SkyWest Airlines 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.each eligible employee’s account under the plan with a discretionary employer contribution. For 2008,

the discretionary employer contribution was 15% of the each eligible employee’s salary and 15% of the

annual bonus earned in the previous year that was paid in 2008. The SkyWest Deferred Compensation

Plan (but not the ASA Deferred Compensation Plan) also permits eligible executives, including the

NEOs, to elect in advance of each calendar year to defer up to 100% of their cash salary and bonus

compensation for the year.

The Company and its subsidiaries do not maintain any defined benefit pension plans for the

NEOs.

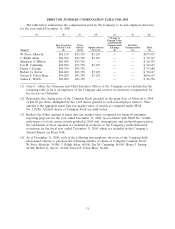

Other Benefits. In additional to the benefits described above, the Company provides other benefits

to the NEOs in order to achieve a competitive pay package. The Compensation Committee believes

that those benefits, which are detailed in the Summary Compensation Table under the heading ‘‘All

Other Compensation’’ below, are reasonable, competitive and consistent with the Company’s overall

executive compensation program. Those benefits consist principally of employer contributions to the

SkyWest and ASA Deferred Compensation Plans on behalf of NEOs, employer-paid premiums on

health insurance, personal automobile allowances, country club dues, and use of employer-owned

recreational equipment.

Additionally, the Company and its subsidiaries maintain a non-discriminatory, broad-based

program under which all full-time Company employees and their dependents, including the NEOs and

their dependents, may fly without charge on regularly scheduled flights of aircraft operated by the

Company’s subsidiaries. The value of such aircraft use is not included in the ‘‘All Other Compensation’’

column in the Summary Compensation Table.

Ownership Guidelines

Each NEO is encouraged to maintain a minimum ownership interest in the Company, defined as

stock ownership equal to five times base salary for the Chief Executive Officer of the Company, and

three times base salary for the Chief Financial Officer of the Company and the Presidents of SkyWest

Airlines and ASA. The NEOs are encouraged to make progress towards the goal in each year that

stock options are exercised or restricted shares vest.

Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code of 1986, as amended (the ‘‘Code’’), imposes a

$1 million annual limit on the amount that a publicly-traded company may deduct for compensation

paid to the company’s principal executive officer during a tax year or to any of the company’s four

other most highly compensated executive officers who are still employed at the end of the tax year. The

limit does not apply to compensation that meets the requirements of Section 162(m) of the Code for

‘‘qualified performance-based compensation’’ (i.e., compensation paid only if the executive meets

pre-established, objective goals based upon performance criteria approved by the company’s

shareholders).

The Compensation Committee reviews and considers the deductibility of executive compensation

under Section 162(m) of the Code. In certain situations, the Compensation Committee may approve

compensation that will not meet the requirements of Code Section 162(m) in order to ensure

competitive levels of total compensation for its executive officers. Stock option grants in 2008 were

intended to constitute ‘‘qualified performance-based compensation’’ under Section 162(m) of the Code.

The Company’s 2008 restricted stock grants and annual performance bonuses, however, were not

‘‘qualified performance-based compensation.’’ In 2008, none of the NEOs received base pay, annual

bonus and restricted stock grants in an amount in excess of the $1 million deduction limit.

21