SkyWest Airlines 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Delta and are contracted for flying with ASA. ASA expects to take delivery of these aircraft

between February and May 2009. The aircraft will serve as replacements for 20, CRJ200s that

are scheduled for removal from contract service between April 2010 and August 2010, which is

earlier than the existing scheduled termination dates as contained in the Delta Connection

Agreement. We have agreements with Delta and United to place all 29 of the new aircraft into

revenue service, under long-term, fixed-fee contracts.

•Scope Clause Relief. ‘‘Scope clauses’’ are elements of major airlines’ labor contracts with their

pilots that place restrictions on the number and size of aircraft, or the amount of flight activity,

that can be operated by major airlines’ regional airline contractors such as ASA and SkyWest

Airlines. Greater liberalization of scope clauses generally creates more business opportunities for

regional airlines. Since 2001, five major domestic airlines (American Airlines, Inc. (‘‘American’’),

Delta, Northwest Airlines, Inc. (‘‘Northwest’’), United and US Airways, Inc. ‘‘US Airways’’) have

achieved some scope clause liberalization. If further efforts by major airlines to relax scope

clause restrictions are successful, it may create incremental opportunities for regional airlines.

•Narrowbody Replacement Flying. A meaningful portion of the recent growth of the regional

airline industry resulted from the replacement of major airline-operated narrowbody jet aircraft

(such as 737s, DC9s, MD80s and A319s) with regional airline-operated jets on the same routes.

Major carriers have replaced narrowbody aircraft in an effort to achieve advantages in trip costs,

unit costs, frequency or a combination of these benefits. At present, the fleets of the six major

domestic airlines include a significant number of narrowbody aircraft that are more than

15 years old. Such older aircraft are frequently less fuel and maintenance efficient than newer

regional jet aircraft. If major airlines substitute newer regional jet equipment for any portion of

these older narrowbody aircraft upon their retirement, we believe incremental growth

opportunities will be created for regional airlines.

•Acquisitions of Domestic Airlines. The airline industry has undergone substantial consolidation,

and it may in the future undergo additional consolidation. Recent examples include the merger

between Delta and Northwest in 2008, the combination of America West Airlines and US

Airways in September 2005, our acquisition of ASA in September 2005 and American Airlines’

acquisition of the majority of Trans World Airlines’ assets in 2001. If the industry continues to

consolidate, we believe there may be additional growth opportunities for regional carriers or

opportunities to acquire regional carriers.

Competition and Economic Conditions

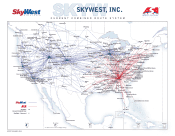

The airline industry is highly competitive. SkyWest Airlines and ASA compete principally with

other code-sharing regional airlines, but also with regional airlines operating without code-share

agreements, as well as low-cost carriers and major airlines. The combined operations of SkyWest

Airlines and ASA extend throughout most major geographic markets in the United States. Our

competition includes, therefore, nearly every other domestic regional airline, and to a certain extent,

most major and low-cost domestic carriers. The primary competitors of SkyWest Airlines and ASA

among regional airlines with code-share arrangements include Air Wisconsin Airlines Corporation,

American Eagle Airlines, Inc. (‘‘American Eagle’’) (owned by American), Comair, Inc. (‘‘Comair’’)

(owned by Delta), Compass Airlines (‘‘Compass’’) (owned by Delta), Mesaba Airlines (‘‘Mesaba’’)

(owned by Delta), ExpressJet Holdings, Inc. (‘‘ExpressJet’’), Horizon Air Industries, Inc. (‘‘Horizon’’)

(owned by Alaska Air Group, Inc.), Mesa Air Group, Inc. (‘‘Mesa’’), Pinnacle Airlines Corp.

(‘‘Pinnacle’’), Republic Airways Holdings Inc. (‘‘Republic’’) and Trans State Airlines, Inc. Major airlines

award contract flying to these regional airlines based upon, but not limited to, the following criteria:

low cost, financial resources, overall customer service levels relating to on-time arrival and departure

statistics, cancellation of flights, baggage handling performance and the overall image of the regional

airline as a whole. The principal competitive factors we experience with respect to our pro-rate flying

include fare pricing, customer service, routes served, flight schedules, aircraft types and relationships

with major partners.

6