SkyWest Airlines 2008 Annual Report Download - page 48

Download and view the complete annual report

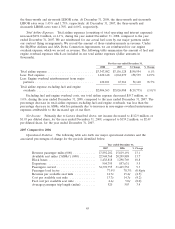

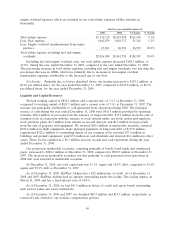

Please find page 48 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.increase was primarily related to the timing of engine overhaul events. Our engine overhaul expense

increased approximately $54.8 million during the year ended December 31, 2008 compared to the year

ended December 31, 2007. The majority of the engine overhauls related to aircraft operated under our

Delta Connection Agreements and we were reimbursed for such engine overhaul costs by Delta. Such

reimbursements are reflected as passenger revenue in our consolidated statements of income. The

increase in maintenance excluding engine overhaul costs was principally due to other scheduled

maintenance events on our aging CRJ200 and CRJ 700 aircraft and repairs incurred on aircraft

damaged during the normal course of business. Additionally, since December 31, 2007, we added four

used CRJ200s and two used CRJ700s to our fleet. Compared to new aircraft, used aircraft typically

experience higher maintenance costs during the first year of service.

Under the United Express and Midwest Services Agreements, we recognize revenue at a fixed

hourly rate for mature engine maintenance on regional jet engines. We record the gross amount of that

maintenance as revenue in our consolidated statements of income, and we recognize engine

maintenance expense on our CRJ 200 regional jet engines on an as incurred basis as maintenance

expense in our consolidated statements of income. As a result, during the year ended December 31,

2008, we collected and recorded $31.4 million (pretax) of revenue in excess of our maintenance expense

under the United Express Agreement and the Midwest Services Agreement, which is intended to

compensate us for the expense of future engine maintenance overhauls.

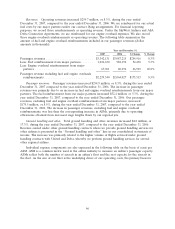

Aircraft rentals. Aircraft rentals increased $1.3 million or 0.5% during the year ended

December 31, 2008, compared to the year ended December 31, 2007. The increase in aircraft rents was

primarily due to the addition of two used CRJ700s that were financed through long-term leases.

Depreciation and amortization. Depreciation and amortization expense increased $11.3 million , or

5.4%, during the year ended December 31, 2008, compared to the year ended December 31, 2007. The

increase in depreciation and amortization was primarily due to the addition of four CRJ200 and three

CRJ900s that were financed using long-term debt.

Station rentals and landing fees. Station rentals and landing fees expense decreased $3.7 million ,

or 2.8%, during the year ended December 31, 2008, compared to the year ended December 31, 2007.

Our station rents and landing fee costs can be impacted based upon the volume of passengers carried

and the number of departures. The decrease in station rentals and landing fees expense was primarily

due to a 2.7% decrease in passengers carried and a 3.6% decrease in departures during the year ended

December 31, 2008.

Ground handling service. Ground handling service expense decreased $34.2 million , or 24.4%,

during the year ended December 31, 2008, compared to the year ended December 31, 2007. The

decrease in ground handling was due primarily to Delta assuming responsibility from ASA in June 2007

for the performance of customer service functions in Atlanta and United transitioning 16 stations from

SkyWest Airlines to other ground handlers during the second quarter of 2008.

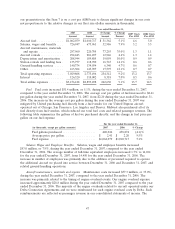

Other expenses. Other expense, primarily consisting of property taxes, hull and liability insurance,

crew simulator training and crew hotel costs, decreased $2.8 million , or 1.7%, during the year ended

December 31, 2008, compared to the year ended December 31, 2007. The decrease in other expenses

was primarily due to the decrease in crew simulator training and crew hotel costs. These decreases

were due primarily to fewer training events in 2008, primarily caused by lower production such as a

decrease of 3.6% in departures during the year ended December 31, 2008.

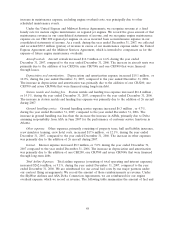

Interest. Interest expense decreased $20.3 million, or 16.0% during the year ended December 31,

2008 compared to the year ended December 31, 2007. The decrease in interest expense was

substantially due to a decrease in interest rates. At December 31, 2008, we had variable rate notes

representing 46.6% of our total long-term debt . The majority of our variable rate notes are based on

44