SkyWest Airlines 2008 Annual Report Download - page 119

Download and view the complete annual report

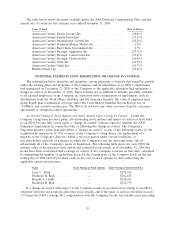

Please find page 119 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For the fiscal year ended December 31, 2008, the net income performance targets for the NEOs

were established by the Compensation Committee in February 2008. With respect to Messrs. Atkin and

Rich, the Compensation Committee established a threshold net income level of $130.6 million, at which

the individual NEO would be eligible to receive a performance bonus equal to 40% of base salary; a

target net income level of $153.9 million, at which the individual NEO would be eligible to receive a

performance bonus equal to 80% of base salary; and a maximum net income level of $177.4 million, at

which the individual NEO would be eligible to receive a performance bonus equal to 130% of base

salary. Similar threshold, target and maximum net income levels were established for Messrs. Childs

and Holt, based on the net income of SkyWest Airlines and ASA, respectively, at which the individual

NEO would be eligible to receive performance bonuses equal to 40%, 80% or 130% of his base salary.

The bonus amounts set forth above were subject to adjustment based on the individual NEO’s

achievement of his Individual Goals.

In November 2008, the Compensation Committee exercised its discretion to adjust the initial net

income targets for the Company, SkyWest Airlines and ASA downward to reflect the unanticipated

reduction in flight scheduling experienced by SkyWest Airlines and ASA, due to the decisions made by

the Company’s major partners, and the general deterioration of economic conditions in the United

States. After carefully evaluating the Company’s operating performance, changes in flight schedules,

industry and general economic conditions, as well as other factors, the Compensation Committee

established revised performance targets for the NEOs. With respect to Messrs. Atkin and Rich, the

threshold, target and maximum net income levels for the Company were adjusted to $110.8 million,

$130.4 million and $150 million, respectively. With respect to Messrs. Childs and Holt, the threshold,

target and maximum net income levels for SkyWest Airlines and ASA were adjusted accordingly. The

adjusted performance targets for the NEOs also remained subject to further modification based on the

individual NEO’s achievement of his Individual Goals.

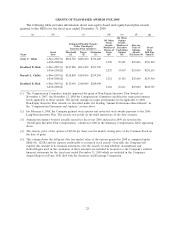

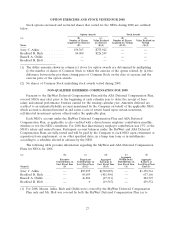

Long-Term Equity Awards. Discretionary long-term equity awards, in the form of stock options

and restricted stock, are granted at the Compensation Committee’s discretion to the NEOs annually in

order to provide long-term, performance-based compensation, to encourage the NEOs to continue their

engagement with the Company throughout the vesting periods of the awards and to align management

and shareholder interests. In making awards to the NEOs under the 2006 Long-Term Incentive Plan,

the Compensation Committee considers grant size and the appropriate combination of equity-based

awards. The Compensation Committee generally grants long-term equity awards at its regularly

scheduled meeting in February of each year.

Options are granted with an exercise price equal to the closing price per share on the date of

grant and generally vest on a three-year ‘‘cliff’’ basis. The Company does not grant options with an

exercise price below the trading price of the underlying shares of Common Stock on the date of grant

or grant options that are priced on a date other than the date of grant. Stock options only have a value

to the extent the value of the underlying shares on the exercise date exceeds the exercise price.

Accordingly, stock options generally provide compensation only if the underlying share price increases

over the option term and the NEO’s employment continues with the Company through the vesting

date.

The Company also grants shares of restricted stock to the NEOs, subject to a three-year ‘‘cliff’’

vesting schedule. Recipients of shares of restricted stock do not pay for the shares; the shares are

issued as compensation for services. Restricted stock awards provide the NEOs with an increased

ownership stake in the Company, subject to vesting, and encourage the NEO to continue employment

in order to meet the vesting schedule. The compensation value of a restricted stock award does not

depend solely on future stock price increases; at grant, its value is equal to the Company’s stock price.

Although its value may increase or decrease with changes in the stock price during the period before

vesting, a restricted stock award will have value without regard to future stock price appreciation.

Accordingly, restricted stock awards can deliver significantly greater share-for-share compensation value

19