally been dominated by several major

airlines, including American, Continental Airlines, Inc. (‘‘Continental’’), Delta, US Airways and United.

The major airlines offer scheduled flights to most major U.S. cities, numerous smaller U.S. cities, and

cities throughout the world through a hub and spoke network.

Low cost carriers, such as Southwest Airlines Co. (‘‘Southwest’’), JetBlue Airways Corporation

(‘‘JetBlue’’), Frontier Airlines, Inc. (‘‘Frontier’’) and AirTran Airways, Inc. (‘‘AirTran’’), generally offer

fewer conveniences to travelers and have lower cost structures than major airlines, which permits them

to offer flights to and from many of the same markets as the major airlines, but at lower prices. Low

cost carriers typically fly direct flights with limited service to smaller cities, concentrating on higher

demand flights to and from major population bases.

Regional airlines, such as ASA, ExpressJet, Mesa, Pinnacle, Republic and SkyWest Airlines,

typically operate smaller aircraft on lower-volume routes than major and low cost carriers. Several

regional airlines, including American Eagle, Comair, Compass, Mesaba and Horizon, are wholly-owned

subsidiaries of major airlines.

In contrast to low cost carriers, regional airlines generally do not try to establish an independent

route system to compete with the major airlines. Rather, regional airlines typically enter into

relationships with one or more major airlines, pursuant to which the regional airline agrees to use its

smaller, lower-cost aircraft to carry passengers booked and ticketed by the major airline between a hub

of the major airline and a smaller outlying city. In exchange for such services, the major airline pays

the regional airline either a fixed flight fee, termed ‘‘contract’’ or ‘‘fixed-fee’’ flights, or receives a

percentage of applicable ticket revenues, termed ‘‘pro-rate’’ or ‘‘revenue-sharing’’ flights.

7