SkyWest Airlines 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.during 2007, and, if ASA does not achieve the winning bid for the proposed flying, ASA will be

permitted to match the terms of the winning bid to the extent necessary for ASA to maintain its

percentage of Delta Connection regional jet flying that it operated during 2007.

Historically, multiple contractual relationships have enabled us to reduce reliance on any single

major airline code and to enhance and stabilize operating results through a mix of contract flying and

our controlled or ‘‘pro-rate’’ flying. For the year ended December 31, 2008, contract flying revenue and

pro-rate revenue represented approximately 96% and 4%, respectively, of our total passenger revenues.

On contract routes, the major airline partner controls scheduling, ticketing, pricing and seat inventories

and we are compensated by the major airline partner at contracted rates based on the completed block

hours, flight departures and other operating measures. On pro-rate flights, we control scheduling,

ticketing, pricing and seat inventories and receive a pro-rated portion of passenger fares. As of

December 31, 2008, essentially all of our Brasilia turboprops flown for Delta were flown under pro-rate

arrangements, while approximately 58% of our Brasilia turboprops flown in the United system were

flown under contractual arrangements, with the remaining 42% flown under pro-rate arrangements.

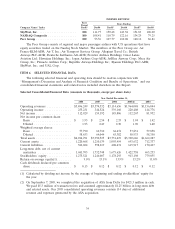

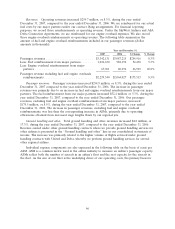

Financial Highlights

We had revenues of $3.5 billion for the year ended December 31, 2008, a 3.6% increase, compared

to revenues of $3.4 billion for the year ended December 31, 2007. We had net income of $112.9 million

for the year ended December 31, 2008, a decrease of 29.1%, or $1.93 per diluted share, compared to

$159.2 million of net income, or $2.49 per diluted share, for the year ended December 31, 2007.

The significant items affecting our financial performance during 2008 are outlined below:

In June 2008, SkyWest Airlines was notified that Midwest was in the process of organizing a

financial restructuring. Subsequently, SkyWest Airlines reached an agreement with Midwest to reduce

the number of aircraft operating under the Midwest Services Agreement from 21 aircraft to 12 aircraft.

As part of the modified terms, SkyWest Airlines agreed to defer a portion of Midwest’s weekly

payment obligations from July 1, 2008 through November 30, 2008. The amount we agreed to defer

plus certain amounts Midwest owed to SkyWest Airlines at June 30, 2008 will be payable, with interest,

by Midwest in four equal quarterly payments starting on August 31, 2009. Because of the unique

modified payment terms associated with the deferred amounts, we did not recognize the revenue

associated with the deferred payments in our consolidated statements of income for the year ended

December 31, 2008. The total amount of deferred payments for the year ended December 31, 2008 is

$9.0 million.

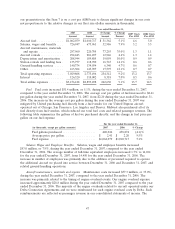

During 2008, our operating subsidiaries, SkyWest Airlines and ASA, experienced reductions in the

block hours scheduled by their major partners under their code-sharing agreements. Under our contract

flying arrangements with our partners, a portion of our compensation is received using fixed rates per

completed block hour. This reduction in block hours reduced the profitability of SkyWest Airlines and

ASA in 2008 under those agreements as we were unable to reduce our operating costs at the same rate

as the reduction in scheduled block hours. The financial impact of the block hour reduction, imposed

by our major partners during the year ended December 31, 2008 was larger than we originally

anticipated. For the year ended December 31, 2008 our block hours have decreased approximately

4.3% from the year ended December 31, 2007.

We are at risk for increased fuel prices on our pro-rate flying operations, pursuant to which we

receive a pro-rated portion of the passenger fare as revenue. As of December 31, 2008, we operated a

total of 32 Brasilia turboprops under separate pro-rate agreements with Delta and United. During the

year ended December 31, 2008, the cost of fuel associated with the pro-rate operations increased

approximately $6.5 million (pre-tax) compared to the prior period.

37