SkyWest Airlines 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2008

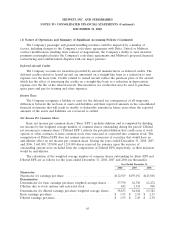

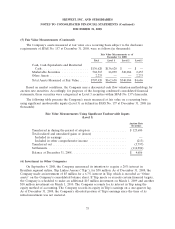

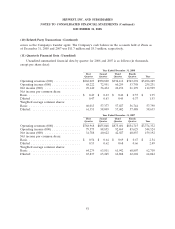

(5) Fair Value Measurements (Continued)

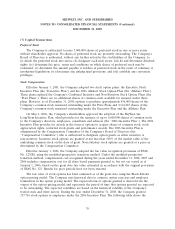

The Company’s assets measured at fair value on a recurring basis subject to the disclosure

requirements of SFAS No. 157 at December 31, 2008, were as follows (in thousands):

Fair Value Measurements as of

December 31, 2008

Total Level 1 Level 2 Level 3

Cash, Cash Equivalents and Restricted

Cash .......................... $136,620 $136,620 $ — $ —

Marketable Securities ............... 568,567 26,030 540,084 2,453

Other Assets ...................... 2,233 — — 2,233

Total Assets Measured at Fair Value ..... $707,420 $162,650 $540,084 $4,686

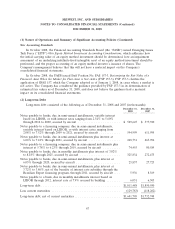

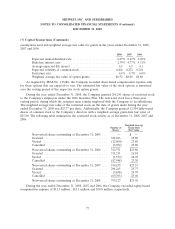

Based on market conditions, the Company uses a discounted cash flow valuation methodology for

auction rate securities. Accordingly, for purposes of the foregoing condensed consolidated financial

statements, these securities were categorized as Level 3 securities within SFAS No. 157’s hierarchy.

The following table presents the Company’s assets measured at fair value on a recurring basis

using significant unobservable inputs (Level 3) as defined in SFAS No. 157 at December 31, 2008 (in

thousands):

Fair Value Measurements Using Significant Unobservable Inputs

(Level 3)

Auction Rate

Securities

Transferred in during the period of adoption .................... $123,600

Total realized and unrealized gains or (losses)

Included in earnings .................................... —

Included in other comprehensive income ..................... (213)

Transferred out .......................................... (3,797)

Settlements ............................................. (114,904)

Balance at December 31, 2008 ............................... $ 4,686

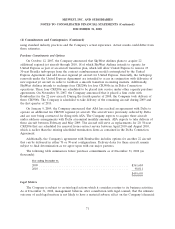

(6) Investment in Other Companies

On September 4, 2008, the Company announced its intention to acquire a 20% interest in

Brazilian regional airline, Trip Linhas Aereas (‘‘Trip’’), for $30 million. As of December 31, 2008, the

Company made an investment of $5 million for a 6.7% interest in Trip, which is recorded as ‘‘Other

assets’’ on the Company’s consolidated balance sheet. If Trip meets or exceeds certain financial targets,

the Company is scheduled to make an additional $15 million investment on March 1, 2009 and another

$10 million investment on March 1, 2010. The Company accounts for its interest in Trip using the

equity method of accounting. The Company records its equity in Trip’s earnings on a one-quarter lag.

As of December 31, 2008, the Company’s allocated portion of Trip’s earnings since the time of its

initial investment was not material.

75