SkyWest Airlines 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2008

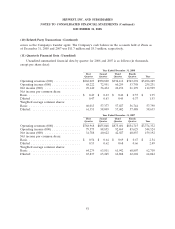

(5) Fair Value Measurements (Continued)

SFAS No. 157 describes three levels of inputs that may be used to measure fair value:

Level 1 —Quoted prices in active markets for identical assets or liabilities.

Level 2 —Observable inputs other than Level 1 prices such as quoted prices for

similar assets or liabilities; quoted prices in markets that are not active; or

other inputs that are observable or can be corroborated by observable

market data for substantially the full term of the assets or liabilities. Some

of the Company’s marketable securities primarily utilize broker quotes in a

non-active market for valuation of these securities.

Level 3 —Unobservable inputs that are supported by little or no market activity and

that are significant to the fair value of the assets or liabilities, therefore

requiring an entity to develop its own assumptions.

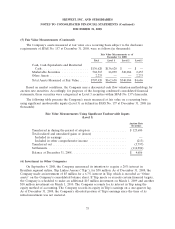

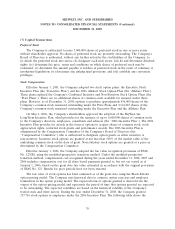

As of December 31, 2008, the Company held certain assets that are required to be measured at

fair value on a recurring basis. The Company has invested in auction rate security instruments, which

are classified as available for sale securities and reflected at fair value. However, due to recent events

in credit markets, the auction events for some of these instruments held by the Company failed during

the year ended December 31, 2008. Therefore, quoted prices in active markets are no longer available

and the Company has estimated the fair values of these securities utilizing a discounted cash flow

analysis as of December 31, 2008. These analyses consider, among other items, the collateralization

underlying the security investments, the creditworthiness of the counterparty, the timing of expected

future cash flows, and the expectation of the next time the security is expected to have a successful

auction.

As of December 31, 2008, the Company owned $4.7 million of auction rate security instruments.

The majority of the auction rate security instruments held by the Company at December 31, 2008 were

tax-exempt municipal bond investments, for which the market has experienced some successful auctions.

For the securities that have announced call dates (approximately $2.5 million), the Company has

classified these investments as current and has identified them as ‘‘Marketable securities’’ on the

Consolidated Balance Sheet as of December 31, 2008. For the securities that have not announced a call

date (approximately $2.2 million), the Company has classified the investments as noncurrent and has

identified them as ‘‘Other assets’’ in the Consolidated Balance Sheet as of December 31, 2008. The

Company has classified these securities as non current due to the Company’s belief that the market for

these securities may take in excess of twelve months to fully recover. As of December 31, 2008, the

Company continued to earn interest on all of its auction rate security instruments. Any future

fluctuations in fair value related to these instruments that the Company deems to be temporary,

including any recoveries of previous write-downs, would be recorded to accumulated other

comprehensive income. If the Company determines that any future valuation adjustment was other than

temporary, it intends to record a charge to earnings as appropriate.

74