SkyWest Airlines 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2008

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

New Accounting Standards

In October 2008, the Financial Accounting Standards Board (the ‘‘FASB’’) issued Emerging Issues

Task Force (‘‘EITF’’) 08-6 Equity Method Investment Accounting Considerations, which addresses how

the initial carrying value of an equity method investment should be determined, how an impairment

assessment of an underlying indefinite-lived intangible asset of an equity method investment should be

performed, and the proper accounting of an equity method investee’s issuance of shares. The

Company’s management believes that this will not have a material impact on the Company’s

consolidated financial statements.

In October 2008, the FASB issued Staff Position No. FAS 157-3, Determining the Fair Value of a

Financial Asset When the Market for That Asset is Not Active (FSP 157-3). FSP 157-3 clarifies the

application of SFAS 157, which the Company adopted as of January 1, 2008, in cases where a market is

not active. The Company has considered the guidance provided by FSP 157-3 in its determination of

estimated fair values as of December 31, 2008, and does not believe the guidance had a material

impact on its consolidated financial statements.

(2) Long-term Debt

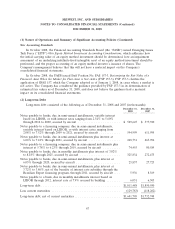

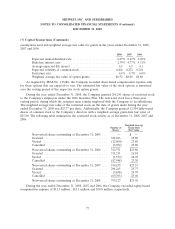

Long-term debt consisted of the following as of December 31, 2008 and 2007 (in thousands):

December 31, December 31,

2008 2007

Notes payable to banks, due in semi-annual installments, variable interest

based on LIBOR, or with interest rates ranging from 2.54% to 5.60%

through 2012 to 2020, secured by aircraft ........................ $ 529,625 $ 577,390

Notes payable to a financing company, due in semi-annual installments,

variable interest based on LIBOR, or with interest rates ranging from

2.08% to 7.52% through 2009 to 2021, secured by aircraft ............ 594,999 611,995

Notes payable to banks, due in semi-annual installments plus interest at

6.06% to 7.18% through 2021, secured by aircraft .................. 248,731 265,706

Notes payable to a financing company, due in semi-annual installments plus

interest at 5.78% to 6.23% through 2019, secured by aircraft .......... 74,455 80,585

Notes payable to banks, due in monthly installments plus interest of 3.82%

to 8.18% through 2025, secured by aircraft ....................... 325,834 272,475

Notes payable to banks, due in semi-annual installments, plus interest at

6.05% through 2020, secured by aircraft ......................... 25,857 27,725

Notes payable to banks, due in semi-annual installments, plus interest at

3.72% to 3.86%, net of the benefits of interest rate subsidies through the

Brazilian Export financing program, through 2011, secured by aircraft .... 5,936 8,569

Notes payable to a bank, due in monthly installments interest based on

LIBOR through 2012, interest rate at 7.9% secured by building ........ 6,051 6,505

Long-term debt ............................................. $1,811,488 $1,850,950

Less current maturities ....................................... (129,783) (118,202)

Long-term debt, net of current maturities .......................... $1,681,705 $1,732,748

67