SkyWest Airlines 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2008

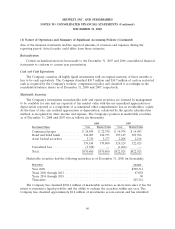

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

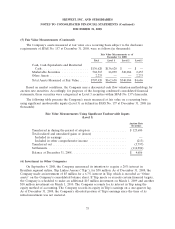

Comprehensive Income

The Company reports comprehensive income in accordance with SFAS No. 130, Reporting

Comprehensive Income (‘‘SFAS No. 130’’). SFAS No. 130 establishes standards for reporting and

displaying comprehensive income and its components in the Company’s financial statements.

Comprehensive income includes charges and credits to stockholders’ equity that are not the result of

transactions with shareholders. These adjustments have been reflected in the accompanying

consolidated statements of stockholders’ equity and comprehensive income. Also, comprehensive

income consisted of net income plus changes in unrealized appreciation (depreciation) on marketable

securities, net of tax, for the periods indicated (in thousands):

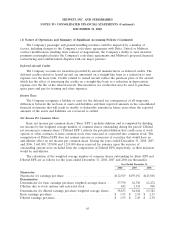

Year Ended December 31,

2008 2007 2006

Net Income ............................. $112,929 $159,192 $145,806

Unrealized appreciation (depreciation) on

marketable securities, net of tax ............. (2,566) 475 61

Comprehensive income ..................... $110,363 $159,667 $145,867

Fair Value of Financial Instruments

The carrying amounts reported in the consolidated balance sheets for receivables and accounts

payable approximate fair values because of the immediate or short-term maturity of these financial

instruments. Marketable securities are reported at fair value based on market quoted prices in the

consolidated balance sheets. However, due to recent events in credit markets, the auction events for

some of these instruments held by the Company failed during the year ended December 31, 2008.

Therefore, quoted prices in active markets are no longer available and the Company has estimated the

fair values of these securities utilizing a discounted cash flow analysis as of December 31, 2008. These

analyses consider, among other items, the collateralization underlying the security investments, the

creditworthiness of the counterparty, the timing of expected future cash flows, and the expectation of

the next time the security is expected to have a successful auction. The fair value of the Company’s

long-term debt is estimated based on current rates offered to the Company for similar debt and

approximates $1,913.5 million as of December 31, 2008, as compared to the carrying amount of

$1,811.5 million as of December 31, 2008. The Company’s fair value of long-term debt as of

December 31, 2007 was $1,838.6 million as compared to the carrying amount of $1,851.0 million as of

December 31, 2007.

Segment Reporting

SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information requires

disclosures related to components of a company for which separate financial information is available

that is evaluated regularly by the Company’s chief operating decision maker in deciding how to allocate

resources and in assessing performance. Management believes that the Company has only one

reportable segment in accordance with SFAS No. 131 because the Company’s business consists of

scheduled regional airline service.

66