SkyWest Airlines 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

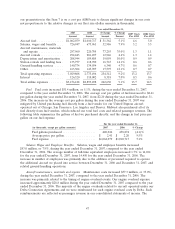

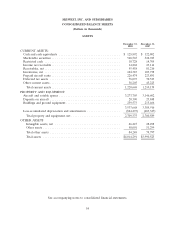

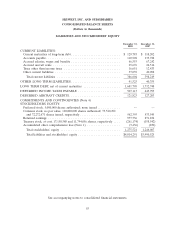

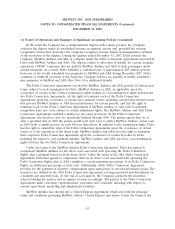

SKYWEST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND

COMPREHENSIVE INCOME

(In thousands)

Accumulated

Other

Common Stock Treasury Stock

Retained Comprehensive

Shares Amount Earnings Shares Amount Loss Total

Balance at December 31, 2005 ........... 65,510 $364,535 $582,620 (6,794) $ (32,551) $(1,406) $ 913,198

Comprehensive income:

Net income ..................... — — 145,806 — — — 145,806

Net unrealized appreciation on marketable

securities net of tax of $40 .......... — — — — — 61 61

Total comprehensive income ........ 145,867

Sale of common stock, net of offering costs

and underwriting discount of $8,864 ..... 4,000 95,336 — — — — 95,336

Exercise of common stock options ....... 1,082 16,210 — — — — 16,210

Sale of common stock under employee stock

purchase plan ................... 161 3,402 — — — — 3,402

Stock based compensation expense related

to the issuance of stock options and the

employee stock purchase plan ......... — 10,771 — — — — 10,771

Tax benefit from exercise of common stock

Options ....................... — 1,151 — — — — 1,151

Cash dividends declared ($0.12 per share) . . — — (7,642) — — — (7,642)

Balance at December 31, 2006 ........... 70,753 $491,405 $720,784 (6,794) $ (32,551) $(1,345) $1,178,293

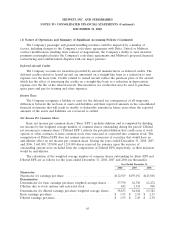

Comprehensive income:

Net income ..................... — — 159,192 — — — 159,192

Net unrealized appreciation on marketable

securities net of tax of $304 ......... — — — — — 475 475

Total comprehensive income ........ 159,667

Exercise of common stock options ....... 1,066 19,572 — — — — 19,572

Sale of common stock under employee stock

purchase plan ................... 454 9,378 — — — — 9,378

Stock based compensation expense related

to the issuance of stock options and the

employee stock purchase plan ......... — 13,121 — — — — 13,121

Tax benefit from exercise of common stock

options ........................ — 69 — — — — 69

Treasury stock purchases .............. — — — (5,000) (125,991) — (125,991)

Cash dividends declared ($0.12 per share) . . — — (8,102) — — — (8,102)

Balance at December 31, 2007 ........... 72,273 $533,545 $871,874 (11,794) $(158,542) $ (870) $1,246,007

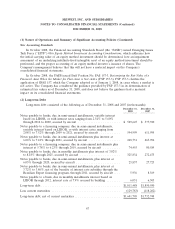

Comprehensive income:

Net income ..................... — — 112,929 — — — 112,929

Net unrealized depreciation on marketable

securities net of tax of $1,573 ........ — — — — — (2,566) (2,566)

Total comprehensive income ........ 110,363

Exercise of common stock options ....... 439 6,135 — — — — 6,135

Sale of common stock under employee stock

purchase plan ................... 808 11,227 — — — — 11,227

Stock based compensation expense related

to the issuance of stock options and the

employee stock purchase plan ......... — 11,489 — — — — 11,489

Tax benefit from exercise of common stock

options ........................ — (1) — — — — (1)

Treasury stock purchases .............. — — — (5,357) (102,632) — (102,632)

Cash dividends declared ($0.13 per share) . . — — (7,067) — — — (7,067)

Balance at December 31, 2008 ........... 73,520 $562,395 $977,736 (17,151) $(261,174) $(3,436) $1,275,521

See accompanying notes to consolidated financial statements.

57