SkyWest Airlines 2008 Annual Report Download - page 120

Download and view the complete annual report

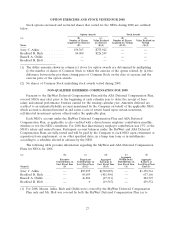

Please find page 120 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.at grant than stock options, and the Company can offer comparable grant date compensation value

with fewer shares and less dilution of the outstanding shares of Common Stock.

The estimated future value at the applicable vesting date of the long-term equity awards for any

year is intended to approximate 125% of projected annual base salary and targeted annual bonus for

the year of grant in the case of the Company’s Chief Executive Officer, and 100% of annual salary and

targeted bonus in the case of the other NEOs. In determining the amount of the award, stock option

equivalents are first calculated assuming the value of a stock option is 25% of the exercise price.

Three-quarters of each NEO’s annual long-term equity award is granted in stock options in an effort to

provide a high level of performance-based incentive, and the remaining one-quarter of the award is

granted in shares of restricted stock (with each share of restricted share valued as if it were an option

for four shares). Currently, both types of awards vest only if the NEO remains employed by the

Company for three years from the date of grant. The Company believes the three-year vesting schedule

assists in retaining executives and encourages the NEOs to focus on long-term performance. In 2008,

the number of shares indicated by the formulas above was also reduced in order to make more shares

available for the Company’s non-executive employees. In granting shares of restricted stock and stock

options to the NEOs, the Compensation Committee also considers the impact of the grant on the

Company’s financial performance, as determined in accordance with the requirements of Statement of

Financial Accounting Standards No. 123(R), Share-Based Payment (SFAS No. 123(R)). For long-term

equity awards, the Company records expense in accordance with SFAS No. 123(R). The amount of

expense the Company records pursuant to SFAS No. 123(R) may vary from the corresponding

compensation value used by the Company in determining the amount of the awards.

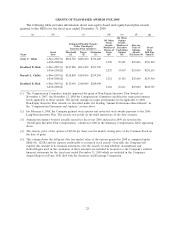

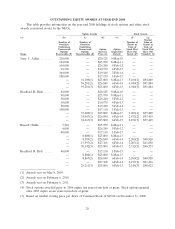

During 2008, the Company granted to the NEOs stock options and restricted stock under the 2006

Long-Term Incentive Plan, as shown in greater detail in table labeled ‘‘Grants of Plan-Based Awards for

2008’’ below. On February 4, 2009, the Company granted the NEOs additional options under the 2006

Long-Term Incentive Plan to purchase at an exercise price of $15.24 per share (the closing share price

on the date of grant) the following number of shares of Common Stock: Mr. Atkin—99,124 shares;

Mr. Rich—57,614 shares; Mr. Childs—51,024 shares; and Mr. Holt—47,535 shares. Additionally, on

February 4, 2009, the Company granted the NEOs the following number of shares of restricted stock

under the 2006 Long-Term Incentive Plan: Mr. Atkin—16,521 shares; Mr. Rich—9,602 shares;

Mr. Childs—8,504 shares; and Mr. Holt—7,972 shares.

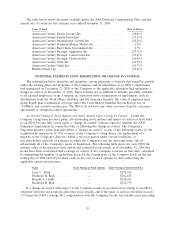

Retirement Benefits and Deferred Compensation. The Company sponsors the SkyWest, Inc.

Employees’ Retirement Plan for its eligible employees and the eligible employees of SkyWest Airlines

(the ‘‘SkyWest 401(k) Plan’’). ASA also maintains a separate but substantially similar retirement plan,

the Atlantic Southeast Airlines, Inc. Incentive Savings Plan (the ‘‘ASA 401(k) Plan’’). Messrs. Atkin,

Rich, and Childs participate in the SkyWest 401(k) Plan and Mr. Holt participates in the ASA 401(k)

Plan. The two plans (the ‘‘401(k) Plans’’) are broad-based, tax-qualified retirement plans under which

eligible employees, including the NEOs, may make annual pre-tax salary reduction contributions subject

to the various limits imposed under the Internal Revenue Code of 1986, as amended (the ‘‘Code’’). The

sponsoring employers make matching contributions under the 401(k) Plans on behalf of eligible

participants, but the NEOs are not eligible to receive such matching contributions under the SkyWest

401(k) Plan.

The Company also maintains the SkyWest, Inc. 2002 Deferred Compensation Plan, a non-qualified

deferred compensation plan (the ‘‘SkyWest Deferred Compensation Plan’’), for the benefit of certain

highly compensated management employees, including Messrs. Atkin, Rich, Childs and Holt (for the

amounts that were funded during Mr. Holt’s employment at SkyWest Airlines—prior to commencing

employment with ASA). ASA also maintains a separate but similar non-qualified deferred

compensation plan, the Atlantic Southeast Airlines, Inc. Executive Deferred Compensation Plan (the

‘‘ASA Deferred Compensation Plan’’), for its highly compensated management employees, including

Mr. Holt. Under the two non-qualified deferred compensation plans, the sponsoring employer credits

20