SkyWest Airlines 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

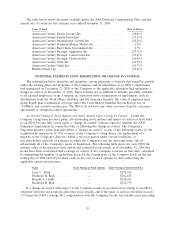

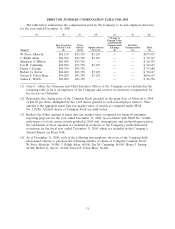

The table below shows the funds available under the ASA Deferred Compensation Plan, and the

annual rate of return for the calendar year ended December 31, 2008:

Name of Fund Rate of Return

American Century Equity Income-Inv ........................ (20.0)%

American Century-Equity Index-Inst ......................... (37.2)%

American Century International Growth-Inv ................... (45.2)%

American Century Premium Money Market-Inv ................. 2.9%

American Century Short-Term Government-Inv ................. 4.7%

American Century Strategic Aggressive-Inv .................... (33.7)%

American Century Strategic Conservative-Inv ................... (15.8)%

American Century Strategic Moderate-Inv ..................... (26.0)%

American Century Ultra-Inv ............................... (41.7)%

American Century Value-Inv ............................... (26.7)%

Buffalo Small Cap ...................................... (29.8)%

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

The information below describes and quantifies certain payments or benefits that would be payable

under the existing plans and programs of the Company and its subsidiaries if an NEO’s employment

had terminated on December 31, 2008 or the Company or the applicable subsidiary had undergone a

change in control on December 31, 2008. These benefits are in addition to benefits generally available

to all salaried employees of the Company in connection with a termination of employment, such as

distributions from the 401(k) Plans, disability and life insurance benefits, the value of employee-paid

group health plan continuation coverage under the Consolidated Omnibus Reconciliation Act, or

‘‘COBRA’’ and accrued vacation pay. The NEOs do not have any other severance benefits, severance

agreements or change-in-control agreements.

Accelerated Vesting of Stock Options and Stock Awards Upon Change In Control. Under the

Company’s long-term incentive plans, all outstanding stock options and shares of restricted stock held

by an NEO become fully vested upon a ‘‘change in control’’ without regard to whether the NEO

terminates employment in connection with or following the change in control. The Company’s

long-term incentive plans generally define a ‘‘change in control’’ as any of the following events: (i) the

acquisition by any person of 50% or more of the Company’s voting shares, (ii) replacement of a

majority of the Company’s directors within a two-year period under certain conditions, or

(iii) shareholder approval of a merger in which the Company is not the surviving entity, sale of

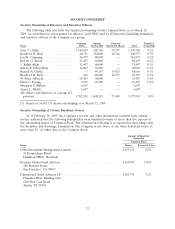

substantially all of the Company’s assets or liquidation. The following table shows for each NEO the

intrinsic value of his unvested stock option and restricted stock awards as of December 31, 2008 that

would have been accelerated had a change in control of the Company occurred on that date, calculated

by multiplying the number of underlying shares by the closing price of the Common Stock on the last

trading day of 2008 ($18.60 per share) and, in the case of stock options, by then subtracting the

applicable option exercise price:

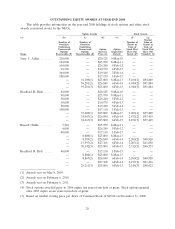

Name Early Vesting of Stock Options Early Vesting of Restricted Stock

Jerry C. Atkin ........... —$278,628

Bradford R. Rich ........ —$162,638

Russell A. Childs ......... —$128,693

Bradford R. Holt ........ —$122,779

If a change in control with respect to the Company results in acceleration of vesting of an NEO’s

otherwise unvested stock options and other stock awards, and if the value of such acceleration exceeds

2.99 times the NEO’s average W-2 compensation with the Company for the five taxable years preceding

29