SkyWest Airlines 2008 Annual Report Download - page 134

Download and view the complete annual report

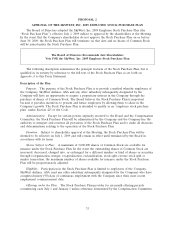

Please find page 134 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Granting of Options: On the applicable offering commencement date, a participating employee

will be granted an option to purchase the number of shares of Common Stock determined by dividing

the participant’s balance in the plan account on the last day of the offering period by the purchase

price per share of the Common Stock.

Participation in an Offering: An individual who is an eligible employee at the beginning of an

offering period may elect to participate in such offering by submitting an enrollment form to the

Company authorizing the Company to make deductions from his or her pay on each payday during the

time the employee is a participant at any rate designated by the employee, from a minimum of 1% to a

maximum of 15% of the employee’s base pay. A participant’s option to purchase Common Stock will

be deemed to have been exercised automatically on the offering termination date applicable to such

offering, unless the participant gives written notice to the Company to withdraw such payroll

deductions. The option will be deemed to have been exercised for the purchase of the number of full

shares of Common Stock which the amount in the account will be purchased and any excess in the

account will be returned to the participant.

Exercise Price of Options: The price per share to be paid by participants under the Stock Purchase

Plan will be 95% of the fair market value of shares on the last day of the offering period unless the

Compensation Committee determines that a different discount will apply. Any alternative discount will

be determined in advance of the offering period by the Compensation Committee; however, in no case

will the discount be greater than 15%. For purposes of the Stock Purchase Plan, the fair market value

of the Common Stock shall be the closing sales price as reported on The Nasdaq Global Select Market

on the applicable date or the nearest prior business day on which shares of the Common Stock traded.

Withdrawal; Termination of Employment: Upon withdrawal by a participant prior to an offering

termination date or the termination of a participant’s employment for any reason during an offering,

including retirement and death, the option granted to such participant shall immediately terminate in

its entirety, and the payroll deductions or other contributions credited to the participant’s account shall

be returned to the participant, or, in the case of death, his or her designated beneficiary, and shall not

be used to purchase shares of Common Stock under the Stock Purchase Plan.

Amendment and Termination: The Board may, at any time and for any reason, amend or

terminate the Stock Purchase Plan; provided, however, that to the extent necessary to comply with the

rules of The Nasdaq Global Select Market or any other securities exchange or market system on which

Shares are listed or quoted, or under Section 423 of the Code (or any successor rule or provision or

any applicable law or regulation), the Company must obtain shareholder approval in such a manner

and to such a degree as so required. Subject to certain exceptions, no termination, modification, or

amendment of the Stock Purchase Plan may, without the consent of a participant then having an option

under the Stock Purchase Plan to purchase Common Stock, adversely affect the rights of such

participant under such option.

General Provisions: No participant or his or her legal representative, legatee or distributee will be

deemed to be the holder of any shares of Common Stock subject to an offering until the option has

been exercised and the purchase price for the shares has been paid. No payroll deductions credited to a

participant’s stock purchase account nor any rights with regard to the exercise of an option to purchase

shares of Common Stock under the Stock Purchase Plan may be assigned, transferred, pledged or

otherwise disposed of in any way by a participant other than by will or the laws of descent and

distribution. Options under the Stock Purchase Plan will be exercisable during a participant’s lifetime

only by the participant.

34