SkyWest Airlines 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

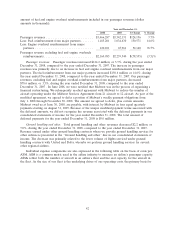

INDEXED RETURNS

Base Years Ending

Period

Company Name / Index Dec03 Dec04 Dec05 Dec06 Dec07 Dec08

SkyWest, Inc. ..................... 100 111.77 150.48 143.58 151.83 106.00

NASDAQ Composite ................ 100 108.41 110.79 122.16 134.29 79.25

Peer Group ....................... 100 95.56 107.77 160.08 140.12 86.81

The Peer Group consists of regional and major passenger airlines with U.S operations that have

equity securities traded on the Nasdaq Stock Market. The members of the Peer Group are: Air

France-KLM-ADR; Air T, Inc.; Air Transport Services Group; Allegiant Travel Co.; British

Airways PLC-ADR; Deutsche Lufthansa AG-ADR; Frontier Airlines Holdings; Great Lakes

Aviation Ltd.; Hawaiian Holdings, Inc.; Japan Airlines Corp-ADR; JetBlue Airways Corp.; Mesa Air

Group, Inc.; Pinnacle Airlines Corp.; Republic Airways Holdings Inc.; Ryanair Holdings PLC-ADR;

SkyWest, Inc.; and UAL Corp.

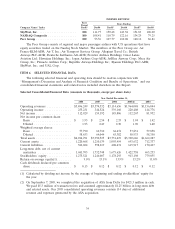

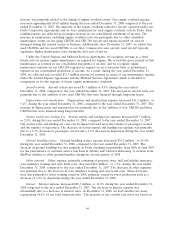

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial and operating data should be read in conjunction with

‘‘Management’s Discussion and Analysis of Financial Condition and Results of Operations,’’ and our

consolidated financial statements and related notes included elsewhere in this Report.

Selected Consolidated Financial Data (amounts in thousands, except per share data):

Year Ended December 31,

2008 2007 2006 2005(2) 2004

Operating revenues .............. $3,496,249 $3,374,332 $3,114,656 $1,964,048 $1,156,044

Operating income ............... 255,231 344,524 339,160 220,408 144,776

Net income .................... 112,929 159,192 145,806 112,267 81,952

Net income per common share:

Basic ....................... $ 1.95 $ 2.54 $ 2.33 $ 1.94 $ 1.42

Diluted ..................... 1.93 2.49 2.30 1.90 1.40

Weighted average shares:

Basic ....................... 57,790 62,710 62,474 57,851 57,858

Diluted ..................... 58,633 64,044 63,382 58,933 58,350

Total assets .................... $4,014,291 $3,990,525 $3,731,419 $3,320,646 $1,662,287

Current assets .................. 1,220,668 1,210,139 1,095,454 693,632 712,337

Current liabilities ................ 386,604 398,219 408,431 615,917 170,467

Long-term debt, net of current

maturities ................... 1,681,705 1,732,748 1,675,626 1,422,758 463,233

Stockholders’ equity .............. 1,275,521 1,246,007 1,178,293 913,198 779,055

Return on average equity(1) ........ 9.0% 13.1% 13.9% 13.2% 11.0%

Cash dividends declared per common

share ....................... $ 0.13 $ 0.12 $ 0.12 $ 0.12 $ 0.12

(1) Calculated by dividing net income by the average of beginning and ending stockholders’ equity for

the year

(2) On September 7, 2005, we completed the acquisition of ASA from Delta for $421.3 million in cash.

We paid $5.3 million of transaction fees and assumed approximately $1.25 billion in long-term debt

and related assets. Our 2005 consolidated operating revenues contain 114 days of additional

revenue and expenses generated by the ASA acquisition.

34